[ad_1]

Graphics = Kim Eun-kyo [email protected]

The break was given by the high international march of the gold price. That’s because the attractiveness of gold, a major player in the security industry, has waned in vaccine development news.

On the 21st (local time) on the US New York Merchandise Exchange (COMEX), the price of gold registered 1872.40 dollars per ounce (about 2.09 million won). Although the price rose 0.58% from the previous day, the momentum that broke the “Major’s $ 2000” level at $ 2035.99 on August 3 has disappeared.

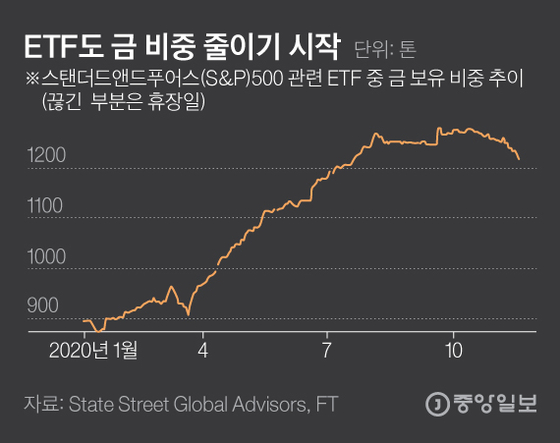

The Financial Times (FT) quoted Macquarie investment analysts, an investment bank on the 20th (local time), citing Macquarie’s investment analysts, saying, “Next year, the price of gold may drop to $ 1550, which is about 17% lower than it is now. ” . This sentiment is also reflected in the stock market. FT said: “The amount of gold in ETFs also peaked in July and then low last week.” This means that investors are starting to take their feet off gold.

![Gold bars. [중앙포토]](https://pds.joins.com/news/component/htmlphoto_mmdata/202011/22/01c29198-1a76-4a45-80ed-b6b8aeeb1f5d.jpg)

Gold bars. [중앙포토]

Gold prices have soared this year to feed the anxiety caused by the new coronavirus infection (Corona 19). In addition, the Federal Reserve System (Fed and Fed), the central bank of the United States, secured further upside engines when they started releasing money, such as aggressive quantitative easing (QE) as a countermeasure for the Crown 19. falling value of money and increasing concerns about inflation. As a means of hedging inflation, the asset value of gold has skyrocketed.

On March 18, after this year’s low of $ 1477.30, it was hovering around $ 1,500- $ 1,600, but it rose sharply as Corona 19 spread around the world. The Bank of America (BoA) even issued a forecast in April that “If this trend is true, it is possible to cross the $ 3,000 mark from October to November next year.”

The rise in the price of gold continued. The spread of the 19 crown was not caught and the US Congress continued to stall in negotiations for further stimulus measures, stirring up market turmoil. Also, Fed Chairman Jerome Powell nailed it in June, saying, “We will keep the zero-level interest rate (0 ~ 0.25%) until 2022.” The average price target (AIT) system was introduced. It gave me the justification for investing in gold. Billionaire investor Ray Dalio Bridgewater, CEO of Bridgewater, said, “The Fed cannot print gold (even if it prints the dollar),” encouraging investment in gold.

Jerome Powell Fed Chairman

As the released money flowed into the stock market, the New York stock market also held a record-breaking relay, but the rise in the price of gold didn’t stop either. This is a phenomenon where the stock price, which is a risky asset, and the gold of the safe assets, rise together.

It is the vaccine that took the price of gold, which was the same as a horse that had been loosened. On the 6th, the price of gold plummeted on the 9th after news that Pfizer and Bioentech showed a prevention effect of more than 90% in the Phase 3 clinical trial. It was $ 1,958.20 on the 8th, but it fell by 5. percentage points to 1861.68 as the effect of the vaccine was reflected in one day. FT reported that the corrective phase of the gold price “could be a sign of a continuing decline”.

ETFs are also starting to reduce the percentage of gold. Graphics = Kim Eun-kyo [email protected]

There is also an analysis that the gold price in 2020 is debut in 2013. The analysis was based on the fact that Lehman Brothers went bankrupt in September 2008 and the financial crisis in 2009 spread across the country. world and gold prices have risen, but peaked in 2011 and started to decline in 2013. FT said: “The situation is similar between now and 2013 as it may be difficult to boost political economy further along with a decline in the sense of crisis due to the development of vaccines “.

There is also an objection. For now, this is a temporary adjustment and gold prices are expected to reserve the upside, at least without further decline. Goldman Sachs pointed out in a recent report that “the feeling of crisis caused by inflation is the best since the 1970s”. This is due to aggressive quantitative easing not only in the US but also around the world. Goldman Sachs predicts that “it could rise to $ 2300 in the next few months. While the $ 3,000 win isn’t enough, it is being analyzed that a further 25% increase is possible in the future.

Reporter Jeon Sujin [email protected]

[ad_2]

Source link