[ad_1]

[ad_1]

Normally I write only gold and silver mining stocks. However, I published a Bitcoin article once before (Bitcoin: Buy, Sell or Hold). Now I will post one on Litecoin.

In my opinion, Litecoin has an excellent risk / reward profile. Below, I will explain the reasons why. If you read something about Bitcoin or Litecoin, then this article will give you information on what excitement is.

Litecoin offers a unique opportunity. It is similar to a technological investment, like companies that have invented computers or software. The valuation of surviving companies, such as Microsoft (NASDAQ: MSFT), Apple (NASDAQ: AAPL), Oracle (NYSE: ORCL) and Google (NASDAQ: GOOG) (NASDAQ: GOOGL), all exploded in value. For this reason, it is not necessary to invest a lot if you have arrived early.

Today it is still early for cryptocurrencies and Litecoin. The percentage of people who own Litecoin is small. If Litecoin is successful, the upside potential will be enormous. For this reason, a small exhibition is all you need.

Litecoin is basically a copy of Bitcoin with some differences. I think these differences give Litecoin an edge over Bitcoin. Allow me to list some

-

Litecoin has 4 times more coins. You may think this is a bad thing because they are not so rare. But it keeps Litecoin more accessible. This should allow Litecoin to outperform Bitcoin.

-

Litecoin transactions are 4 times faster than Bitcoin. Bitcoin takes 10 minutes to generate a new coin block, while it requires only Litecoin 2.5 minutes.

-

Litecoin has a base that makes it much easier to make changes to the base code. Bitcoin, on the other hand, is a rudderless developer network that requires an extreme amount of agreement to make changes. This makes Litecoin much more adaptable and responsive to technological changes.

-

Litecoin has a goal, which is economic and fast financial transactions. Bitcoin has the dual objective of providing peer-to-peer financial transactions and by maintaining a stable and secure network. Bitcoin provides transactional capabilities but also a source of value from a reliable network. Litecoin also does this, but it's not something they should focus on. Bitcoin does not actually deal with transaction costs because it is not their first priority. Their first priority is to maintain a stable and secure network. Litecoin, on the other hand, will quickly reduce its transaction fees if they increase too quickly.

-

Litecoin has a base that not only markets its product but works proactively with other companies to expand Litecoin's reach as a transactional currency. Litecoin can proactively and quickly change its code to work more efficiently with specific companies or standards.

I do not know which of these benefits will end up helping Litecoin, but I am confident that one of them will do it. The risk / return profile of Litecoin appears to be one of the best in cryptographic space. While I think Bitcoin is the king of cryptocurrencies and should be kept, I think Litecoin will probably outperform over the next three years.

It should be noted that Litecoin originates from a copy of Bitcoin. The technology and the basic network are essentially the same. They have differentiated in subtle ways as listed above and will continue to diverge, but the strength of Bitcoin's blockchain is the technology behind Litecoin. Also, I think Litecoin's success depends on Bitcoin, since their blockchains are so similar.

So while I like Bitcoin, I think Litecoin will outperform it. I think it has better fundamentals. It has everything Bitcoin has, plus some extras that give more value. The opportunity that exists is that most investors do not understand.

While I am bullish on Litecoin, it has risks. The biggest risk is that your case of being a low-cost transactional currency may compete. Bitcoin could find a way to resize in order to allow very low transaction fees. If this happens, then why would anyone need Litecoin? Secondly, Litecoin has several competitors, such as Dash and Monero, as well as any new cryptocurrency that appears all of a sudden, like AmazonCoin.

It is amazing how many of the older people think that Crypto is scam and have zero intention of owning it. I guess none of them read such a long article on cryptos. They think it's a waste of time. In my opinion, they are wrong. Those who think that Bitcoin has peaked or will go to zero will be proved wrong. At least, this is my expectation, with a high level of trust.

I think this will be the year when the cryptocurrency is revealed as the real deal. We are already seeing this from the way the mainstream media is presenting it. We will probably look back to 2018 as the year when the cryptocurrencies and their underlying technology (the blockchain) became legitimate, as well as one of the most significant financial inventions of all time .

In 10 years, most finance transactions probably occur via a blockchain. And the blockchain and the cryptos will be used for much more than just financial transactions. In fact, most of the cases of use for the blockchain will probably exceed financial transactions.

Any company that finds a use case for the blockchain and discovers a way to monetize it could become a big company. This is what is happening today, with over 1,600 tokens and tokens more and more added each month.

For this reason, it seems that the financial titans of the over-50 crowd, miss you an opportunity with the encrypted. I could be wrong and cryptos will all crash, but that's not what I expect. In fact, I expect Bitcoins to reach at least $ 20,000 in 2019. If that happens, it will bring the ratings of other much higher cryptos, including Litecoin.

I will focus my discussion on Bitcoin. If Bitcoin thrives, then Litecoin will not only prosper, but will probably outperform Bitcoin because of the list I gave above.

I'm sure many of you do not have Bitcoin and have doubts about it. I urge you to examine your reasons for not owning it. Write them down, do not just try your instincts. And it was my instinct that made me ignore Bitcoin for years and not look for it. Once I looked under the covers, I discovered that the underlying technology (the blockchain) is elegant and probably sustainable for decades to come.

If you prefer gold to Bitcoin, compare them. What is the difference between gold and Bitcoin? Both require energy and work to be transformed into an asset. Both are extracted and are rare. Both are a resource that can be converted into Fiat. Both are based on supply / demand forces. Both have no counterparty risk. Both have the characteristics that define money.

My main concern for Bitcoin is that it has a high risk due to uncertainty. We do not know which countries will adopt it and which countries will fight it. I live in the United States and I expect the state and the federal government to fight Bitcoin to some extent. If I lived in Japan, I would be much more comfortable to own Bitcoin. Even with my discomfort, I do not expect the United States to ban Bitcoin. After all, digital currencies are probably the future of trade all over the world.

Bitcoin is clearly a threat to the financial system and even to the monetary system. This creates risks for Bitcoin investors. The reason I'm more optimistic about the pessimist is that the United States is competing in a global economy. If the US government outlaws Bitcoin and other cryptocurrencies, it will ignore the economic benefits of the cryptocurrency blockchain.

There is a reason why Bitcoin has a market capitalization of $ 125 billion today. And this reason is the ability of two parties to do peer-to-peer transactions using a secure ledger blockchain. This is a revolution in commerce. Is the United States going to turn its back on this development and outlaw it? I do not think so This is why Japan has adopted it. They could read the writing on the wall.

The technology behind Bitcoin (the blockchain) is essentially a digital ledger that records all transactions in Bitcoin. Not only is it the whole story of all Bitcoin transactions on the blockchain, but it is also a record of which public keys the Bitcoins own. Anyone can see the list of public keys (portfolios) and how many Bitcoins are present in each portfolio. The caveat is that you do not know who owns those public keys. Each public key has an associated private key, necessary for making transactions.

What makes Bitcoin work is encryption. Hence the name cryptocurrency. Those private keys are encrypted and the only thing that prevents someone from stealing your Bitcoins are those keys. The reason hackers stole so many Bitcoins over the years is to hack websites and find those private keys. If you take away your Bitcoins from Internet trading, then the chances of stealing your Bitcoins are very low. This is why hardware portfolios are so popular, where you can store your private keys on a device. These are similar to USB sticks.

The other thing to know about Bitcoin (as well as Litecoin) and what makes it so powerful is that it is decentralized. This means that there is no central computer or organization that runs it. The Bitcoin network is made up of thousands of computers. If you deactivate half of it, the network will continue to function. Anyone can join the network (adding a server) and there is no organization that approves someone or charges a commission to join. It is open to the global public. It is truly a global network, without an owner.

My nickname for Bitcoin is the unstoppable train. In my opinion, the only thing that can stop Bitcoin is Bitcoin. Bitcoin developers should make some stupid decisions, which is not what I expect. I do not think that a single country can slow it down by legal means. If the US or China makes it illegal, they will continue to increase in value. This train will continue to work, unless, perhaps, something better does not replace it.

Some investors are paranoid that futures trading in Bitcoin will allow bank interest to manipulate the price of Bitcoin downwards. I suppose it's possible, but the biggest Bitcoin exchanges are all in Asia (Bitmex, Bitfinex, Binance, Huobi, Bithumb, OKEx). It will be difficult to manipulate these exchanges. In fact, I think that futures trading will push Bitcoin prices higher as it creates more legitimacy and publicity.

For those of you who think Bitcoin is in a bubble, consider this. Only 1,800 Bitcoins are created every day. This is only $ 18 million to $ 10,000 for Bitcoin. You might think it's a lot of money, but what if a hedge fund wants to own $ 1 billion in Bitcoin? Where do they take it? They have to buy it from people who already own Bitcoin and are willing to sell at a premium. This purchase order will push the price of Bitcoin much higher

My example is for a single fund . Multiply that for dozens of hedge funds. There is no reason why Bitcoin can not go to $ 50,000 or $ 100,000 in the next 5 years if it remains the main cryptocurrency.

Bitcoin (and Litecoin) has several advantages:

1) Get a personal bank (which is what becomes your Bitcoin wallet.

2) Get a cover against the fiat currency

3) Get an investment.

4) Get inflation protection.

5) You can spend it using a debit card (this is becoming more common) or you can buy a gift card with a Bitcoin (or Litecoin).

You might think, but is it a good entry point? It is hard to say why Bitcoin is highly volatile. It is quite likely that it will trade significantly lower in the short term. However, I do not know why anyone would want to sell their Bitcoins at this time when it seems that the cryptocurrencies and the blockchain are the future.

Ironically, most people think that cash is less risky than Bitcoin. I think the opposite is probably true. When you compare money with Bitcoin, what you value will probably be Bitcoin. For this reason, cash trading (or Yen, Euro, Yuan) for Bitcoin is a trend that will probably continue. And probably an intelligent business.

Consider that a year ago, Bitcoin was trading under $ 1,000. Will we ever see it again? Probably not. However, cash (or Yen, Euro, Yuan) will probably depreciate in value. Which will be more stable going forward? Which is free from debt? I'm starting to think it's Bitcoin. This is only an affirmation, but the facts seem to confirm this result.

That said, what will improve in the next 3 years, Bitcoin, silver or junior miners? I expect them to be miners because they are bouncing on the bottom and they have a huge influence. But when you add Litecoin to the mix, the winner is Litecoin, in my opinion. The upside potential for Litecoin is the highest, with silver with the best risk / return profile.

People tend to liquidate Bitcoin as a bubble because they believe it has an intrinsic value of zero. However, I think Bitcoin has intrinsic value because of its network. After all, the value of Facebook (NASDAQ: FB) is its user network. Moreover, Bitcoin has a value from its rarity, with only 1,800 new Bitcoins drawn every day and a maximum of 21 million coins.

It is one of the rarest cryptocurrencies. This is why keeping Bitcoin is probably smarter than holding a legal currency. We have been conditioned to believe that cash is safe. The truth is probably that Bitcoin is safe, and money is not. Time will tell, but the underlying debt of most currencies is currently perceived as low risk, when it probably is not.

One of Bitcoin's greatest strengths is that it solves the problem of a third party holding money. Also, when you try to spend your money using a credit card, a third party checks the transaction and approves it. With Bitcoin, the only thing that approves the transaction is the Bitcoin network.

I think peer-to-peer transactions are the reason for Bitcoin's success. Of course, it is exploding in value because of its investment appeal, but Bitcoin's true value is its network. Bitcoin allows people to break away from the banking system. I think Barrack Obama is right when he said that owning Bitcoin is like having his own personal bank. The banking system is clearly in poor condition due to all the debt, so Bitcoin is providing an answer to this problem.

By owning your personal bank, you can not only protect your Bitcoin in a location of your choice, but you can make a transaction anywhere in the world from your computer or phone. The only third party is the Bitcoin network which pays a commission. This is a case of powerful use. But perhaps the greatest case of use is the ability to maintain value. Inflation is always devaluing the fiat currency. Bitcoin is the answer to this problem.

These powerful cases of use are the reason why Bitcoin is clearly becoming adopted. Every day, week, month, we see evidence of its proliferation. Not just in the United States, but all over the world. In my opinion, this trend will not stop soon.

How many Bitcoins are needed for $ 1 billion? 100,000 to $ 10,000. This is 55 days of new mining supplies with 1,800 coins a day. And in a couple of years, the daily mining offer is reduced by half, through a process called Halving. One of the brilliant ideas of Satoshi Nakamoto (the anonymous inventor of Bitcoin) was not only to limit supply (only 21 million will ever be created) but to continually increase supply at a slower pace.

The 82% of all Bitcoins has already been extracted and it will take another 100 years to extract the last 18% (this is also true for Litecoin). The reason why it will take 100 years is that every four years the daily mining offer is cut in half. In May 2020, it drops to 900 Bitcoins a day. Then, in 2024, the daily mining offer will drop to 450 Bitcoins a day.

So, in May 2020, it will take 110 days to extract $ 1 billion bitcoins worth $ 10,000 per Bitcoin. In 2024 it will take 220 days. This fact should make the head spin.

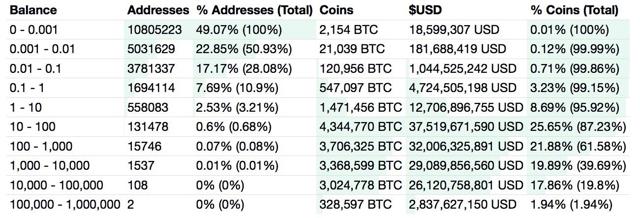

If Bitcoin survives as a dominant cryptocurrency until 2020, the odds are very good that the value will be multiple of its current value. Because? Rarity. Only 3% of Bitcoin owners own one or more Bitcoins (see the distribution list below). And if you're lucky enough to own 10 Bitcoins, then you're in a small group of about 150,000 people.

And now for my final argument. If Bitcoin succeeds, then the odds will also favor Litecoin. Today, 1 Litecoin is valued at $ 66 against 1 Bitcoin at $ 7,300. This means that a single Litecoin is worth 1% of a Bitcoin. If there is only 4x as many as Litecoin, then it should be worth much closer to 25%. This is the main reason why Litecoin should outperform Bitcoin. He simply has something to recover. My estimate is that it should reach at least 3% of the value of Bitcoin. Of course, I'm just assuming, and no one has a crystal ball.

I strongly feel that Litecoin has enough demands that it can not be kept under $ 100. Of course, it could trade back under $ 100, but my feeling is that it will not stay there long. The Litecoin brand is too strong. At least, this is my opinion. He equated it with silver. Of course, silver could trade back under $ 10, but it will not stay very long.

A last note on timing. C & # 39; is currently a well-known Bitcoin technical analyst who recently made a bet on the fact that Bitcoin will trade less than $ 6,000 this year (before jumping higher). He has a good record, so you may want to be patient and see if we go further down.

Bitcoin has always been volatile and we should continue to see big moves, both up and down. We could see much lower prices, but I also expect to see big moves and a new maximum both this year and the next

For Litecoin, the price would be over $ 360, its all-time high. Prepare popcorn for the fourth quarter. We could get the same rally we had in 2017. Why? Expectations. Investors follow the feeling and then the psychology of the market takes over. If Bitcoin and Litecoin start the rallies in September or October, the herd will start running. If you want to accumulate with a low rating, this summer is probably the right time to do it.

If I lose money in Bitcoin and Litecoin, I will look back and say it was a good bet. The risk / reward profile is excellent, and the upside potential is huge.

I normally invest only in gold and silver mining stocks, which are one of the most risky investments that can be made. Bitcoin and Litecoin seem domesticated by comparison. Also, I do not invest much in cryptocurrencies (about 3% of my cost base) because returns can be so high. The key is simply to have a position.

I consider cryptocurrencies as an investment for diversification, even if to be honest, it is really an investment FOMO (fear of losing). I do not want to feel like an idiot if Bitcoin explodes in value when that was the obvious result.

Disclosure: We are / are long LTC-USD, BTC-USD.

I wrote this article myself, and expresses my opinions. I'm not getting any compensation for this (other than Seeking Alpha). I have no business relationship with any company whose title is mentioned in this article.

[ad_2]Source link