[ad_1]

Political Affairs President Kwan-seok Yoon proposed … KFTC’s BOK-related activities, with the exception of the Supervisory Service of the Financial Services Commission

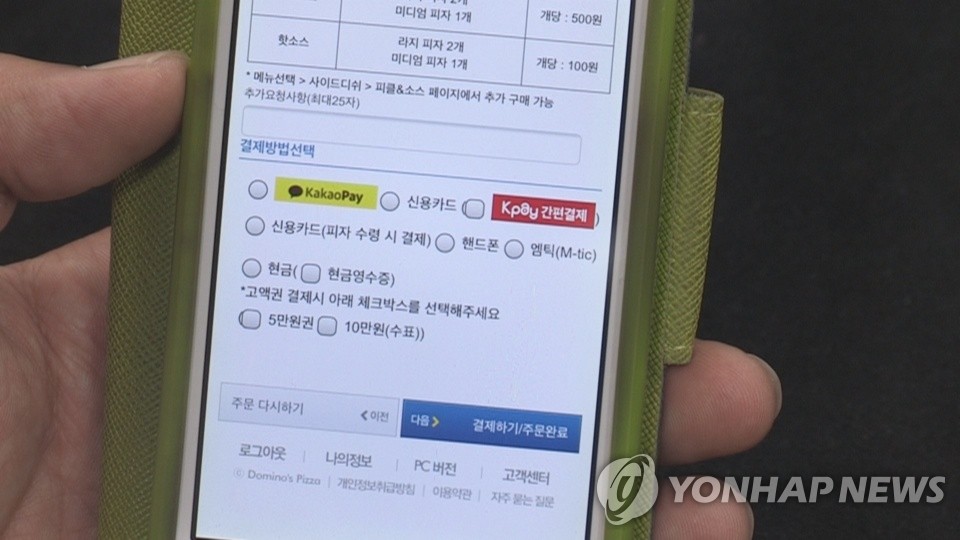

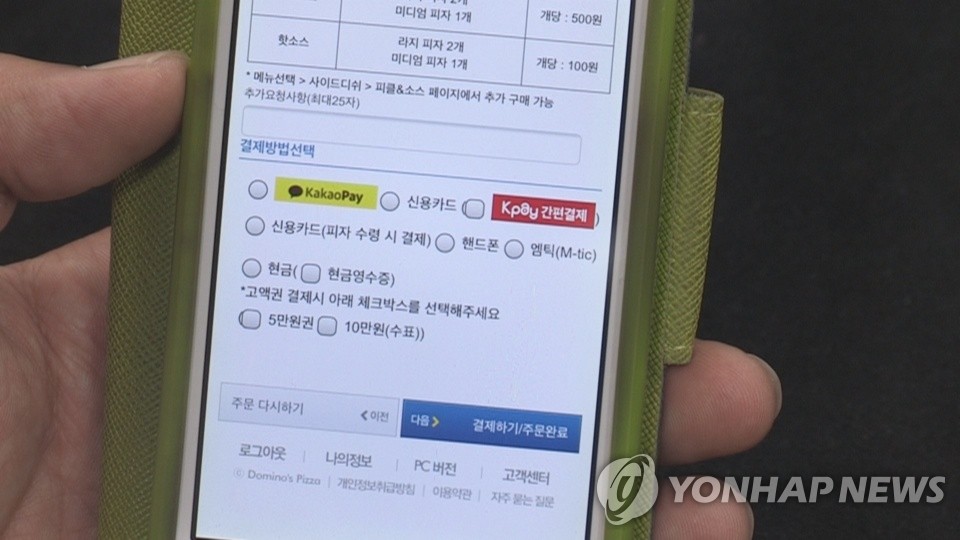

(Seoul = Yonhap News) Reporter Kim Nam-kwon = The legislative process for MyPayment (payment order delivery business), the introduction of full payment service providers, and ○○ Pay deferred payments are large-scale.

Screenshot of Yonhap News TV. Written by Choongwon Lee (Media Lab)

On the 29th, Democratic Party representative Yoon Gwan-seok, who is the chairman of the National Assembly’s Political Affairs Committee, announced on the 29th that he had proposed an amendment to the law on electronic financial transactions.

After enactment in 2006, the Financial Services Commission tabled a comprehensive amendment on the judgment that the Electronic Financial Transactions Act, which hasn’t changed much since it was enacted in 2006, does not adequately capture the changes in the financial environment of 4th industrial revolution and the ‘Post Corona Era’. It was presented to the National Assembly in a format.

In addition to promoting fintech (financial technology) and big tech (large information and communications companies), the revised bill focused on strengthening user protection and service infrastructure security by accelerating digital transformation across the industry. financial.

The introduction of the my-payment system (minimum capital of 150 million won or more) is the focus of the amendment.

MyPayment refers to the concept of instructing transfers as payment and remittance to all accounts of a customer with a single application (app).

Under the Credit Information Act, it is a “digital financial assistant in hand” that can be linked to MyData (personal credit information management business) and can search for financial assets, recommend portfolios and even distribute assets as transfers with a single app.

It also introduces a full payment settlement activity (minimum capital of 20 billion won or more).

Full payment and payment service providers can collectively provide account-based services, such as payroll transfer, card payment, insurance premium and bill payment, on a single platform.

It means that customers can receive a variety of bank-wide financial services without using a bank account.

It also includes content that enables small deferred payment functions to simple payment companies like Naver Pay and Kakao Pay.

The deferred payment limit is 300,000 won. I referred to the hybrid credit card level (300,000 won).

The revised bill was also included in the revised bill, such as the separate storage of user deposits of electronic financial companies, the maintenance of authentication and identification systems to prevent fake and bogus financial incidents, and the establishment of a management and supervision system for Big Tech’s entry into the national and foreign financial sector.

[의원실 제공]

In the case of Big Tech, external settlement through a clearing agency is mandatory.

This is a measure to prevent Big Tech from internalizing user top-ups and to prevent the risks of money laundering.

Settlement of an electronic payment transaction refers to the task of instructing settlement after determining the settlement amount by deducting the obligations and liabilities arising from the transaction.

The Financial Services Commission has the authority to authorize and supervise clearing houses for electronic payment transactions.

The Bank of Korea protested that such measures had been pursued before the bill was launched.

It was based on the logic that the only place in the electronic payment transaction settlement industry is the Financial Clearinghouse, which is currently managed and supervised by the BOK. There is dissatisfaction that the Financial Services Commission is trying to get overly involved in the central bank’s role in payment and settlement.

Ultimately, in this amendment, the “ BOK-related assets among KFTC’s assets (assets that reduce payment risks such as credit risk and liquidity listing as BOK supplies the differential settlement system to KFTC) are excluded from supervision and inspection by the Financial Services Commission. The phrase “to do” has been inserted as an addendum.

Furthermore, it also included content according to which “the procedure for authorizing the settlement of electronic payment transactions at KFTC is also exempted”.

President Yoon is known to have proposed a compromise to minimize the confrontation between the Financial Services Commission and the BOK.

However, a bill has been proposed to strengthen the BOK’s accountability and authority over the payment and settlement system, such as requiring the BOK to prepare measures to manage settlement risks for digital money transfer and settlement activities. on the equipment of the National Assembly. Noticed.

Unauthorized reproduction – prohibition of redistribution>

29/11/2020 10:00 sent

Source link