[ad_1]

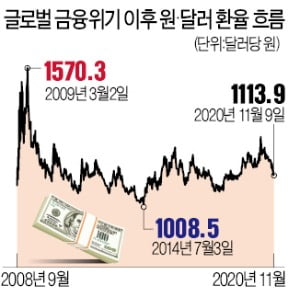

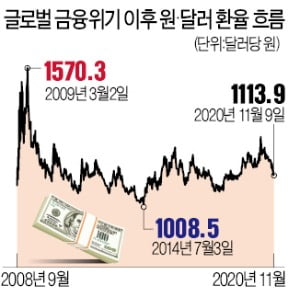

When Democratic Party candidate Joe Biden was elected president of the United States, the exchange rate dropped to 1,110 won in one year and ten months (the value of the won increased). It is expected that if Biden-elect launches a large-scale economic stimulus package, the dollar will continue to weaken, causing the won-dollar exchange rate to drop from 1,100 won to 1050 won. In the medium to long term, there is also the possibility that a “super strong win” will drop below 1,000 won.

On the 9th, the won / dollar exchange rate in Seoul’s foreign exchange market ended at 1113 won90 per dollar, down 6 won 50 times over last weekend. The closing price on this day is the lowest level since January 31, 2019 (1112 won before 70). Compared to this year’s high point, March 19 (1285 won 70), fell 171 won 80 times.

The expectation that Biden-elect will produce more than $ 2 trillion in economic stimulus has been reflected. The value of the dollar decreases when the US government releases the dollar to stimulate the economy. The observation that the US fiscal deficit will grow is also a factor that drives the dollar down. Yale University Professor Stephen Roach has predicted that the dollar’s value will drop by 35% by the end of next year due to the so-called twin deficit, such as the recent fiscal deficit and current account deficit. The dollar index, versus major country currencies like the euro, yen and pound, is trading at 92.1, down 0.03% over the day. It has fallen for the past 5 consecutive trading days and is down 2% from the end of last month.

The dominant outlook is that Korea’s economic recovery is faster than that of the US and Europe, so the value of the won will be strong. Seungji Jeon, researcher at Samsung Futures, said: “Global investors are valuing Korea as the best investment destination, which has strong domestic finances and has been successful in preventing COVID-19.”

Furthermore, the analysis that the won is heavily influenced by the strong Chinese renminbi is fueling the drop in the exchange rate. There is great hope that the Biden administration will restore the international trade order that Donald Trump has damaged. As foreign trade shows a recovery trend, the value of the Chinese and Korean yuan, which is highly reliant on exports, is expected to rise. Based on this analysis, Hana Bank and some investment banks (IBs) saw that the exchange rate could drop to 1050 won next year.

There are also observations that the exchange rate will be close to the level of July 3, 2014 (before 1008 won 50), the lowest level since the global financial crisis of 2008. In 2014, the Korean economy experienced a short-term boom. term with a growth rate of 3.2%. Korea’s growth rate this year, estimated by the International Monetary Fund (IMF), is -1.9%, the second highest among the 37 member countries of the Organization for Economic Cooperation and Development (OECD).

Reporter Kim Ik-hwan [email protected]

Ⓒ Hankyung.com prohibits unauthorized reproduction and redistribution

Source link