[ad_1]

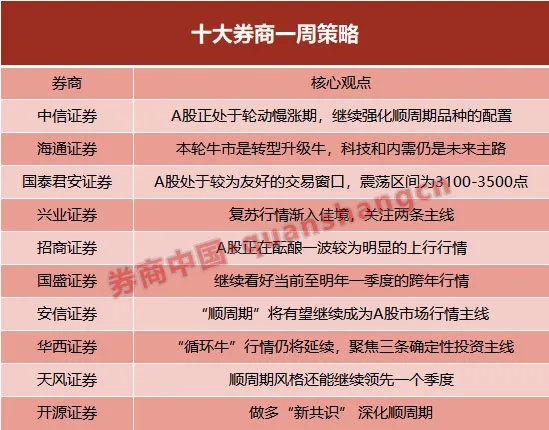

Original title:[Strategia di una settimana dei primi dieci broker]A shares are generating a bull market wave! This bull market round is transforming and upgrading cattle technology and domestic demand is still the main road going forward

CITIC securities: A shares are experiencing a period of slow growth and continue to strengthen the allocation of pro-cyclical varieties

A shares are going through a period of slow growth and multifactorial resonance will continue to improve fundamental expectations and increasemarketIn conclusion, in the meantimecreditThe perturbation caused by the risk of individual cases is limited; it is recommended to continue strengthening the allocation of pro-cyclical products around cyclical products and optional consumer sectors.

First of all, under the multifactorial resonance, market expectations for economic recovery will continue to strengthen. Second, this round of recoverysupplyAnd the recovery in logistics lags behind demand.Finally, individual credit risk in the bond market in this round will strengthen credit stratification, but will not lead to it.Domestic creditThe rapid contraction will not change the trend of internal and external fundamental reset and will have a limited impact on A equities.

We believe that after the October lull, November A shares have entered a period of slow rolling growth, and the pro-cyclical sector is the most important main line driving growth, and the market consensus will continue to strengthen. It is recommended to continue strengthening the allocation of pro-cyclical products around cyclical products and optional consumer sectors. In terms of cyclical products, we continue to recommend those benefiting from the weakness of the US dollar and the expected improvement in the global economy.Non-ferrous metals, Including copper and aluminum epriceDemand-driven return to lithium; chemical fiber is recommended in the chemical sector. In terms of optional consumption, in addition to appliances, automobiles, spirits and home furnishings, you can start paying attention to hotels, lookout points, and other varieties whose fundamentals have begun to be restored in the medium term.

Haitong Securities: This bull market round is a transformation and upgrading, technology and domestic demand are still the main road in the future

① During the bull market, funds alternate between main road and auxiliary road due to the gradual change in fundamentals. In the first half of this year, technology and consumption drove growth, the initial third quarter cycle increased, and the post-fourth quarter cycle began to exert strength.

② At the moment, China is similar to the US in the early 1980s and the economy is in a transition period, then most of the bullish stocks in the US appeared on the tech + consumption highway.

③The bull market pattern has not changed: in the short and medium term, post-cyclical finance is better and the main line of the medium and long term is still technology and domestic demand which represent transformation and updating.

Guotai JunanStocks: A shares are in a relatively friendly trading window, with a shock range of 3100-3500 points

The Monarch’s strategy pointed out that the Shanghai Composite Index will remain volatile in the next quarter, maintaining a shock of 3100-3500.RMBThe appreciation and external risks have landed and A shares are in a relatively friendly trading window. The resumption of trade is the main engine of the current market: in the post-epidemic era, there are two main lines of optional consumption and Chinese production.

It is necessary to look at it from a higher perspective and from greater profitabilityinvestmentOpportunity, two main lines of “optional consumption + made in China” are recommended: 1) Optional consumption recommendation: hotel / liquor / auto / appliance / aviation. 2) Recommended product in China: new energy vehicles / photovoltaic / mechanical / petrochemical / basic chemicals.

Industrial securities: The recovery market is improving, pay attention to two main lines

The China Industrial Securities Strategy pointed out that the global economic recovery has accelerated, global wholesale prices have hit new highs, the recovery in demand has accelerated the response and the inventory cycle is replenishing inventories. Europe and the US recover, RCEP is achieved, and China demonstrates its supply advantages as a major producing and strong producing country.ExportContinue to exceed expectations.

1) A chain of export advantages around the benefit of foreign supply and demand. 2) Global economic recovery, massProductReplenishment of stocks, the direction of the price boom.

Securities of Chinese traders: A shares are generating a more noticeable uptrend

The investment strategy believes that the current A-share listingthe companyIt is in the cycle of upward earnings from Q2 2020. Earnings from A shares in 2021 will be significantly better than this year and the valuation shift will be activated towards the end of the year. A shares are preparing a market for relatively obvious upside.

Guosheng Securities: Continue to be optimistic about the current New Year market until the first quarter of next year

Guosheng Strategy pointed out that it continues to be optimistic about the New Year’s market from now to the first quarter of next year, and this market wave is not.Unilateral market。

We believe that under the multiple combined forces of the resounding global economic recovery, the digestion of external uncertainties and the increased risk appetite brought about by the expected warming of domestic policies, there are opportunities in the cycle, consumer and technology sectors. It will exceed expectations and it is recommended to actively participate.

Essence Securities: “pro-cyclical” should continue to become the main line of the A-share market

The market is still in an uptrend. As the Chinese economy continues to recover, vaccines are getting closer and “pro-cyclical” is expected to continue to become the main line of the A stock market. Special attention should be paid to the demand side with its own inventory cycle and stock market. logic of the industrial cycle, and the supply side has the direction of shrinking or shrinking capacity. The sustainability of these directions can exceed market expectations.

The industry focuses on: liquor, white electricity, cars (including new energy vehiclesindustryChain), chemicals, machinery, non-ferrous metals, coal, steel,Insurance、bank、Brokerage, Military industry, semiconductor, etc.

Western China stocks: The “Circular Bull” market will continue, focusing on three main lines of deterministic investing

Overall, the global “negativeinterest rate“In the environment, A shares are still assets being chased by global funds.Net inflowThe trend remains unchanged. With the positive progress of vaccine research and development, the US fiscal stimulus plan, etc., the A-share “circular bull” market will continue.

Investors are advised to actively implement the year-end market with three clues: the first isTeslaMapping and support for local policies will increase the number of electric vehiclesIndustrial chainThe boom is going up, the second is in the terminalProductThe electronic industry chain, which is still prosperous in the medium term, driven by the electronics trend and the demand for technological updating; the third is that the promotion of vaccine research and development will lead to the recovery of the offline economy and promote the export industrial chain and periodic replenishment of product stocks. The industry focuses on: automobiles, electricity, non-ferrous metals, chemicals, steel, coal, electronics, etc. Topics include: new energy (vehicles), consumption enhancements, military industry, reforms of state-owned enterprises, etc.

Tianfeng Securities: The pro-cyclical style can continue to lead by a quarter

On hold,CSI 300By the first quarter of next year, there could be an obvious gradual advantage. This is an important factor that supports the pro-cyclic style that can continue to drive a quarter or so. The next six months are.PPIA window period of recovery continues. In terms of the sustainability of excess income, building materials and chemicals have the greatest benefits.

As we enter the early stage of the spring turmoil, while maintaining the pro-cyclical base pattern, it is advisable to pay attention to some of the component segments that have oversold this year and that may have some marginal improvement, such as credit innovation. financial IT and medical information with major adjustments in the first period. And 5G.

Open Source Titles: Do More “New Consensus” to Deepen Pro-cyclicality

The phase of economic recovery,market structureWatch the follow-up cycle better than the optional consumption. The cycle is not limited to low valuations, the return of market returns to ROE will become a “new consensus”. The time when yield returns to ROE is now, buy procyclical. Investors should appreciate the opportunity to adjust positions even as the recent recurrence of the outbreak has led to recurring styles.

Grasp the following three main lines (in no particular order): Under certainty of the direction of recovery, economic recovery leads to restoration of value: financial (bank、Insurance、real estate) Seize domestic economic momentumproductionRecovery investment opportunities: chemical industry (major refining and chemical, titanium dioxide), shipping, machinery and equipment, household appliances, papermaking. Inflation exchanges can be organized: non-ferrous metals (copper, aluminum), coal (coking coal).

(Source: Brokerage China)

(Responsible publisher: DF380)

Solemnly declares: The purpose of this information released by Oriental Fortune.com is to disseminate more information and has nothing to do with this booth.

.

[ad_2]

Source link