[ad_1]

1.8 trillion won in the third quarter of this year

Biggest Increase Ever … Worsening of Family Circumstances

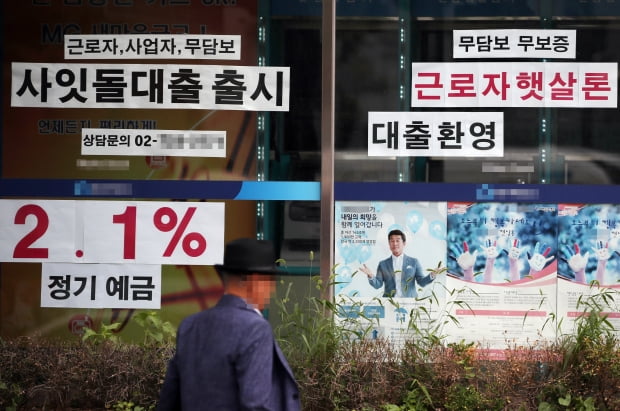

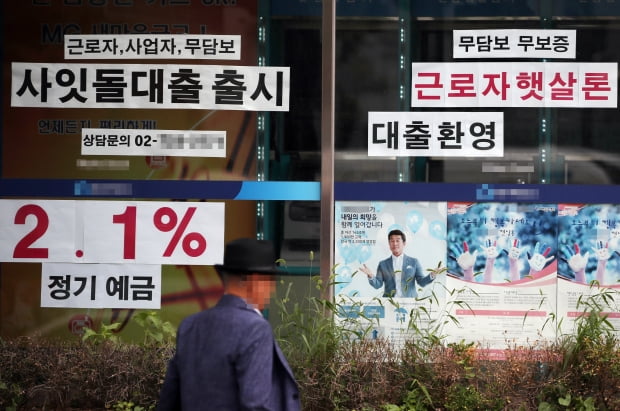

Photo-Yonhap News

Loans to savings bank households also rose to the highest levels ever in the third quarter of this year. There are rumors of concern that the regulation on loans to the first financial sector may emerge as a balloon effect.

According to the Bank of Korea on the 25th, the balance of loans to households of savings banks at the end of the third quarter was 29,591.3 billion won. Compared to the previous quarter, it increased by 1,826.7 billion won in three months. This is the biggest increase since the first quarter of 2003, when the BOK released its statistics.

It has been 3 years and 6 months since the first quarter of 2017 (1.1 trillion won) that loans to households in savings banks increased by more than 1 trillion won in the quarter.

“The savings bank’s household loans also increased mainly to other loans, including credit loans,” he said.

Loan demand is estimated to be driven by savings banks with relatively high interest rates as financial authorities begin to regulate lending in the first financial sector. The interest rate of savings banks is relatively high compared to that of the first financial sector, raising concerns that household conditions may deteriorate.

The total credit of the savings banks exceeded 70 trillion won for the first time in July. Subsequently, it rose to 71 trillion 66.2 billion won in August and 73.231.8 billion won in September.

Reporter Yoon Jin-woo [email protected]

Reporting of article and press release [email protected]

Ⓒ Hankyung.com prohibits unauthorized reproduction and redistribution

Source link