[ad_1]

[ad_1]

The peak period for mining activity based on cryptocurrency is almost over. These days you seriously need to know what you're doing if you want to compete with older kids. Operations on an industrial scale have led many enthusiasts to look for opportunities in smaller currencies in hopes of catching the next big trend.

We have already discussed some information on cryptocurrency on CoinCentral beforehand. However, we thought it was time to see how two cryptocurrency heavyweights accumulate in the mining department. This is Bitcoin mining vs. Litecoin mining.

Before jumping into the differences, here are some important cryptocurrency mining factors to consider if you're going to get your feet wet:

- Cheap and Stable Electricity

- Geographical location [19659006] Hardware and software costs

- Competence

- Mining and transaction commissions

The specialized mining hardware is designed to operate at the limit and, as a result, consumes a lot of electricity. It is therefore not surprising that the largest number of miners are in countries with low-cost electricity. These machines are also particularly hot and the cooling of your precious equipment becomes a problem in warmer climates.

To stay competitive, you need the latest hardware and software. Furthermore, the necessary experience is needed to ensure that your rig works optimally. Investing in mining equipment also means putting time to educate yourself. Finally, it is important to consider all the fees associated with mining operations on the Bitcoin or Litecoin blockchain.

Bitcoin Mining

Let's shake it up – We come to consensus

Both Bitcoin and Litecoin use proof of work to validate and protect transactions on their networks. Bitcoin uses the algorithm SHA-256 to achieve this goal. The safe hash algorithm is a function that is commonly used in blockchains and has been tested by Bitcoin.

Bitcoin mining is considered more complex than Litecoin mining due to the differences in the algorithm. Over the years more and more computing power has been committed to protecting the Bitcoin network. As a result, the difficulty of Bitcoin mining has increased dramatically to the present day.

Bitcoin was designed to confirm transactions around 10 minute intervals . And to keep this time constant, the difficulty is increased so that more computing power does not upset the predictable speed of the network transaction. Unfortunately, this also means that, unless you have the latest hardware, you'll probably enjoy making profits in this market.

Sharpen your tools – Hardware

Extraction hardware has evolved from basic desktop processing to specialized chips called ASIC s. The application-specific integrated circuit was designed exclusively for the extraction of cryptocurrencies. But ASICs are not cheap and a top-of-the-range bitcoin mining facility can save you a couple of thousand dollars.

The first Japanese bitcoin miner. Image courtesy of Yuji Nakamura

The OGM recently announced the first Japanese Bitcoin miner, the B2, which sells for $ 2000. The OGM is defying BitMain, a leader in the BitMain mining industry, with the B2. The CEO Masatoshi Kumagai has recently declared the following to his controversial competitor:

"Respect Bitmain, but we will overcome them"

You will want to stay abreast of the latest developments in the hardware race and make sure you have the & # 39; right equipment when you need it.

Litecoin Mining

A quicker consensus

By comparison, Litecoin uses the algorithm Scrypt instead of SHA-256. Initially it was designed to be ASIC resistant to prevent the kind of centralization of the extraction that we are currently observing in the working test blockchain. However, with dedicated research and development, the established miners were able to build specialized hardware specifically for the Litecoin mining sector.

An important advantage that Litecoin has on the older brother is the transaction time 2.5 minutes . At 4x Bitcoin speed, it seems that Litecoin would be more a contender for merchants. Both currencies, however, have probably lost the advantage over the almost instantaneous transactions of the new contenders.

2.5 And 10 minutes respectively are excellent transaction times for credit transfers, both locally and in particular to international transfers. A traditional international transfer through the existing banking system can take from a ridiculous 7-10 working days to confirm. Keep these types of use cases in mind. With the increased use of cryptocurrencies, the best opportunities for extraction occur where they are more sensible to users.

Litecoin Mining Hardware

The best Litecoin mining plant available at the moment is probably Bitmain's Antminer L3 ++. We are currently in a difficult market as the fall in cryptocurrency prices has made unprofitable mining for many smaller miners. Any investment made today should take into consideration Litecoin's long-term price table. Your preferences may be different, so always try to do your research

Considering network security

In proof-of-work cryptocurrencies, if a miner reaches> 50% of the network hash rate (amount of computing power committed to the network) have the ability to stage a 51% attack. This basically allows the miner to steal money from the network with a double expense.

This attack would initially be very profitable for the miner. However, eventually the network would become unusable and money holders would shift their funds to a safer blockchain. An interesting estimate of the costs to start this type of attack for different blockchains can be found here.

The centralization of mining activities remains a concern for Bitcoin as Bitmain continues to dominate the market. If Bitmain is ever able to capture more than 50% of the network hash rate, any Bitcoin mining equipment you own is going to lose value very quickly.

In terms of Litecoin's position on security, Charlie Lee, the founder of Litecoin had the following to say in a tweet at the start of this year (2018):

In the recent attacks of the 51st % e https://t.co/yfy2GcBfQE information, we assure you that Litecoin is extremely safe and mining is very healthy. 👍🚀

– Pools are well distributed (22% larger)

– Hashrate up 50x (past 1 year)

– High capital costs to attack ($ 322-761MM + ~ $ 38- 50k / h) pic.twitter.com/hD8IrYM8dD– Charlie Lee [LTC⚡] (@SatoshiLite) May 30, 2018

https: // platform .twitter.com / widgets.js

Entry barriers

In the beginning, almost anyone could extract Bitcoin with a standard computer. Then, the careful miners saw the immense profits that could be made through mining. These days, companies have dedicated research and development teams and have fielded large budgets to stay at the forefront of cryptocurrency mining technology.

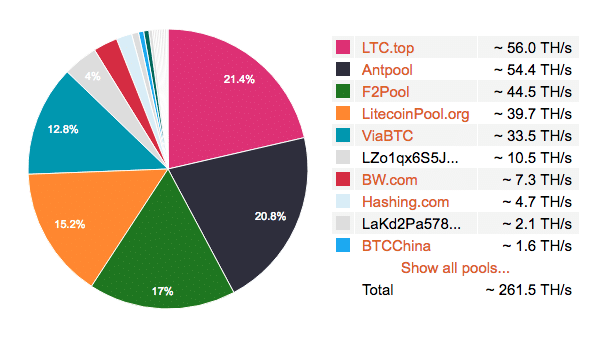

Mining Pools

Fortunately, there is a solution if you are a smaller fish in this rather large pond – mineral pools. If you've jumped and invested in some reasonable hardware, now you have the chance to contribute your hash power to a group of miners known as pools. Both the Bitcoin mining pools and the Litecoin mining pools offer their respective miners a lower barrier for entry into mine. The shared power of the pool allows you to collect your reward in proportion to your power contribution.

The main advantage of this approach is a regular payment over a predictable period of time. The main disadvantage, however, is that it is concentrating power on the pool owner. This centralizes the network, even if only a fraction. The beauty, of course, is that you can move your hardware to another pool if you do not like what your current pool is.

Bitcoin hash rate distribution:

![Bitcoin extraction compared to Litecoin mining. Percentage breakdown of Bitcoin data mining pools "width =" 706 "height =" 549 "srcset =" https://coincentral.com/wp-content/uploads/2018/09/btc-mining-pool.png 706w, https : / /coincentral.com/wp-content/uploads/2018/09/btc-mining-pool-300x233.png 300w, https://coincentral.com/wp-content/uploads/2018/09/btc-mining- pool- 579x450.png 579w, https://coincentral.com/wp-content/uploads/2018/09/btc-mining-pool-600x467.png 600w "sizes =" (maximum width: 706px) 100vw, 706px [19659021] Percentage breakdown of Bitcoin mining pools courtesy of Blockchain.com </p>

</div>

<h3> Litecoin hash rate distribution: </h3>

</p>

<div id=](https://coincentral.com/wp-content/uploads/2018/09/btc-mining-pool.png)

Subdivision in percent of Litecoin mining pools courtesy of litecoinpool.org

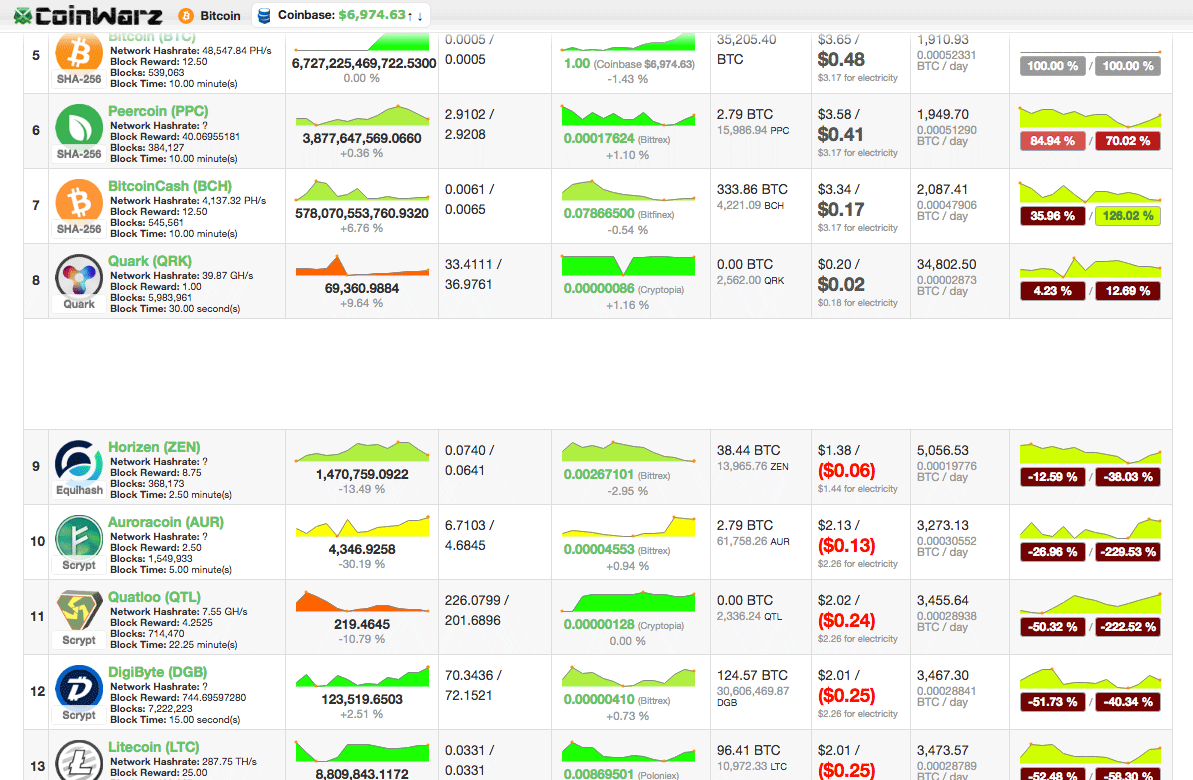

Profitability

And now in the section you, no doubt, I was waiting for him! So which is more profitable, Bitcoin or Litecoin mining? Well, in this particular snapshot Bitcoin was in the lead. There are, however, many factors to consider in such a calculation that it is advisable to approach this with a good drain.

Coinwarz provides an interesting real-time comparison of the most profitable coins:

A detailed look at the profits of cryptocurrency mines

These calculations focus almost entirely on hash rates . Other factors to consider include exchange rate fluctuations pool efficiency, tax code changes and so on. Finally, it is worth noting that monitoring the tables here and on other sites should provide a better representation over time. Monitoring data for just one day is not particularly reliable.

Final considerations: Bitcoin Mining vs. Litecoin Mining

Making the decision to enter the world of cryptocurrency extraction is not easy. This type of decision actually means competing with large-scale operations around the world. It is certainly worthwhile to be involved at the start of the launch of a new currency. However, the market has quickly become saturated with so many unnecessary cryptocurrencies, it has become much more difficult to know what success will be and consequently where to commit resources.

The extraction of Bitcoin and Litecoin is still feasible if you are willing to invest in the right hardware and software and dedicate these resources to a data mining pool. With so many choices and so many factors beyond your control, it seems that the likelihood of turning a good profit becomes more difficult from day to day.

A healthy debate continues in the community of cryptocurrencies. The general feeling is that those passionate about cryptocurrency, the hardware and the constant techniques to make it happen will be fine. Those with pure investment objectives would probably do better by buying the coins outright.

Related

[ad_2]Source link