[ad_1]

[ad_1]

Green Tech's blockchain system creates large contracts with renowned securities companies. Here's how it works and why this particular system is capturing the attention of many stock agencies.

Greenbriar Capital Corp. (GRB: TSX.V; GEBRF: OTC), a high-impact renewable energy investor and producer of green technology, has created RealBlock, a blockchain system that has proven effective in the real estate world.

The company has signed an agreement with Title Security of Arizona and Landmark Title Agency. A common problem of computer security in the real estate mortgage and in the transfer of the title is electronic fraud. With these incidents steadily increasing, the need for a safer way to do business has also increased, especially in the real estate sector.

"As cyber frauds continue to increase, the need to ensure the exchange of documents and communications between buyers and sellers and others involved in real estate transactions is more crucial than ever, is often the biggest financial transaction of their lives and we want do everything possible to ensure that it works as it should RealBlock will be the new standard of care in the title industry, "says Landmark President Vicki Etherton.

Professor Todd Taylor, founder of the blockchain research laboratory at Arizona State University and one of the founders of RealBlock, questioned the idea that the blockchain is simply useful for cryptocurrencies, public voting platforms and sharing of the Uber-less ride. He claims that the real power of the blockchain lies in its ability to counteract or prevent serious cybersecurity problems.

How RealBlock works

Blockchain technology creates applications that can be used by multiple customers. This intelligence can transform industries and, in essence, the way the business is done. Here lies the opportunity to execute and share documents in a way that is at very low risk.

Todd also points out that the more traditional methods of document exchange "create single points of attack and failure that hackers are able to exploit with greater and greater ease".

RealBlock (and other forms of blockchain) make hackers' work much more difficult. Instead of a single point of attack, blockchain uses "segregation, distributed computing, multiple party validation, cryptography, public and private keys and smart contract code". Through all these components, blockchain creates single technology stacks (single distributed applications) on which these multi-client applications can be built.

Some may call it the best of both (or all) the worlds. In real estate, it could be a dream come true.

Tommy Sullivan, CEO of Title Security, adds: "As we talk to the major insurance companies providing insurance to the companies that deal with the title … they are embracing this [idea of blockchain] so great that they are writing policies around this adoption. "

The vision of Greenbriar Capital for the company does not stop with its blockchain technology.

A few other things on the sleeve …

While the biggest news surrounding Greenbriar Capital is its RealBlock system, the company has substantially more to offer.

Greenbriar knows all about intelligent technology and power alternatives. Currently, the company uses solar and wind energy technologies, both of which have proven to be profitable and resourceful.

For starters, Greenbriar has a huge solar site on the south-western shore of Puerto Rico. Being the largest solar project in the Caribbean, the management says that the area is ideal not only for investors but also for citizens. On board there are mayors and municipal senators of Ponce and Mayaguez, who support the project.

Management says the project will stimulate the economy through job creation and $ 2 billion in reduced energy costs (over 35 years) for taxpayers. In addition, it provides 35 million annual revenue for 35 years, a net present value (NPV) of $ 191 million for Greenbriar's shareholders.

Meanwhile, in the county of San Juan, Utah, Greenbriar founded the Blue Wind Wind Project in Utah. The company sees its project as a way to not only benefit the environment, but to prevent the costs associated with coal-fired energy methods. The management explains: "The use of wind to produce enough energy for over 200 houses (2,000,000 kilowatt hours) of electricity instead of burning coal will leave 900,000 kilograms of coal in the ground and will reduce annual greenhouse gas emissions by 2,000 tons ".

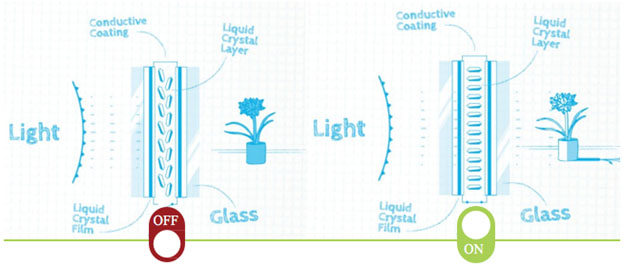

Greenbriar Capital has brought its technology from the outside to the interior with Smart Glass. Any glass with light transmission properties that can be modified is considered Smart Glass. Greenbriar has adopted this technology and added it to its product arsenal. The crystalline technology used allows the glass to convert from transparent to opaque in a flash.

Source: Greenbriar Capital

According to Global Industry Analysts Inc., the global smart glass market is estimated to exceed $ 5 billion by 2020. Greenbriar has put itself in a position to take advantage of the trend, which has become increasingly invisible in high-tech or energy-efficient homes and even hotels.

With the strong presence of Greenbriar in the real estate market, it has an active role not only on the side of the stock, but on the real estate side of the transactions.

Greenbriar Capital currently owns a California subdivision of $ 350 million, sustainable, with 1,072 homes. The plan includes a variety of property options, from apartments to bungalows and other single-family home options. The Sage Ranch Neighborhood Masterplan of the company is available here.

In the announcement of the company's December 6 investor announcement, the management reiterated that its overall plan is structured to create short, long-term and medium-term value for its customers and shareholders.

Greenbriar's shares currently stand at $ 0.88.

[NLINSERT]Revelation:

1) Nikia Wade has compiled this article for Streetwise Reports LLC and provides services to Streetwise reports as an independent contractor. You or members of your family hold securities of the following companies mentioned in the article: None. You or members of your family are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are sponsors billboard of Streetwise Reports: None. Click here for important information on sponsor fees.

3) The comments and opinions expressed are those of specific experts and not the Streetwise Reports or its officials. The information provided above is for informational purposes only and does not constitute a recommendation for the purchase or sale of any security.

4) The article does not constitute an investment advice. Every reader is encouraged to consult their financial professionals and any action taken by a reader following the information presented here is under his own responsibility. By opening this page, each reader accepts and accepts the terms of use of Streetwise Reports and the complete legal disclaimer. This article is not a solicitation for investment. Streetwise reports do not make general or specific investment advice and information on Streetwise Reports should not be considered a recommendation to buy or sell any securities. Streetwise Reports does not endorse or recommend the activities, products, services or titles of any company mentioned in the Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as people interviewed for articles and interviews on the site, may have a long or short position in the titles mentioned. Directors, officials, employees or members of their immediate families are prohibited from making purchases and / or sales of such securities in the open market or otherwise from the time of the interview or from the decision to write an article up to three working days after the publication of the interview or the article. The aforementioned prohibition does not apply to articles that essentially support only company releases previously published. As of the date of this article, officials and / or employees of Streetwise Reports LLC (including members of their family) hold Greenbriar Capital securities, a company mentioned in this article.

[ad_2]Source link