[ad_1]

In fact, how much savings should I have at 30? What are the savings standards for each age group? Below, the author integrates various information for readers to help you make a financial plan.

Written by: Wu Baiqiong | Photo: Unsplash, China News Service, Fidelity website

Survey: Hong Kong people save an average of $ 7,000 per month

From August to September this year, the Deposit Insurance Commission used the telephone to interview 1,000 Hong Kong people who were over 18 years old.

The survey results show that 67% of respondents have a habit of saving: each person saves an average of 7,000 yuan per month, while the average monthly savings remain at 5,000 yuan.

Clear savings targets primarily serve to meet emergency needs

Regarding savings goals, 46% of respondents said they save money to meet emergency needs, followed by retirement preparation. In addition, nearly 40% of respondents said they have set a savings target for this year and 70% of them believe they can reach their savings target.

It can be seen that although Hong Kong has experienced social instability and economic fluctuations over the past year, the savings targets of the Hong Kong population are still clear.

Nearly a quarter of people are used to keeping cash at home

The Deposit Insurance Commission pointed out that in this survey, nearly 83% of young people between 18 and 29 had a habit of saving, the highest of all age groups. Of these, more than half said they have savings goals.

Although bank demand or fixed deposits are still the most commonly used saving method by all respondents, the survey found that nearly a quarter of respondents aged 18-29 would choose to save money at home instead.

Regardless of the form of savings used, the most important thing is to have a clear savings goal. Some people save money to have a high quality retirement life, while others save money for emergencies.

However, when devising a savings plan, employees should have a clear savings goal and therefore adapt their spending habits to manage their finances well.

What is the standard savings of 30 years for each age group?

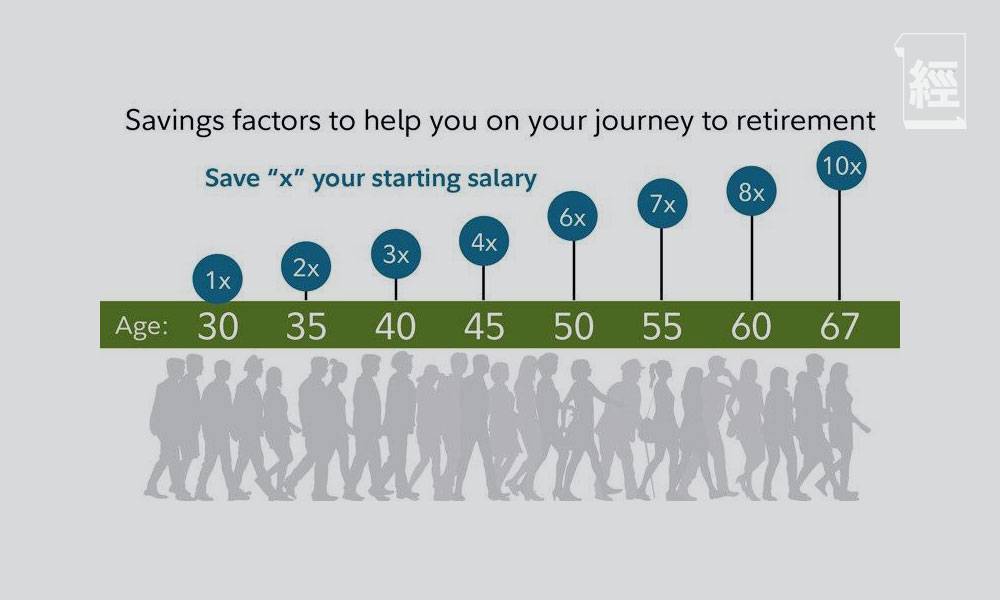

A few days ago, CNBC foreign media cited Fidelity’s recommendations on benchmarks and pension savings amounts, taking into account employee age, annual salary, and other factors to calculate savings employees should have in each age group.

According to statistics, employees are expected to save an amount similar to the current annual salary at the age of 30.

As you get older and experience, you should save twice as much for every 5 years and so on. The retirement age for Americans is 67. By then, employees are expected to save 10 times their current annual salary.

example

Taking Hong Kong’s latest median monthly income of 19,000 yuan as an example, the annual salary of employees is around 228,000 yuan. According to the Fidelity calculation method, it is possible to calculate the savings standard for each age group in Hong Kong.

| Age-based savings standards | ||

| age | multiple | Total savings |

| 30 | 1 | 228,000 |

| 35 | 2 | 456,000 |

| 40 | 3 | 684,000 |

| 45 | 4 | 912,000 |

| 50 | 6 | 1,368,000 |

| 55 | 7 | 1,596,000 |

| 60 | 8 | 1,824,000 |

| 67 | 10 | 2,280,000 |

Other: In the second quarter, the average income of 19,000 yuan decreased by 1,000 yuan compared to the previous quarter Which age did you get the most? A list of salaries in each sector

From this it can be seen that Hong Kong workers should theoretically save up to 228,000 yuan when they are 30 and should have 2.28 million yuan in savings when they are 67. However, the above calculation method is imported from foreign countries and may not be in line with the real situation in Hong Kong. In Hong Kong, coupled with factors such as inflation and high prices, the amount may not be enough for workers to meet their daily needs.

More importantly, this calculation method can be used for reference purposes only, not for everyone.The final savings plan for workers should be determined according to their needs and must be done according to their abilities.

5 great tips to save

Do you want to start saving but can’t do it? Below, the author selects 5 money-saving tips for readers.It’s not impossible to meet the savings standards of every age group.

1. Start saving as soon as possible and rely on compound interest to “build” the wealth

The first step for wage earners should start saving as soon as possible: the sooner they start saving, the more money they will save. If wage earners use their savings for long-term investments and the capital is accumulated monthly and annually with compound interest, the amount of savings will naturally increase.

2. Set your savings goals in advance

Saving money can’t be done overnight, it requires planning and long-term vision. US sales training expert Grant Cardone once said that quitting drinking habits like buying coffee won’t make you rich.

The key to getting rich is to increase your income.

He believes that setting a high savings goal and investing in yourself is the real way to get rich.

3. Know the actual consumption

Making money is not the most important factor in saving money. Sometimes “doing more does Zhongdo”.

If you want to save money, the author suggests that readers should check the flow of their funds, be clear about each consumption, try to calculate the money that must be used each month, then allocate part of the income as unnecessary expenses and then save the remaining amount.

4. Forcibly depositing money via automatic transfer

Employers may consider requesting an automatic account transfer and transfer a certain amount to a savings account each month to deposit money in a mandatory manner.

A foreign millionaire accepted the CNBC interview and said that through this method, his savings in the bank increased from $ 2.26 (about 17 Hong Kong dollars) to $ 1 million (about 7.75 million. Hong Kong dollars) in just five years.

5. There is more than one income channel

The slash family has become more and more common in recent years, and many people have other occupations besides regular jobs. In other words, some employees may have more than one source of income. If you want to save money, I suggest that wage earners can save one of their income and rely on another income for daily consumption.

Extended Reading: Is it enough for a family of four to travel once a year to rework and buy a few cups of coffee every day? I teach you 5 easy ways to save money, financial freedom is not a dream | Wu Baiqiong

Extended Reading: Buying a home does not need to rely on the father to do 5 ways to save money at 28, save nearly 2 million goals, 37 years, financial freedom and retirement, use the “4% rule “to calculate retirement expenses | Wu Baiqiong

[ad_2]

Source link