[ad_1]

When holding 0.01% of the shares

Simulation of commercial law changes

Litigation is not possible in Japan

Photos = Yonhap News

When the multi-representative lawsuit system included in the government-sponsored trade law amendment is introduced, shareholders who own 0.01% of the shares of a listed company can sue not only the subsidiary of the listed company, but also of the leaders of their grandchildren. It is claimed that the UK, Germany, etc. They no longer recognize representative lawsuits and that standards are too high even compared to Japan.

According to the amendment to the commercial law presented by the government to the National Assembly on the 14th, the system of multi-representative lawsuits allows a representative lawsuit to be brought against the directors of the subsidiary (managers) if the directors of the subsidiary cause damage to the subsidiary. Institution’. In the case of listed companies, the government is pursuing a review of the law so that shareholders with a stake of 0.01% or more (1% of unlisted companies) can sue directors of subsidiaries.

Usually, a subsidiary refers to a company in which the parent company holds shares. In commercial law, a company whose parent company owns more than 50% is considered a subsidiary. But it doesn’t stop there. This is due to the fact that the range of branches stipulated by Korean commercial law is very large.

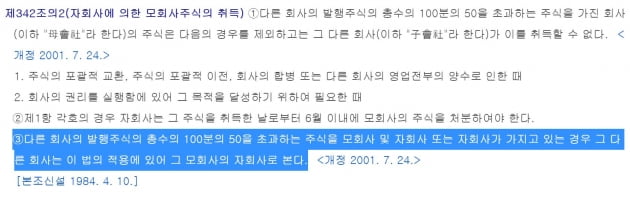

According to Article 342-2 (3) of the Commercial Law, which regulates the scope of subsidiaries, “ if the parent, subsidiary or subsidiary company owns shares that exceed 50/100 of the total number of issued shares of other companies , the other company applies this law. It is said to be considered a subsidiary of the parent company. This means that the branches of the branches, that is, the branches, are included in the branches.

For example, if company A owns more than 50% of the shares of company B, B is a subsidiary of A. At this time, if B owns more than 50% of the shares of C, C becomes the subsidiary of A under the commercial law even if A does not own the shares of C.

Article 342-2 of the Commercial Law, which regulates the scope of the branches.

Based on this standard, I applied it to Kakao, who has 97 affiliates. If the trade law amendment is approved, shareholders who own more than 0.01% of Kakao shares can sue not only 18 subsidiaries such as Kakao Ventures, Kakao Pay and Kakao Games, but also the executives of 36 subsidiaries including Kakao Pay Securities, Kids Note and K Venture Group. It will be. This equates to 55.6% (54 companies) of all affiliates.

In Japan, you can sue a subsidiary even if you only have one share. However, the scope of the lawsuits is limited compared to Korea. In Japan, the parent company must own 100% of the capital and only subsidiaries whose book value of the controlled shares exceeds 20% of the parent company’s assets can sue.

When applied to Kakao as a Japanese standard, there was no affiliate company for which Kakao’s shareholders could bring more representative lawsuits. A Korea Listed Companies Association official pointed out: “Even if we consider US precedents and Japanese legislation, the criteria for Korean subsidiaries have no rationale or rationality.”

The KOSDAQ Association, which is mostly small to medium-sized, was concerned about the possibility that the risk of litigation would increase with smaller companies. According to the KOSDAQ Association, companies listed on the KOSDAQ market, which represent 84% of companies with a market capitalization of less than 300 billion won, can sue even if they own shares worth at least 2 million won. .

Reporter Mi-Hyun Cho [email protected]

Ⓒ Hankyung.com prohibits unauthorized reproduction and redistribution

Source link