Secure automated loan technology [SALT], a platform that offers blockchain loans, will now accept Litecoin [LTC] as a side part of their commitment to the growing crypto-loan ecosystem. The announcement made by the company on its own blog, along with a number of new features, including the removal of maximum capitalization on loan amounts and updated loan solutions to meet the emerging market.

With the addition, in addition to Litecoin, customers can now obtain cash loans on the platform if supported by Bitcoin [BTC] and Ethereum [ETH].

SALT has made a name for itself in the niche market to be the leading liquidity provider for large-scale cryptocurrency investors, including entities, companies working in the crypt market and miners. Although the main goal is to offer lending solutions to large companies, the organization has invested fairly in individual customers. This makes it a go-to solution provider for a broad spectrum of customers. With attractive features such as a live portfolio valuation, flexible loan terms, 24 × 7 support and exclusive custody solution, it is probably the largest blockchain-based loan platform.

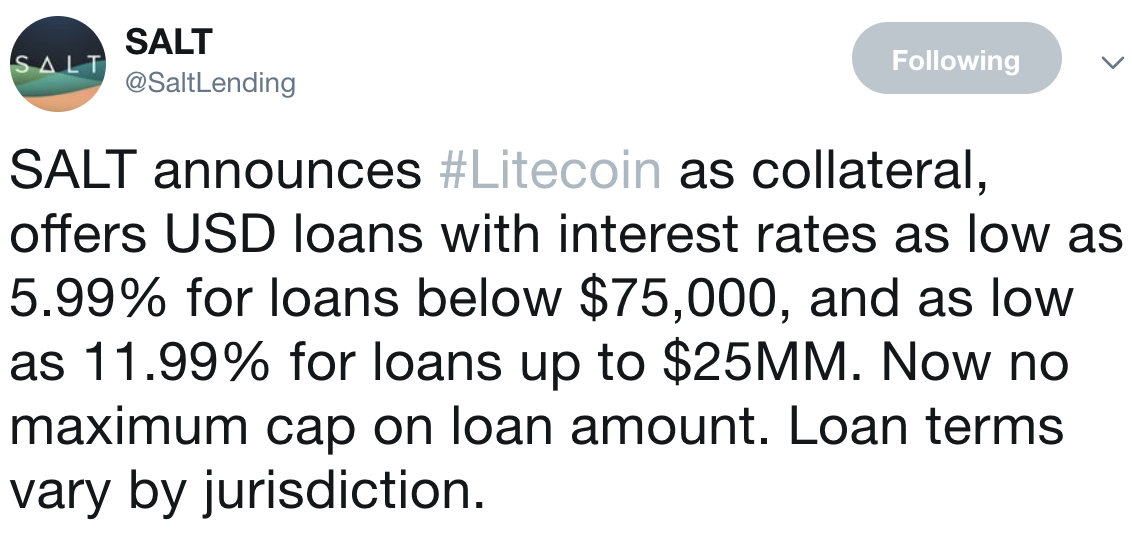

The SALT now offers USD loans with a 5.99% interest rate for loans up to $ 75,000 and an interest rate of 11.99% for loans under $ 25MM. To obtain a loan amount of more than $ 25MM, the company activated tailor-made options. But their interest rates and loan amounts will vary by jurisdiction.

The company token, SALT, was traded for the first time on 28 July 2017 and has recently seen an increase in value. The value of the SALT increased by 9.25% compared to the dollar in the last week and continues to rise gradually. At the time of writing this article, the price was trading at $ 0.75, with a market capitalization of $ 53.190.028.

SALT currently has a user base of 70,000 users and operates all over the world with the commitment to reach every corner with its legal and authorized lending solutions. The company aims to open offices in Switzerland, Hong Kong, United Arab Emirates (United Arab Emirates), Brazil, Puerto Rico, Bermuda and Vietnam this year.

[ad_2]Source link