[ad_1]

[ad_1]

In this overview, we explore Kraken and his journey from a mountain. Gox's alternative to soften the blow of bitcoin addiction from one bag to becoming one of the most respected cryptocurrency exchanges in the world. We will also see the various features of its platform, mainly trading and acquisition of cryptocurrency.

snapshot

Operational from: May 2013 (beta) / September 2013

Location: Canada, EU, Japan, United States

Supported Fiat Couples: USD, EUR, CAD, JPY

Notable cryptocurrencies supported: BTC, ETH, LTC, BCH, XRP, XMR, DASH, XLM, DOGE, EOS, ICN, GNO, MLN, REP, USDT, ZEC

Countries served: all over the world, with restrictions in New York and other areas.

Account verification: full name, date of birth, mobile number, country of residence (Tier 1), + physical address (Tier 2), + proof of identity and proof of address (Tier 3), + know- your-customer (KYC) documents and application form (Tier 4)

Financing options: SEPA bank transfer, SWIFT, US national wire transfers, national wire transfers, Canadian wire transfers, cryptocurrency

Withdrawal options: SEPA bank transfer, cryptocurrency, electronic funds transfer (EFT) for CAD, SWIFT, US domestic wire transfers, Japanese domestic wire transfers, Canadian domestic wire transfers

Commissions structure: reduction of 0.36 percent up to 0 percent depending on the volume of the 30 days, the assets traded, the size of exchanges and if your order is "maker" or "taker"

A brief history of the biggest Euro-to-Bitcoin exchange in the world

While Kraken was founded in July 2011, it eventually emerged as a platform to reduce bitcoin market dependence from a single exchange. Kraken's founder and CEO, Jesse Powell, offered assistance to the Mountain. Gox, which represented about 70% of all bitcoin transactions in the period between April 2013 and early 2014, after two hacks in 2013.

After examining the mismanagement of the Mount. Gox in May 2013, Powell launched the beta version of Kraken and the startup began to thrive in one of the world's technology centers, the Bay Area of San Francisco. Powell said in 2014: "I wanted there to be another one [exchange] take his place, if Mount Gox has failed. "And indeed, Kraken delivered.

In the same year, Payward, the parent company of Kraken, raised $ 5 million in a round of A-series financing led by Hummingbird Ventures and comprising the Digital Currency Group and Blockchain Capital. These funds have been guaranteed for the security and legal compliance of the exchange. In February 2016, SBI Ventures conducted a multi-million dollar B round of financing to expand the reach of the exchange; that round also included the support of Money Partners Group, one of the leading foreign exchange brokers in Japan.

The company started offering bitcoin and litecoin, gradually expanding to include dogecoin in April 2014 and Ethereum ether in August 2015. The exchange now offers nine out of ten of the best cryptocurrencies for market capitalization.

A rocky relationship with the United States

Kraken was also a strong supporter of reasonable regulation. Together with Bitfinex, Kraken moved from New York following the BitLicense proposals in 2015, which were seen as a suffocating innovation. Because of problems with US regulators, Kraken has shifted his attention to other markets such as Canada in July 2015.

More recently, Powell came out against the New York regulatory measures, which for some added more credibility to enthusiasts encrypted to exchange as a front line business in the crypto-revolution, seeking reasonable regulation. At the beginning of 2018, when information was requested about operations, internal controls and market manipulation and fraud, Kraken refused to participate.

In 2017, the exchange explained that while its competitors could have some sort of insurance plans in place, they examined various insurance policies and determined that no one offered significant protection to their clients. They also mentioned that FDIC insurance does not cover losses due to hacks or the loss of bitcoins or other cryptocurrencies.

On the contrary, they think that having world-class security in step is the best protection, adding: "But if some form of insurance becomes available that really offers a significant level of protection without being overly expensive, we will consider adopting it. ".

The exchange claimed to have been withdrawn from New York in August 2015 but was indicted in September 2018, with the New York attorney head accusing Kraken of operating illegally in the state, reporting the alleged infringement to the New Department York for financial services (NYFDS). Uncertainty about what will happen in the future could turn into a regulatory risk for Kraken and its US customers.

Kraken is one of the longest and continuously running Bitcoin exchanges and one of the most respected for its security practices, ethics and "agnostic support" for the cryptocurrency industry. Powell said earlier, "We are an agnostic exchange, which means we do not prefer a certain digital resource over another", when we judge the competition case study of investment in collaboration with The Economist.

Kraken has never delayed the introduction of litigation fork, such as Bitcoin Cash or Ethereum Classic, or has sided with a particular cryptocurrency project. At the same time, Kraken has not hastily added new cryptocurrencies, as Bitfinex did in the past (for example, Bitcoin Interest), suggesting that their restriction is towards the company that wants the cryptocurrency space as a whole to succeed rather than risk to promote scams. One comic tweet from Kraken plays Coinbase for his ad of potential additions to its platform in July 2018.

Compared to the way in which Coinbase handled Bitcoin Cash, with market manipulation charges and insider trading when the BCH-USD rose above $ 3,500 in January 2018, Kraken added BCH without controversy, shortly after the crossroads. In addition, Powell has never publicly stated what his holdings are in cryptocurrency, which still contrasts with Coinbase's CEO Brian Armstrong, who previously said he held more bitcoin ether.

Safety first of all

Kraken undergoes a regular audit to show that it has the full cryptocurrency reserves in support of its operations and was the first to provide cryptographically proven reserves evidence following the Mt. Gox implosion. The auditor checks the balances of Kraken's holdings, with the exchange providing the addresses and signing them. The public signatures of the addresses are then added together to check the total balance of the bitcoins at a given time.

Then the exchange provides the balances of each customer's account and the auditor verifies that this figure matches the balance held. A Merkle tree is used, in which the reviewer publishes the root node hash so that it is publicly available to confirm that the held balances are approximately equal to the sum of customer balances, using the Bitcoin blockchain.

Finally, users can independently verify that their data has been used in the verification, allowing customers to comply with the motto "Do not trust, verify".

As usual, two-factor authentication is suggested so that individuals' personal data can not be leaked. Kraken also recommends setting up a master key so that you can still recover your account if you lose access to your login or if an attacker gains access to your account. Using the master key, you can prevent the password from being reset.

If you are planning to keep your cryptoassets on the Kraken exchange for a long period of time (for example, if you are running a margin trade that you plan to last about a month), also enable the recommended Global Setting Lock (GSL). This security feature ensures that no changes are made to the account settings and that this information is hidden. If an attacker gains access to your account while GSL is enabled, you will not be able to add new withdrawal addresses or change the email address associated with the account.

Finally, you can configure PGP inside your e-mail to make sure that all communications from Kraken are authentic and are not fake phishing links or emails. The fact that your emails coming from Kraken are encrypted adds an additional level of security since, from time to time, you may have sensitive information contained in the correspondences from the exchange. All correspondence is done via e-mail and the company does not have a telephone number for support.

The platform itself has never been compromised, but its users have poor OpSec, so it is better to take advantage of all the features described above. Another key point to do is to use a new e-mail address, not publicly known, to allow each exchange to hinder potential hacking attempts. To encourage white hat hackers to disclose and help fix vulnerabilities on the site, Kraken offers a bug bug with a discretionary reward based on the severity of the problem.

Liquid assets

At the time of writing, most of the volume on the Kraken exchange is oriented towards Ethereum ether (ETH), followed by bitcoin (BTC), ripple (XRP), EOS, Tether (USDT) and monero (XMR) . While Kraken offers both USD and EUR for all cryptocurrencies, EUR pairs are generally more liquid, and if margins are negotiated, it is advisable to take advantage of them.

Source: https://coinmarketcap.com/exchanges/kraken/

Source: https://coinmarketcap.com/exchanges/kraken/

If you use an arbitrage strategy, it may be worth considering the Kraken XBT-USD pair, as it often diverges significantly from the prices of other trades due to the liquidity difference. The chart below shows that the Kraken XBT-USD may differ significantly from the BTC-USD pair of Bitstamp, with a trader making a risk-free return on the exchange with the lowest price and from the exchange sale with the highest price.

The difference between Kraken's XBT-USD and Bitstamp's BTC-USD

The difference between Kraken's XBT-USD and Bitstamp's BTC-USD

Kraken also offers dark pools, which allow you to place an order hidden from public view. Dark pools are offered for both bitcoins and ether, allowing traders to place large orders that could otherwise move the market and be matched to similar orders at potentially better prices; It is important to note, however, that the dark pools involve an additional cost. You can execute these orders on the intermediate and advanced tabs in the trading subsection.

You can select orders using the dark pool in the intermediate or advanced tabs on the new order page.

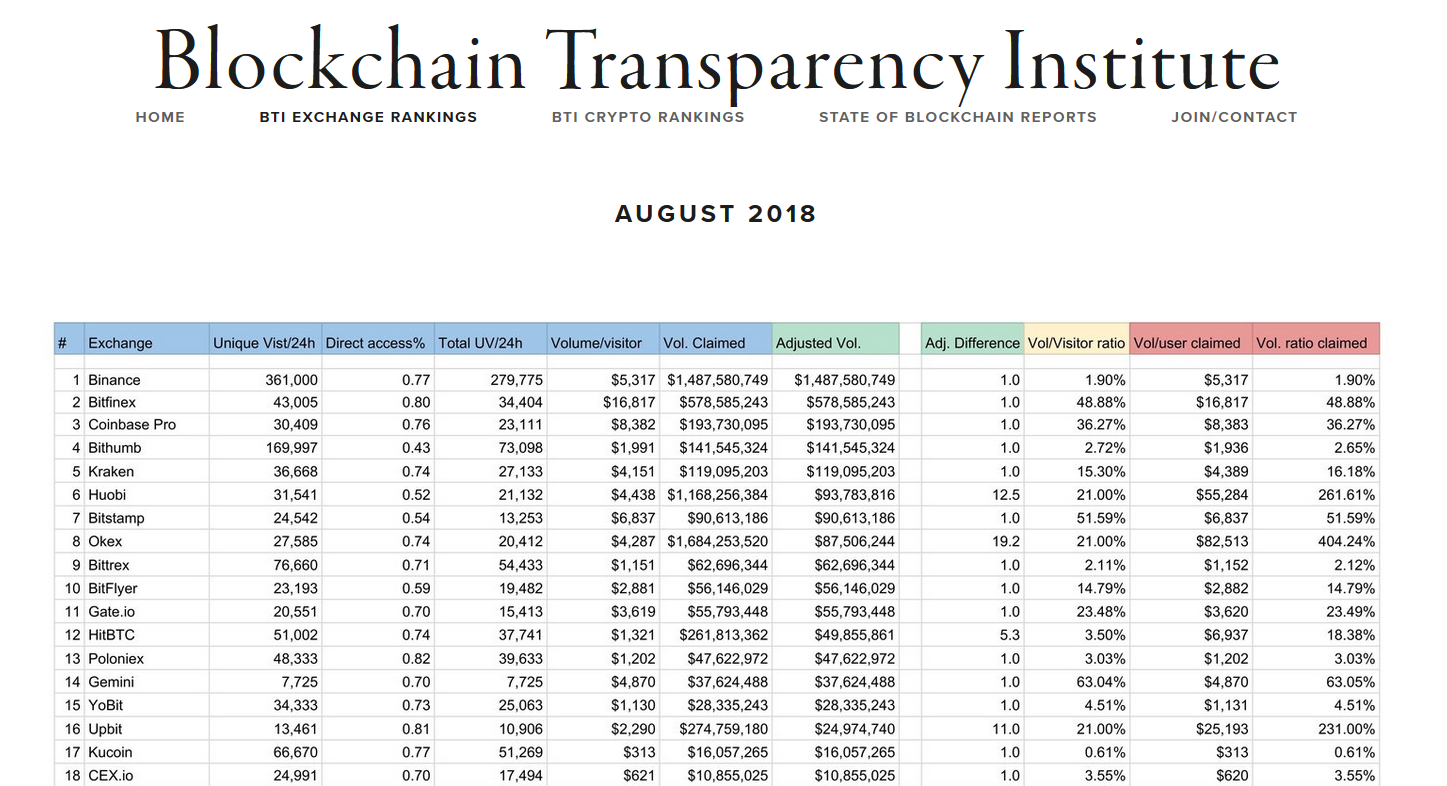

As in the case of Bitstamp, it is not suggested that the cleaning of the trading and the falsification of the volume are problems for Kraken, highlighted in a report by the Blockchain Transparency Institute. The researchers found no evidence of the washing trade, as the volumes reported corresponded closely to the volumes discovered in the report. However, this ranking is subject to change and the updated figures will be published starting September 2018.

Kraken is one of the few Bitcoin exchanges where no evidence of washing operations has been discovered.

Kraken is one of the few Bitcoin exchanges where no evidence of washing operations has been discovered.

Reputation

Kraken left his mark on the cryptocurrency scene at the start, with the discovery of a defect in the Namecoin protocol in October 2013, which led developers to solve the problem. While the altcoin was listed on the platform after the vulnerability was addressed, namecoin (NMC) was removed later due to a downward spiral in trading volumes.

Kraken's reputation has also benefited from foresight and long-term commitment, as highlighted by the 2014 scare on the malleability of transactions, where users can change the transaction ID (TXID) within a short window of opportunities and certain conditions.

Fortunately for Kraken customers, the exchange was not affected by this "bug" because it predicted the problems that would occur by relying solely on transaction IDs to track bitcoin transfers and developed a more robust accounting system.

Around the same time, the mountain. Gox had to deal with this problem of mutated TXIDs and had no other way to keep track of his clients' incoming bitcoin transactions. By tracking bitcoin transfers with a variety of information, such as transaction size, time and recipient data, Kraken has consolidated its reputation among Bitcoins by demonstrating a thorough understanding of the Bitcoin protocol.

In addition, the exchange was also enlisted to help recover the bitcoins stolen from the Mount. Gox, and the claims can still be made through the Kraken platform. The trustee in charge of the Mount. The Gox case chose Kraken for its proven operational experience and its resistance to hacks.

Kraken also helped form the Japanese Digital Property Authority (JADA), the first Bitcoin regulatory body with government support. Similarly, in the United States, Kraken was an important actor in setting up the Digital Asset Transfer Authority (DATA), a self-regulating authority for the cryptocurrency industry. Moreover, as proof of its position as a leading trade in the industry, Kraken was one of the first exchanges to add to the Bloomberg terminal to track the price of bitcoins.

Over the years, Kraken has also been active in the field of mergers and acquisitions, with the exchange of four encrypted businesses in 2016 and 2017. In 2016, Kraken acquired the American Coinsetter and Glidera, the Canadian Cavirtex stock exchange, as well as Exchange Dutch CleverCoin. Later, in March 2017, the Cryptowatch chart site also fell under the ownership of the exchange.

The reputation of the exchange is strengthened by the recognition of the main trade magazines. The exchange was named among the 10 most promising startups of the blockchain by Great Swanson, author of Great Wall of Numbers in 2014, in Business Insider. Moreover, before its launch, Kraken was named as one of the most important Bitcoin companies by Upstart Business Journal.

Fiat-to-Crypto

Fidor Bank, a financial institution regulated by the German financial regulator BaFin, is the partner bank of Kraken; Cooperation began in October 2013. Kraken can be considered a Eurocentric exchange, but the platform has gradually expanded its reach, adding USD, CAD and JPY as the supported fiat currency.

Customers in the United States have not always had problems with Kraken. The exchange withdrew from the US market in 2014, but later returned from the partnership with PayCash to offer USD deposits. Deposits and withdrawals in GBP were available earlier, but this feature has been withdrawn and can be added again later.

Kraken is one of the biggest exchanges that list Tether, and you can trade this American cryptocurrency with dollar pegs using the exchange, which could prove useful if the fears surrounding the stablecoin always boil on the surface.

In the event of a Tether break, you may margin the USDT-USD short as your peg breaks down. Alternatively, if you believe that Tether is in good faith, you can provide market liquidity by buying under the peg when the Tether value falls below $ 1.00. However, in the case that Tether implodes, Kraken could suffer serious short-term consequences, but since it does not depend entirely on Tether, it should be able to survive any "criptopocalisse" related to the stablecoin.

Commercial interface

Kraken's interface is pretty simple, but shows the difference between the offers and the questions and the depth of the order. However, it is not possible to trade directly from the graph page on Kraken and it is not possible to apply technical analysis in the site's interface. Unlike other exchanges, there is no SMS feature for price alerts.

The depth of diffusion and order can be shown in Kraken's commercial interface, but without technical analysis.

You can also connect your Kraken account to Cryptowatch to trade directly from the graphics website and apply technical indicators such as MACD and Parabolic SAR.

To apply technical analysis to Kraken pairs and trade from your account, you can use Cryptowatch, shown above.

Those trading bots can take advantage of Kraken's API, with Thrasher as an example of a trading bot that you can use in conjunction with Kraken.

Tariff structure

The commissions on Kraken depend on a number of factors, including the total cost of your order, the currency pair you are trading, the trading volume of 30 days and whether your order is a producer or a buyer. Furthermore, if the margin is negotiated, two additional fees apply: opening fee and rollover fee.

If you want to place an order for the manufacturer, which provides liquidity, you can use the Post-Limit Order check box on the New Order page and the rates range from 0 to 0.16%. On the other hand, buyers' orders take liquidity from the market as your order will be immediately compared to another in the order book. Fees for buyer orders range from 0.10% to 0.26%.

It is important to note that Tether transactions do not count for 30-day trading volume. The initial screen indicates which commission you will pay and which commission you can expect if your trading volume rises to a specific amount.

Unlike Bitstamp, the cryptocurrency charge involves a commission that depends on the cryptocurrency you wish to withdraw; for example, the commission is 0.0005 BTC per bitcoin, 0.005 ETH per ether and 0.001 LTC per litecoin.

Altcoin support

Kraken has regularly added new coins to its platform, with the most recent bitcoin money in August 2017. The platform supports many ERC20 tokens, such as REP, ICN and MLN, along with privacy-focused currencies such as monero and zcash. Also available are favorites from crypto-seasoned traders, such as dogecoin, bitcoin and Stellar. Two coins that have been traded on Kraken but are no longer available are Namecoin and VEN, a centralized digital currency founded in 2007 and supported by a basket of currencies, commodities and carbon futures.

The new altcoins like Cardano, Nano and Tron are not yet supported by Kraken, and the bitcoin cash was the last bitcoin fork that was added; not surprisingly, this established exchange is not trying to cash in the fork craze in the last year. Customers and development teams can request new additions to the Kraken platform on the secondary support page, and then click Request a feature; his team has stated many times that he will not announce new additions before being listed to avoid market manipulation.

Powell recently highlighted that the exchange has no listing cost, which helps to reduce the moral hazard problems frequently associated with the cryptocurrency exchange market, and also suggests that the company adds coins based on merit, not on the depth of the pockets of their founders.

Kraken is somewhere in the middle of the scale of coverage of the encrypted market among the largest exchanges; while other altcoins are on offer compared to platforms like Bitstamp and Coinbase, it does not offer many altcoins like Bittrex, Binance, Poloniex or Huobi.

KYC verification processes

There are five levels of verification on the Kraken platform, called Level 0 – 4, respectively. Level 0 allows you to have an idea of the platform and does not allow negotiations, deposits or withdrawals. You only need to send an email address for Tier 0 accounts.

Subsequently, Tier 1 allows you to trade exclusively in digital currencies, limiting the use of legal currencies for deposits or withdrawals, but you can withdraw up to $ 2,500 per day and $ 20,000 per month. For level 1, you must submit your full name, date of birth, country and telephone number.

Level 2 alleviates restrictions on legal currencies, allowing you to withdraw $ 2,000 a day and $ 10,000 a month, depending on the country you are in. You must provide your address to be accepted at this level. Both levels 1 and 2 can be verified within one hour, with the latter increasing the daily withdrawal limit for cryptocurrencies ($ 5,000) but halving the monthly cryptovalute withdrawal limit ($ 10,000) to keep account of the introduction of legal currencies.

Level 3 is equal to level 2, except that the funding limits are much higher and you must provide proof of identification and proof of your address.

Finally, Level 4 is probably only useful to you if you are an individual of high net worth, since the funding limits for Level 3 are already quite high (withdrawals allowed up to $ 25,000 per day and $ 200,000 per month, for example ). In this case, you must complete and sign an application form as well as KYC documents, which will allow you to increase your deposit / withdrawal limits to an even higher level. Verification for levels 3 and 4 can take anywhere from one to five days, as it is not automated like for the lower levels.

Trading

Powell has previously indicated that the exchange exists for "first of all … providing a market for spot and deliverable bitcoins" and that "advanced features for traders, such as margin, are secondary" and could be removed if the market becomes too volatile.

Nonetheless, Kraken is one of the best places to trade margins and has been offering this function since May 2015. Margin trading allows you to amplify gains (and losses), with Kraken offering 5: 1 leverage for pairs like BTC-EUR and ETH-XBT, while other pairs such as XMR-EUR and USDT-USD offer a lower leverage of 2: 1.

The margin function is useful for advanced traders, who can borrow funds to open a larger position on their account balance and potentially increase their profits if the market moves in their favor. The following table shows the pairs that support margin trading and the levers you can use with these tickers. EUR margin pairs are not available for NH, TX and WA residents in the United States.

Although Kraken does not offer extremely high leveraged transactions, such as BitMEX, which allows you to use a 100: 1 margin, it serves as an ideal place to start margin trading if you have not done it before, providing the opportunity to get there. dealing with leveraged trading.

A variety of orders are available, allowing you to be flexible with your trades and how much attention you place on the cryptography market. For example, advanced orders such as stop loss and take profit are available. The most vanilla orders such as market orders and limit are also present for novice traders. These different types of order can be used to adapt to the market, allowing you to be more productive with your trading.

Trading with margin on Kraken. Select the desired lever on the right side.

We can not talk about Kraken and its history without talking about the trading engine. There was a time when I got an order while Kraken's margin trading was a very frustrating exercise. Many have complained about the lack of effectiveness of the trading engine and how, at worst, it caused merchants to lose money through no fault of their own, where orders were not executed when they should have been.

Some customers have been reimbursed in part with Kraken Fee Credits, so traders can be assured that if such losses are due to the fault of the trading engine, they will receive compensation; however, the easiest choice was to move to a platform with a better trading engine.

The problem was exacerbated during the crypto-mania in late 2017. Kraken had to renew his trading engine to keep up with the demand. In a post in January 2018, the company announced that a new, more scalable trading engine had been put in place. The engine works much better now, and a recent blog post explained that the trading engine will be updated and maintained frequently.

Verdict

Kraken is a handyman: he has trading margins, a variety of security features and a fairly broad support for several cryptocurrencies, providing most traders with enough markets to entertain them.

Moreover, its reputation is excellent, initially emerging as an alternative to the Monte. Gox to take on the role of leader in the trade of cryptocurrencies. Kraken's hand in the discovery and correction of a defect in the Namecoin protocol and its reluctance to add the myriad Bitcoin forks means that customers can be sure that the exchange will perform due diligence before adding other cryptocurrencies.

The platform has some minor drawbacks. US customers may not be well served by a company that supplies the middle finger to certain regulatory bodies in states, such as the NYFDS, which could solicit further actions from US regulatory authorities in the near future. The trading interface is rather insignificant, but integration with Cryptowatch has more than made up for it. Even SMS price alerts would be a welcome addition. Providing greater leverage for margin trading could also be useful for the platform to take a bite out of BitMEX's market share. Also, for beginners, the site may be a little complicated to use in its full extent.

Fortunately, when you place a new order, you can choose between beginner, intermediate or advanced setups and enter a relevant order. For intermediate or advanced traders, you will not get much better than Kraken and, in that case, it will only be a marginal improvement, ie higher margins (BitMEX) or lower sampling fees for bitcoins (Bitstamp).

[ad_2]Source link