[ad_1]

- Ethereum returns to the green after testing the waters below $ 100.

- ETH / USD is still tied to the band despite the slight recovery in the market.

Ethereum explored the new lows of 2018 in a new round of decline that entered into force on Wednesday evening session (GMT). The market is slightly green while the bulls come back to retaliate after falling victim to another crash. Ethereum added 1.02% on Thursday after withdrawing from the lows around $ 95.64.

The 3rd the largest volume of cryptocurrency exchanges by market capitalization is increasing. The increase is the result of the selloff that has become unstoppable. Its 24-hour trading volume is $ 2.1 billion from $ 1.9 billion at the close of the December 5th session. However, market capitalization continues to decline. It currently dances to $ 10 billion compared to $ 11.4 billion over the same period.

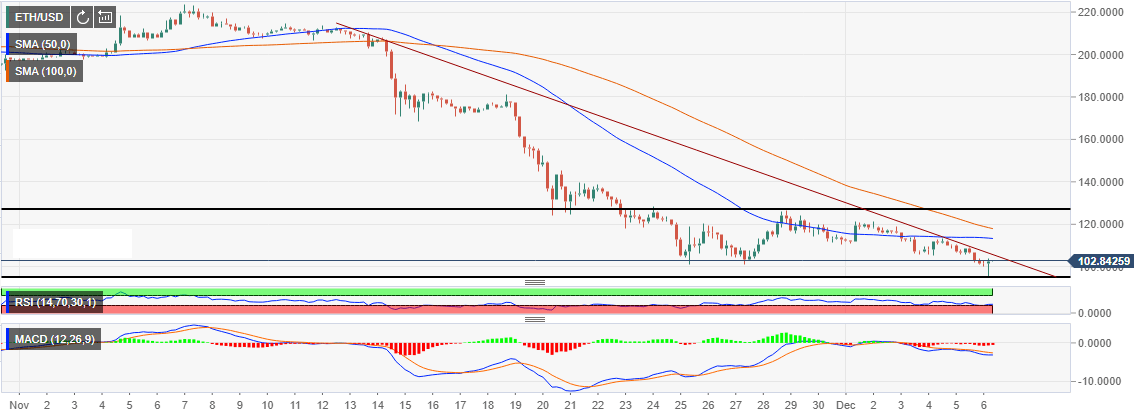

Although there has been a reversal from the annual lows, Ethereum is still tied to the range. The range limit at $ 126.73 is a significant obstacle. However, the gap between moving averages is closing when buyers increase their income. The RSI on the chart of the time slot that struggles to maintain the terrain and avoid the oversold regions. In contrast, the MACD sends a different signal as it advances deeper into the negative zone. It is likely that ETH / USD will maintain a position above $ 100 in the meantime, but a correction outside the range resistance will not be an easy task for the bulls.

The fall below $ 100 was an excellent time for investors to buy in the dive. The rebound of Ethereum is inevitable, however it may take longer. According to renowned industry experts, the cryptos will soon begin to reverse the trend as we begin the Q1 of 2019. In the meantime, this may be the best time to buy ETH, while the price is low in preparation for the imminent rise in bulls.

ETH / USD 1 hour chart

Source link