[ad_1]

Daily economic news

2020-11-17 22:41:18

Each time the reporter Zhao Linan Each time the publisher Zhang Haini

On the evening of November 17, Zijin Mining (601899, SH) made an announcement stating that it intends to implement a limited stock incentive plan, the number of which does not exceed 100 million shares, or approximately 0.39% of the total equity of the company.

“Daily Economic News” reporter noted that Zijin Mining’s first restricted stock exchange price was 4.95 yuan per share, that is, after meeting the grant conditions, the incentive object can buy the restricted shares additional issues issued by Zijin Mining at a price of 4.95 yuan per share. As of the November 17 close, Zijin Mining closed at 8.21 yuan per share and the concession price was 60% of the current price.

The total depreciation is approximately 313 million yuan

Regarding the purpose of this equity incentive, Zijin Mining said: “In order to further promote the establishment and improvement of the company’s long-term incentive mechanism, attract and retain outstanding talent, fully mobilize the enthusiasm of employees and effectively combine the interests of shareholders and the company. The personal interests of the operators come together to make all parties interested in the long-term development of the company. “

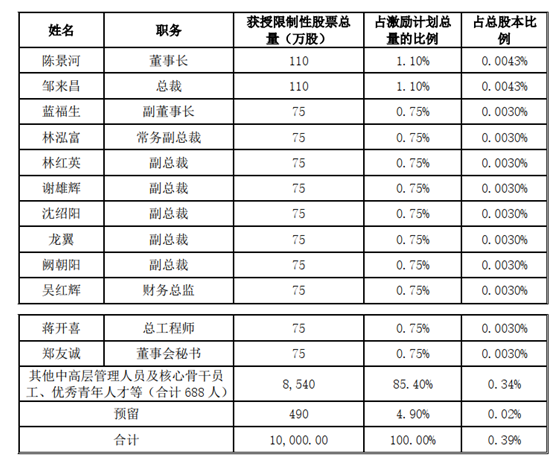

According to the announcement by Zijin Mining, the equity incentives are aimed at directors, senior executives, middle managers, senior technicians, outstanding young talent and highly educated talent, as well as talents who according to Zijin Mining will have a direct impact on company performance and future development. . .

Image source: Zijin Mining announcement screenshot

According to Zijin Mining’s announcement, President Chen Jinghe and President Zou Laichang have each been awarded 1.1 million restricted shares, equivalent to 1.1% of the total incentive plan. The managers named in other announcements each accounted for 0.75% of the total incentive plan. , Managers and executives, core staff, young exceptional talents (688 people in total) represent 85.4% of the total incentive plan.

It is worth noting that, based on the difference between the closing price on the grant date and the grant price as the fair value of the restricted shares, Zijin Mining has estimated that the total depreciation cost of the restricted shares is approximately 313 million. yuan.

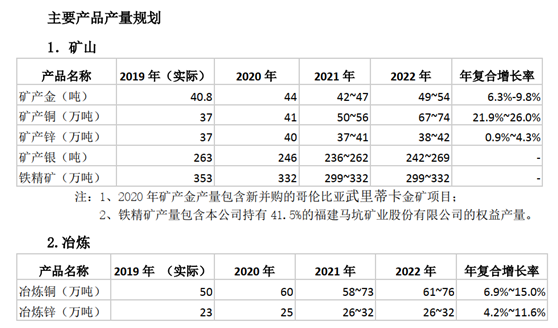

Image source: Zijin Mining announcement screenshot

According to Zijin Mining’s calculations, the above expenses will be amortized by approximately 9.4 million yuan, 113 million yuan, 109 million yuan, 58 million yuan and 24 million yuan respectively from 2020 to 2024, respectively. Zijin Mining said: “According to the plan to unlock the performance conditions, the costs of the above incentives will not have a significant impact on the net profit of the listed company. After the granting of the limited shares, the company will announce the costs of the incentives for limited actions verified and the annual report in the annual report. The amount of confirmed costs and expenses and the amount of accumulated confirmed costs. “

The concession must satisfy several conditions

Zijin Mining announced that the assessment year for the removal of limited inventory granted by this incentive plan for the first time will be three fiscal years from 2021 to 2023 and that the withdrawal of the limited inventory must meet multiple conditions.

Image source: Zijin Mining announcement screenshot

For the three evaluation periods, Zijin Mining has set four types of evaluation indicators. One is that the compound growth rate of net profit must not be less than 25% and must not be less than the average value of the same sector or the 75th percentile of the benchmarking companies; the second is net profit. The compound growth rate of the return on assets is not less than 10% and is not less than the average value of the same sector or the 75th percentile of the benchmarking company; the third is that the asset-liability ratio does not exceed 65%; the fourth is the performance evaluation of the incentive objects B (Inclusive) above.

Zijin Mining said: “The company-wide performance indicators are the compound growth rate of the net profit attributable to the parent company and the return on equity. The compound growth rate of the net profit attributable to the parent company reflects the profitability. and the growth of the company and can establish a better image in the capital market; The index of the compound growth rate of return on net assets reflects the results of the operating income of listed companies; the debt / asset ratio is used to measure the ability of the company to use creditors to provide funds for operational activities and is an indicator that reflects the safety of creditors’ loans. Taking into account the incentive effect of this incentive plan, the company has set the aforementioned performance assessment objectives for this restricted stock incentive plan. “

The “Daily Economic News” reporter noted that compared to the “Company’s 2020-2022 Work Guidance” published by Zijin Mining earlier this year, the assessment of future equity incentives more clearly defined the corresponding financial indicators for future targets. business.

The main objectives of Zijin Mining mentioned in the “Guide to the company’s work for 2020-2022” earlier this year are: “The production of the main mining products will increase significantly and the smelting, processing, trading and operations capabilities of capital will be further improved; by 2022, Under conditions of overall market stability, we will strive to achieve substantial growth of indicators such as sales revenue, net profit attributable to parent company and net operating cash flow; further increase of retained resource reserves, significant optimization of financial indicators and a substantial increase in the status of the sector “.

Image source: Zijin Mining announcement screenshot

From 2017 to 2019, Zijin Mining’s net profit growth rate attributable to its parent company was 90.66%, 16.71% and 4.65%, respectively. In the first three quarters of this year, Zijin Mining made a net profit of approximately 4.572 billion yuan attributable to its parent company, an increase of 52.12% year-on-year.

In the third quarterly report, Zijin Mining did not explain the reason for the change in net profit, but when he explained the change in net cash flow generated by operating activities, he said: “Mainly because gold and copper sales have increased by year on year; the price of gold has risen; the cost of some mineral products has fallen, etc. This is due to an increase in gross profit. “

In the first three quarters of 2020, gold sales in Capital Mining’s mines were around 27,400 kg, compared to around 28,000 kg in the same period last year, a slight decrease of 2.18% on an annual basis. Although the sales volume of mining gold has decreased, the price has increased significantly. In the first three quarters of this year, the unit price of Zijin Mining mining gold sales was around 362.24 yuan / d, compared with 290.1 yuan / d in the same period last year, an increase of about 25% on an annual basis.

Source of the cover image: photograph

Source link