[ad_1]

Ethereum was undoubtedly the crypt of the year in 2017. We have seen tremendous growth since its launch. The intelligent contracting capability integrated into the blockchain is a perfect stage for ambitious developers and entrepreneurs to upset every single sector that can be imagined. The main use of Ether is used as "gas" (the tariff) to execute smart contracts on the Ethereum network.

One of the greatest uses of the Ethereum network is Initial Coin Offering (ICO) / Token Sales. Numerous start-ups have issued smart tokens (which comply with the Ethereum network standard, ERC20) on the Ethereum network to raise funds. However, the amount of rising startups has raised concerns for some. For example, in just 30 seconds, around US $ 35 million was collected in BAT ICO and $ 153 million was raised in BANCOR ICO in 3 hours. People are starting to wonder if those companies really need a lot of money and how to fund the fund is "fair". The way ICO works will ensure that start-ups accumulate a huge amount of ether in their pocket. If any of the companies starts to unload stocks, it could create a chained effect and overturn the price of the ether.

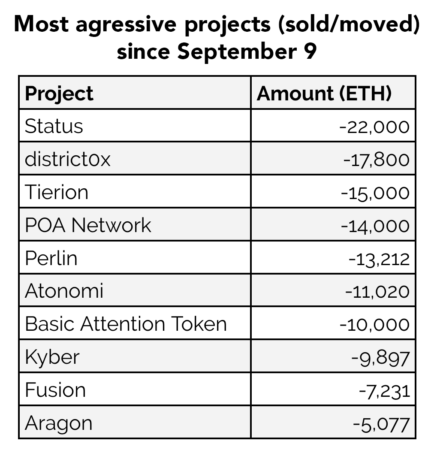

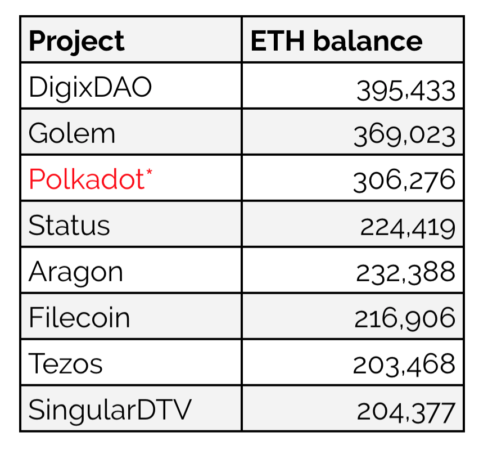

Larry Cermak of TheBlock has made a very interesting analysis of the treasuries of several ICOs of the ETH to see how much funds (in ETH) have left. He found that ICOs hold about 3.57 million ETHs in their portfolios, which makes up 3.5% of the total supply of ether.

Although the discharge of ETH has not been as high as some have predicted, Ethereum is far from being cleared through customs. The reason for this is not only conditioned by the market but has a lot to do with SEC decisions. Although, Ethereum is probably safe to be classified as a security, many of the ICOs launched on the platform will almost certainly have a contact with the SEC. We have already seen a road that SEC has chosen to use: they offer ICO teams an agreement with a fine and force them to reimburse ICO buyers.

Such as The block highlighted, the SEC seems to be developing a model for the application of ICO. It therefore seems reasonable to expect further short-term enforcement measures.

Both Airfox and Paragon were fined and agreed to register their tokens as titles. In addition, they agreed to return funds to investors. The vast majority of international product organizations have raised funds in ETH, while a minority has also increased in BTC. According to the Airfox application form, companies will have to return the USD value of the purchase price or trading loss, including interest.

Seven companies hold more than 200k ETHs (excluding Polkadot, which has funds locked in the Parity bug).

There is still no sell-off of ICOs of ethers, which have sold only about 2% of holdings in the last 2 months, 64% in total.

It seems that many teams are responsible for money and are still liquid and operational without having to use treasury funds. However, as Cermak concludes, the danger for ETH is looming and grows bigger with each passing day:

But since most of the projects that organized ICO are not yet generating significant revenue, they will eventually be forced to start selling ETH to cover operational expenses. When the sale takes place, or when the SEC forces the projects to liquidate their treasures, ethereum will probably experience the true capitulation.

Join our Telegram channel or Follow @CaptainAltcoin

The writers and authors of CapitanAltcoin may or may not have a personal interest in any of the projects and activities mentioned. None of the contents on CaptainAltcoin is an investment advice, nor does it replace the advice of a certified financial planner.

The opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of CaptainAltcoin.com

[ad_2]

Source link