[ad_1]

[ad_1]

introduction

As many of you know, there are many scams in the criptoasset space. Some of these are scam output (you run something that seems legitimate, but then one day you go out with all the funds), some are multilevel marketing schemes, Ponzi schemes, plots to steal your identity, etc. Today I want to talk about some of these models, so you can identify these scams before losing money.

Bitconneeeeecccttt !!

First, let's talk about a couple of popular scams that have been dealt with in the past, so you can start to see the models. One of these was Bitconnect (BCCOIN-USD).

Bitconnect turned into a cryptocurrency loan platform that also included an artificial intelligence trading bot of some sort. The way it worked has been publicized a certain return on investment for "loans" granted to them and others. The amount you have recovered depends on how much you have "invested" and the users have been encouraged to reinvest their earnings.

Bitconnect had its own token, which it traded with the BCC ticker. However, the token was traded only on its stock exchange (so that it could manipulate the price) and only accepted deposits in Bitcoin (BTC-USD) (COIN) (OTCQX: GBTC). Bitconnect had a popular referral program, where you can earn bonuses from the people below you and the people below them.

In this Jon Oliver segment, you can see how incredibly obvious it would be. Still, many people have still lost a lot of money in this scam, just this year.

In the end, the founders of this scheme ended up being arrested.

Divyesh Darji, the Indian chief of BitConnect and considered one of the main promoters of the scheme, was arrested by the Gujarat Criminal Investigation Department (NASDAQ: CID) after arriving in Dubai during his trip from Ahmedabad.

– ZD.net

But it was not just the creators and operators of the platform that perceived the heat of the fallout, but their promoters on YouTube also found themselves in hot water.

The Bitconnect scam was old school MLM, HYIP, AI mumbo jumbo combined with crypto BS. If you do not know what HYIP is, do not worry; we'll talk about it later.

What is a HYIP?

A HYIP is a high-yield investment program. Let's take a look at the definition from Wikipedia.

A high-yield investment program (HYIP) is a type of Ponzi scheme, an investment scam that promises a return of unsustainably high investment by paying back to former investors the money invested by new investors.

Source: Wikipedia

Experienced investors should know that there is an intimate relationship between risk and return. High-yield bonds can be obtained, but such returns carry the additional risk that the bond issuer will limit itself to default, leaving you with little or nothing to show for your investment.

To make a comparison, Bitcoin returned to around 0.5% a day from the start. This is a crazy level of RIO, but some of these HYIPs offer more than that figure. Bitconnect, for example, offered 1% per day on "cryptographic credits".

Here is another example, which I just discovered yesterday.

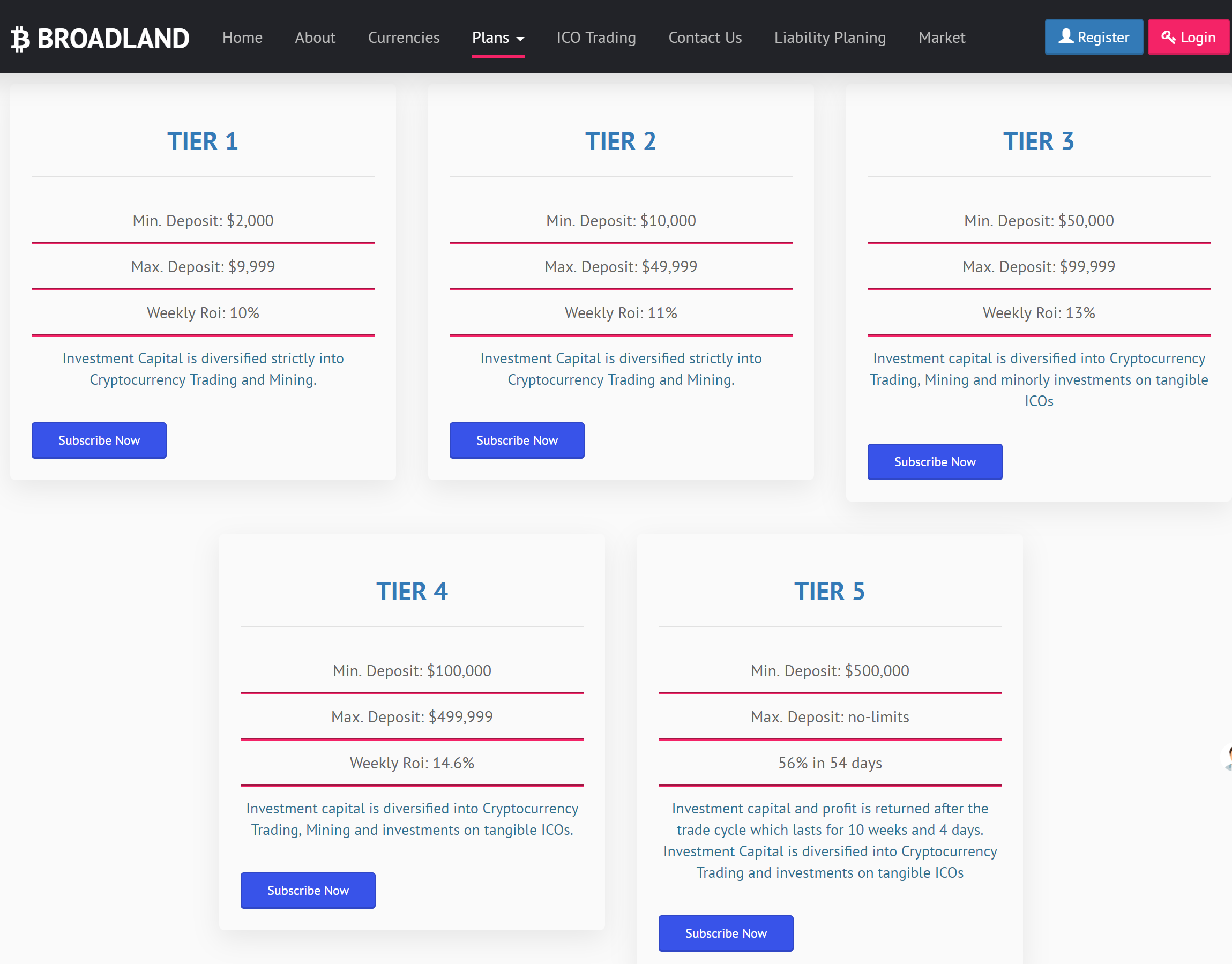

Source: Broadlandfinance.com

Source: Broadlandfinance.com

Now, notice some things that are happening here.

- The more you "invest" and the higher the ROI.

- ROI is guaranteed.

- Even the lowest level returns 1.4% per day or 159.9x returns for the year.

- Returns are not related to the state of the market.

One of the obvious signs of smoke left by Bernie Madoff, with his legendary Ponzi Scheme, was the fact that his fund's yields never faltered. They always returned the same amount in a high market, down, it did not matter. This is a red flag because every investment strategy has strengths and weaknesses. Some will be better in a bull market, others are more stable in a bear market, others do better when volatility is high, etc.

If we look at the cryptocurrency market for this year. Please tell me what you could do to extract, buy or exchange to return 159.9x in 2018?

Here is the whole market cap of criptos in 2018:

Source: coinmarketcap.com

Source: coinmarketcap.com

What about Bitcoin's mining profitability?

Source: blockchain.com

Source: blockchain.com

What about the mining of Ethereum (ETH-USD)?

Source: bitinfocharts.com

Source: bitinfocharts.com

Hmm, fun. It is almost as if it were not possible to get those types of returns in the cryptoasset space, let alone without risk.

What is an Exit Scam?

An exit scam is where you set up and run what appears to be a legitimate business or project. But, once it became big enough; take the money and run. This is why it is important not to leave cryptography on exchanges any longer than necessary. Let's talk about two recent cases of this tactic.

Canadian cryptographic exchange MapleExchange did it only last month, and so Pure Bit came out of Korea.

According to Blockchain ROK, a Korean blockchain provider, the exchange of newcomers Pure Bit actually came out cheated with at least 13,000 Ethereum investors in hand.

As evidence of the scam, BROK emphasizes the fact that the CEO of the exchange has changed his name on the popular Korean social media network Kakao to "I'm sorry" in the "high formality" fashion of the Korean language.

– CCN.com

This type of scam can be difficult to identify; but if you are following the best practices with the security of Bitcoin; you're less likely to come across this. I wrote about this on my blog a few months ago.

Rule n – Take yourself a hardware portfolio.

A hardware portfolio is the best way to store your Bitcoin. There are two companies that I trust, Trezor and Ledger. Or one of these will work well. Follow the instructions in the package and make sure you buy directly from the manufacturer, not a schmuck on Craigslist or eBay (EBAY).

Rule n. 6 – Never leave Bitcoin in an exchange for longer than you can help.

Exchanges are violated every other day. You may or may not recover your funds. This is a serious business, move your Bitcoin from the exchange on your hardware portfolio.

Rule n. 7 – Use only large sized control units.

In the United States I would suggest using Coinbase (or their Coinbase Pro exchange), Gemini or Kraken. These exchanges observe the necessary regulatory requirements and best security practices as far as I can tell. Stay away from smaller, shady and overseas exchanges.

If you follow these rules you will be at the top of the information security curve and sleep better. These rules do not provide 100% perfect protection, but I see them as the prerequisites for starting in space.

Hans Hauge's Blog – Looking for Alpha

Conclusion

The cryptoasset space is dangerous. There are ways to reduce the risk in this space and, if you are seriously involved, you have to do your homework and take the necessary precautions.

Do not expect returns without risk and be wary of anyone who seems to offer this. Do not leave your funds in return any longer than you have. Take a hardware wallet yourself and learn how to use it (and make sure it is backed up).

If you notice a scam, let the community know. You could save a lot of pain to someone, and in the process you will all do us a favor by bringing these scammers to light.

Be sure guys,

Hans

This article was first published in Crypto Blue Chips.

Revelation: We are / are long-term BTC-USD, ETH-USD.

I wrote this article alone, and expresses my opinions. I'm not getting any compensation for this (other than Seeking Alpha). I have no business relationship with any company whose actions are mentioned in this article.

[ad_2]Source link