[ad_1]

It's around the end of October. Outside of the sprawling Prague Congress Center, not only is the weather changing, but the world of cryptocurrencies is collapsing, as it has been for most of this year. The expectations for blockchain systems, skyrocketing just a year ago, are declining almost at the same speed as coin prices based on them. But inside, the mood is quite different. Here, Devcon – the annual "family reunion" organized by the Ethereum Foundation – is in full swing, and there is just a hint of negativity to be found.

On the contrary, there is a lot of enveloping clothes, with unicorn and a sense of excitement for the future. This crowd does not care what happens outside. Whatever is happening here, it is much more than magic money on the internet.

Ethereum is already the most famous cryptocurrency after Bitcoin and the third largest in total value. Unlike the others, however, it aims to serve as a generic computer platform that, according to its members, could make possible new forms of social organization. The central topic of Devcon is "Ethereum 2.0", a radical update that would allow the network to realize its true power.

The nagging truth, however, is that all positivity in Prague mask discouraging questions about the future of Ethereum. The handful of idealist researchers, developers and administrators in charge of maintaining their software is under increasing pressure to overcome the technical limitations that hinder the growth of the network. At the same time, well-funded competitors have emerged, claiming that their blockchains have a better return. Crackdown by regulators and a growing understanding of how most blockchain applications are ready for prime time, have frightened many cryptocurrency investors: the market value of Ethereum in dollars has fallen more than 90% from the peak of last January.

The reason why Devcon feels so optimistic, despite these storm clouds, is that the people who build Ethereum have something more important in mind, something that changes the world, in fact. However, to achieve its goal, this streamlined community needs to solve a complicated problem such as any technical challenge of curvature of the feet it faces: how to govern itself. It must find a way to organize a dispersed global network of contributors and stakeholders without sacrificing "decentralization", the principle that every cryptocurrency community seeks, that no entity or group should have control.

Devcon's stage.

It's possible? Other blockchain communities, including Bitcoin, have struggled with infighting and paralysis on key software updates that Ethereum is planning. That the community can make it happen Ethereum 2.0 is not only important for cryptographic speculators and nerd blockchains: it can simply go to the very heart of how society is managed.

Sign up for Chain of Sant & Antonio

Blockchains, cryptocurrencies and why they are important.

By signing up you agree to receive e-mails and newsletters

notifications from MIT Technology Review. You can change your preferences at any time. Look at ours

Privacy statement for more details.

The CryptoKitties effect

To understand the hype about Ethereum, you first need to understand the hype around the blockchains in general, and then what makes Ethereum different. (Skip the next four paragraphs if you already know).

A blockchain is essentially a shared database, stored in multiple copies on computers all over the world. These computers are known as "nodes" and any computer on the Internet can become a node in a blockchain network by installing and running specially developed software. What makes a blockchain different from a normal database is that, thanks to the innovative use of cryptography, there is no need for a central authority like a bank or a government to maintain it. The nodes run the software and collectively make sure that each new transaction follows certain rules before adding it to the blockchain.

This process, called mining, requires a lot of computer science. This makes it very difficult to tamper with the blockchain transaction record, since this generally depends on controlling most of the network's extraction power and this would require a huge amount of resources. So the ideal blockchain is "decentralized", ie it has many independent users so no one has control.

The first blockchain application was Bitcoin, a system for peer-to-peer payments. Ethereum takes another ambitious step. Instead of processing and archiving currency transactions, its nodes should function collectively as "world's computers" on which, using specialized programming languages, people can create applications that should appear and resemble those already present on our phones-except that nobody is responsible for them.

These decentralized applications, or "dapps", could include elements such as voting systems, trading markets or even social networks – imagine a Twitter or Facebook that no one owns. Being decentralized, they would be theoretically immune to attempts to manipulate or close them. For Ethereum's most avid believers, these contain the promise of a completely new type of democratic society in which it is much harder to concentrate wealth and power, hide corruption and exercise an embassy influence behind the scenes.

A year ago – practically in centuries of encrypted time – investors were pouring billions of dollars into promising projects that they built up. They invested through initial coin offerings, in which the blockchain founders collected money, in crowdfunding style, selling digital tokens. Coins prices, including Ether, Ethereum's own crypto-token, were soaring. Many of their fans believed that blockchains and cryptocurrencies would soon replace traditional financial intermediaries, rewrite the monopolistic internet companies and decentralize the web.

Then the CryptoKitties arrived.

CryptoKitties

Perhaps it is appropriate for a child's play to be the right thing to kill the mood. The CryptoKitties, launched in late 2017, are colored digital versions of Beanie Babies cats, stuffed animals that have become a collector craze in the 90s. Like the Beanie Babies, the CryptoKitties are all unique in some ways, but unlike the Beanie Babies, they can reproduce. The uniqueness of each cat is verified on the Ethereum blockchain using a particular type of token, and players can buy, sell or "breed" cats using Ether.

The problem was that the CryptoKitties became too popular too quickly. As with Beanie Babies, some kittens have become very popular, exchanging hands for an Ether value of $ 170,000. The mad rush to play them suddenly led to a six-fold increase in the volume of transactions that blocked the network and slowed the arrest of Ethereum. He highlighted the truth: technology is immature, unable to handle the workloads that great needs would require.

"I think people may have outdone themselves," says Jamie Pitts. We are sitting on the edge of Devcon, which was financed and organized by the employer of Pitts, the non-profit Ethereum foundation, which is based in Switzerland. The foundation is not big on titles, but Pitts is an administrator of sorts. It helps to improve the technical improvements of the Ethereum software, a job that can be like grazing the cats of real life.

A web developer for suffocated and introspective voice, Pitts is a true supporter of Ethereum, and has been since its first publication in Vitalik Buterin's white paper in 2013. (Each cryptocurrency begins with a white paper outlining its technical principles). no illusions about its current capabilities, though. "A funky computer from the 70s," he says with a warm smile. Buterin, the enigmatic young creator of Ethereum, uses a slightly less pejorative comparison, calling it "a 1999 smartphone that can play Snake".

Dozens of investors and entrepreneurs have overestimated the ability of the Ethereum blockchain and have convinced others to invest billions in their projects. "They were thinking things like," Hey, I could build this medical company on Ethereum's blockchain … and a doctor can go somewhere and their stethoscope will talk to their iPad or something above the blockchain, Quite right? "He says, laughing." The CryptoKitties have really put a little fear in their hearts. "

Exposing the inherent weakness of the network, CryptoKitties helped investors realize their mistake. Suddenly they became much more interested in the Ethereum roadmap. "These guys are now trying to influence what happens," says Pitts.

Vitalik holding a Lambo

This is why the question of governance is such a hot topic in Prague. The craze of 2017, when cryptocurrencies increased in value and investors accumulated, made the Ethereum stakeholder map much more complicated. The CryptoKitties fiasco and a series of successive challenges have made it clear that everyone needed a better way to work together to solve the technical problems of Ethereum.

The afternoon before sitting down with Pitts, he and Hudson Jameson, who also works for the foundation, helped lead a sober discussion on how to create better decision-making processes.

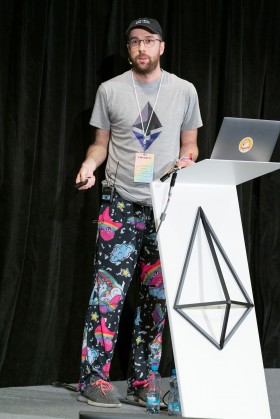

Panelists speak during a session on governance. From left to right: Boris Mann, Ethereum volunteer and blockchain entrepreneur; Sarah Friend, artist and software designer for the Ethereum Foundation; and the employees of the Jamie Pitts Foundation and Hudson Jameson (in Halloween costume, dressed as a Saturday Night Live character).

Jameson, who has a computer background and a friendly Texas tweak, runs the most important decision-making forum that Ethereum currently has: the bi-weekly calls among the group of self-identified core developers. The meeting can attract between 15 and 30 participants, depending on how controversial the topics are on the agenda.

Jameson often shows admirable patience during these calls transmitted by YouTube. But in Prague there is a bit of exasperation in his voice as he addresses a crowd of about 100 people. Complicated technical questions are testing the limits of Ethereum's very simple governance system, he says: "We do not have enough people to really help us with these things." This means that the same people are making decisions over and over again; the community needs better and more accessible forums for technical discussions and decision-making processes.

What is now the governance of Ethereum? Jameson poses the question rhetorically before moving on to the next PowerPoint slide, which presents the illustration of a cosmic-sized Buterin holding a Lamborghini. ("Lambos" has become an ironic symbol of crypto-wealth.) "Vitalik is holding a Lambo," he says dryly. Some in the crowd giggle.

Jameson jokes above all. However, everyone knows that, for all Ethereum's ambitions to be decentralized, Buterin is still its North Star. When difficult times have arisen in the past, the community has relied heavily on him to guide them.

"Vitalik's thinking has influenced us so much," says Pitts. "His ethics and his vision of life and things like that, his humility and austerity There are so many ways in him – even his humor – there are so many ways he has influenced everyone here, and he has attracted people who had similar values ".

Vitalik Buterin, founder of Ethereum, in an ironic image of him as a deity holding a Lamborghini.

Reddit | user: earthquakequestion

A brilliant and talented child whose family left Russia when he was six years old to move to Canada, Buterin discovered Bitcoin when he was still a World of Warcraft-playing teen in Toronto, and was so inspired by blockchains and cryptocurrencies that he dropped out of college to focus on them. But while Buterin loved Bitcoin, he found it limited. So he decided to design a blockchain system that could do much more than manage an archive of digital values.

At age 19, he published the white paper that describes Ethereum. In it, he explained how he believed that certain Bitcoin ideas could be used to create a decentralized computing platform. Since it would not have a single component whose failure could bring it all down and would not be subject to control by any central intermediary, such a platform could never be closed. For Buterin, this meant freedom from online censorship, surveillance, and other forms of centralized power.

Obviously, someone with such a vision would not have been satisfied with the digital Beanie Babies. According to Buterin, Ethereum's mission is to reach 1.7 billion adults around the world who do not have a bank account or access to a mobile money provider. Last December, when Ether's price was rocketing and the total value of all cryptocurrencies was over $ 500 billion, Buterin went on Twitter to challenge blockchain developers. "How many unallocated people have we veered? How much censorship-resistant business for ordinary people have we enabled?" Churches. "Not enough."

Ethereum 2.0

On Devcon's stage, Buterin is lively and optimistic about the future of Ethereum. Slim for the railroad, angular and dressed in a black T-shirt and black trousers, he subconsciously contrasts his wrists and strong hands while he speaks, almost childish, and his other movements are rather robotic. However, the audience of around 3,000 developers and entrepreneurs, mostly men aged 20 to 30, is paralyzed. They believe in his vision.

Buterin's speech, which is littered with obscure jargon and acronyms, is centered on Ethereum 2.0 The label refers to "a combination of a lot of different characteristics we have been talking about for several years, researching for several years and the construction active for several years, which are finally going together in this unique coherent whole, "he proclaims.

Buterin on the stage of Devcon.

The Buterin problem and some trusted collaborators took years to deal with the fundamental weaknesses of Ethereum, and the reasons why CryptoKitties was able to bring it down, derive from the very core of how almost all the existing cryptocurrencies are built.

To create an application on Ethereum, a specialized programming language is used to write the so-called smart contracts. These are programs that are automatically executed when certain conditions are met, for example when the price of something falls below a certain value. The Ethereum blockchain tracks changes to the status of all the smart contracts stored in it.

To execute smart contracts, users must pay a commission in Ether, called "gas". Gas is what makes the whole system work. The expenses ultimately go to the owners of the nodes that perform the mining, the expensive (because it flickers the electricity) to perform the calculations that add data to the blockchain.

CryptoKitties provides a good example of how it works in practice. To create your one-of-a-kind cat, you must first purchase one using the game's website. A transaction on the blockchain transfers you the immutable property of the kitten. To "breed" your kitten with another, just send enough fuel to a smart contract on the blockchain. The game automatically mixes the "DNA" of the two parents, spits out a new kitten and, in another transaction, stores the proof that you are the sole owner of the blockchain.

Ethereum can handle only about 15 of these transactions per second, on average. Depending on network congestion, long periods of time may elapse before a transaction becomes final. (To make a comparison, Visa's payment network handles an average of 2,000 card transactions per second and has a capacity of tens of thousands.) This slowness is intrinsic to the design: because each node stores and processes each transaction, the smart contracts they are extremely difficult to interrupt or stop. The downside is that the system is as slow as its slower node.

Devcon teems with lively discussions about projects to solve the technical problems of Ethereum. Three terms in particular – "sharding", "Plasma" and "Casper" – appear in almost every speech. To be part of Ethereum 2.0, together they promise to dramatically increase the ability of the system to manage transactions without sacrificing its ability to recover and substantially reduce carbon emissions from Ethereum's growing network of power-hungry computers.

Sharding is supposed to work by dividing blockchain data. Instead of storing and calculating each intelligent contract, the subsets of nodes managed smaller pieces altogether.

Plasma is a system that allows users to interact with each other without having to always go through the main blockchain. Essentially, they agree to open a private and secure channel of communication and use it to do things like cryptocurrency exchange or play a game. When they are finished, they can add all updates to the main blockchain in a single transaction.

Casper, the friendly ghost

The most ambitious project of all, however, is Casper. Led by Buterin and fellow Ethereum researcher Vlad Zamfir, he has been developing for years. The goal is to reinvent the way in which computers on a public blockchain network reach consensus.

To function as a decentralized network that no entity controls, each cryptocurrency requires a consent protocol, a process that the nodes in its blockchain network use to agree, over and over again, that the information in the blockchain is valid. For Ethereum, Bitcoin and most other cryptocurrencies, the central part of the consent protocol is an algorithm called proof of work.

Proof of work works like a race. Computers designed for cryptocurrency extraction devote enormous amounts of processing power to repeatedly guess a solution to a mathematical puzzle. The first to solve the puzzle comes to add a new "block" of valid transactions to the chain of the previous ones and receives a reward in cryptocurrency. The idea behind the demonstration of the job is that the would-be attackers are discouraged by the huge cost of hardware and mining electricity they would need to manipulate the ledger.

The creator of Bitcoin, Satoshi Nakamoto, did not invent the proof of work, but had the inspired idea of using it as a way to make participation in a blockchain network open to the public. Anyone with the right hardware and enough electricity can extract Bitcoins, Ethers and similar cryptocurrencies without the need for authorization.

The protocol of consent of Nakamoto was revolutionary. But "it's absolutely horrible from a performance standpoint," says Emin Gün Sirer, a computer scientist and cryptocurrency expert at Cornell University. Not only is it painfully slow; he uses too much electricity.

"Spent energy is a huge multiple of the energy needed to build the blockchain," says Sirer. Although Ethereum burns much less than Bitcoin, recent estimates suggest that it still consumes the same amount of electricity as a small country, while Bitcoin uses a large enough one. (Quantities vary, but at the time of writing, the consumption of Ethereum was equal to that of Costa Rica, and Bitcoin was approximately at the level of Bangladesh.)

Buterin recognizes that this must change. "The social impact of burning huge amounts of resources has consequences," he told me when I met him at Devcon. Billions of dollars are "wasted" through work trials, which translates into a "loss of resources that spreads through every single user of cryptocurrency and, ultimately, through all environmental externalities, every single person in society". It's also pretty bad for the brand: "I like it, it could mean the difference between anyone who really cares about the environment being your friend against trying to stop you."

Devcon's audience.

The algorithm that Buterin and his disciples have chosen as a substitute is called a pole test. Rooted in the approaches described for the first time in the 80s, the stake test is based on "validators": members of the network who, quite simply, verify and attest that the transactions added to the chain are valid. Their incentive to be honest is that they have to deposit, or "bet", large sums of money (the current plan is 32 Ether, about $ 2,800 at the time of writing). When their term as validators ends, they can recover the money; if they were dishonest, they are about to lose it.

The mechanisms to choose which validators to obtain new blocks to the chain and penalize them for incorrect behavior must be incorporated into the algorithm. Doing this in a fair and sustainable way depends on solving problems in game theory, economics and information technology. There is also the question of how to design a system that can handle a large number of validators without interruption. Finally, proof-of-stake networks are vulnerable to some malicious attacks that proof-of-work systems are not (the opposite is true), and Ethereum researchers are still struggling to determine the best way to defend themselves against they.

The ancient research to replace the proof of work has continued stock and start. Promising ideas have been discarded and deadlines rejected. This could be part of why, despite Buterin's optimism at Devcon, his exciting speech does not offer a timeline to complete the update.

Many of the problems that confuse the developers of Ethereum have been known for over a decade, says Sirer, who suggests that perhaps this is why Nakamoto has invented a different approach to Bitcoin. "The fact that they have not been able to implement a working protocol tells me that this is really a very difficult problem," says Sirer. "Not only that, but the fact that nobody else was able to do it, even all the academics could not do it."

Unicorns and rainbows

Ethereum 2.0, says Buterin, will be able to handle volumes of transactions a thousand times larger than the current version, allowing it to truly become the world computer it has imagined. On stage, and later in person, exudes a naked confidence that implies that it is simply an obvious matter.

None of the foundation's employees, developers and other participants with whom I speak to Devcon express doubts in Buterin, or in the prospects for Ethereum 2.0. But some are more cautious about the challenges.

Lane Rettig, one of the main developers of Ethereum.

Lane Rettig, one of the main self-identified developers, echoes Jameson's concerns about the need for better decision-making systems: "The things we have to solve are more complex, the problem of coordination is becoming more difficult." There are more people involved, more organizations, more software. "Rettig, whose Devcon clothing features black pajama trousers with unicorns and white and pink rainbows, states that in addition to technical scalability, it is equally urgent for the community to achieve" social scalability. "

One key problem with Ethereum is that the process of making software changes is not completely defined, says Pitts. To solve the problem, he and principal developer Greg Colvin are leading a new organization called the Fellowship of Ethereum Magicians. They are modeling it according to the Internet Engineering Task Force, the open organization of voluntary Internet standards.

All of this sounds like the beginning of a traditional institution, albeit with rules and hierarchy. Is it not contrary to the decentralized ideals of Ethereum?

Perhaps, but to win what Jameson calls "blockchain wars", he will probably need more structure. "There are many paradoxes here," admits Rettig. "A centralized process is needed to invent a decentralized governance mechanism".

Furthermore, many people argue that Ethereum is already more centralized than it should be. As with Bitcoin, only a few groups of miners control most of the mining power of the network. There is also his continued dependence on Buterin for driving, although Buterin pushes back emphatically when I ask him if it's a single point of failure. "Dependence on me is definitely diminishing," he insists.

Ultimately, what seems to unite the Devcon participants is not Buterin or an abstract notion of decentralization. It is a true belief that Ethereum's technology can and should disrupt the way human beings organize themselves on a global scale. The question is how long its supporters have to take it out, especially if the enthusiasm for cryptocurrencies continues to fall. In the end, the bold ambition and idealism on display in Prague addresses the same question: Ethereum's blockchain: can it scale? Or are they just CryptoKitties, unicorns and rainbows?

[ad_2]

Source link