[ad_1]

[ad_1]

It is no secret that Japan is a favorite of blockchain adoption. The country has been a hot spot for cryptography ever since Bitcoin entered the market nine years ago. Recognizing this technology as a unique opportunity, the officials of the crypt of Japan managed to turn their country from an uninformed community into one of the major countries for the adoption of the blockchain.

Japan's blockchain intentions have not always been clear. At times, there have been significant concerns raised by government officials regarding the unregulated nature of the cryptomarket. After the Japanese exchange, Mt. Gox, collapsed in 2014, there was a time when many Japanese citizens associated the word Bitcoin with fraud.

Today you can buy almost everything in Japan with BTC, but their encrypted journey started much earlier. Let's take a moment to see how Japan managed to ride the cryptic wave and move from the most significant hack exchange of all time to its current position as one of the best cryptic countries in the world.

Japan Crypto – The Early Days [19659005] Blockchain technology surprised Japanese officials like most regions of the world. Japan was one of the first companies to recognize the potential of Bitcoin. Bitcoin became popular in Asia in 2011. At this time, an increasing number of people were entering the BTC mining industry. In particular in the countries of Japan, South Korea and China.

In Japan, many people believed that Bitcoin was created by a Japanese citizen because the name Satoshi Nakamoto was Japanese. This conspiracy theory has helped increase the adoption of Bitcoin in the region.

In these early days of the cryptomarket, officials paid little attention to the cryptocurrency. There were no cries for regulation and, despite BTC's growing popularity, most people still had no idea that Bitcoin existed. All this changed once Mt. Gox collapsed.

The Crypto Exchange of Japan dominate

In 2014 Japan hosted the biggest Bitcoin exchange in the world: the mountain. Gox. The now infamous and deceased exchange once dominated the BTC trade. At one point, it was estimated that Mount Gox controlled up to 70% of BTC's global trading volume.

The Japanese market was preparing to undergo a blockchain upgrade and platforms like Bitflyer were ready to take investors to new levels. Japanese investors, recognizing the mountain Gox earnings have flooded the crypt market and in a short period several Japanese stock exchanges have been opened. Gox eventually folded due to numerous hacks, but not before it opened a new era of Japanese cryptographic exchanges.

Japan Crypto – Monacoin

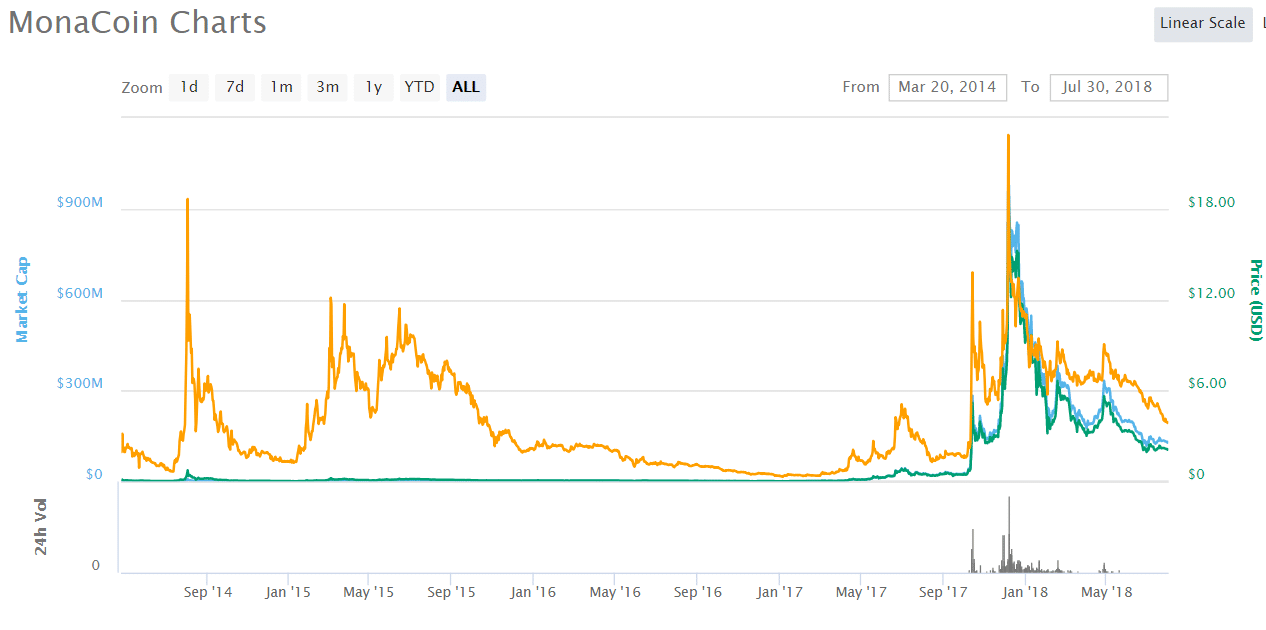

Japan began to see the entry of its first Italian cryptocurrencies at this time. Monacoin was the first cryptocurrency developed in Japan. This indigenous altcoin entered the market in December 2013 through a post on 2channel. The developer of the currency, Mr. Watanabe, chose to remain anonymous and the development of the currency proceeded via an open source protocol.

Monacoin Chart Via CoinMarketCap

Japanese Crypto Legislis

After 2014, Japanese officials felt the public heat due to the massive amount of funds lost in the Monte. Gox flask (850,000 BTC). In response to the growing international public protest on the incident, the Financial Action Task Force (FATF) has published the Guide for a risk-based approach to cryptocurrencies.

The report provided many suggestions to Japanese legislators, including the fact that Japan legalizes cryptocurrencies and their exchanges. This maneuver would allow the Japanese government to regulate the sector and provide much-needed supervision to the local crypto economy.

Japan Legalizes Bitcoin

In April 2017, acting on the advice of the FATF, Japan revised its payment services Act. The review included the legalization of virtual currency as a form of payment, as well as the new licensing requirements for internal trade within the country. Technically, Japan does not consider Bitcoin to be legal tender because it is not issued by any central government, but recognizes that it can be used to purchase items.

Exchanges took six months to comply with regulations, which included storing customer funds, updated accounting requirements, and planned audits. Most of these clauses were a direct result of the Mount. Gox hacks and intended to prevent further loss of funds. The platforms could remain open during this six-month period while they awaited the approval of the Japanese government. Eleven exchanges received their approval for the operation by September 2017.

China gives Crypto a Japanese impulse

China has moved to close their local exchanges last year, bringing to an exodus of cryptic investors from mainland China. These blockchain investors are resettled in the surrounding regions in search of more friendly shores. The majority of these despised investors moved to Japan.

Japanese officials recognized this exodus and began to develop ways to capture these funds. The Japanese government had already legalized Bitcoin as a form of payment, and investors knew they would be welcome in the country.

Japan Bitcoin Mining

While all these changes were taking place, the city of Fukui quietly became an important mining center in the region due to a combination of factors. A subsidy for the city now covers half of the rental of an enterprise if they have chosen to occupy a free warehouse in the city. This subsidy is attracting Bitcoin miners to the region. In addition to the discounted rent, miners can receive electricity at discounted prices. While the cost of electricity in the city is not as cheap as abroad, Fukui's rates are considered the best in Japan. These favorable mining conditions have turned Fukui into the mining region of the country and have increased interest in cryptocurrency mining operations.

Japan regulates the ICOs

Japan's attention seems to be directed to the Initial Coin Offerings (ICO). In April of this year, the center for strategy building strategies at Tama University published a list of guidelines for ICO regulations. These standards include the implementation of Know Your Customer (KYC) laws. ICOs operating in Japan must have a clear and open distribution policy. In addition, ICOs must maintain an open tracking system that allows investors to monitor the development of the project. It is expected that these guidelines will become law in the next year.

Revisions of cryptographic taxation in Japan

The latest news on the Japanese cryptic sector imply changes in their progressive encrypted tax rate. Under current law, cryptocurrency traders can be taxed up to fifty-five percent of their capital gains. Regulators are trying to move from this adjustable tax rate to a uniform rate. The MP, Kenji Fujimaki, started the debate at a meeting of the House's budget on 25 June. He suggested that cryptocurrencies are not taxed as miscellaneous revenue, but, on the contrary, a new flat crypt is established to stimulate new investments.

Japan Crypto – A bright future Blockchain

Japan's crypts continues to be a dominant force in the space blockchain. The country's pro-cryptic position has helped drive blockchain-based businesses on its shores in record numbers. Now, Japan is trying to consolidate its position as the blockchain epicenter of the world. The exclusive blockchain legislation of the country is laying the foundations for the digital economy. For now, all eyes are on the cryptic Japanese sector to see how its regulations affect the growth of this budding industry.

Related

[ad_2]Source link