[ad_1]

[ad_1]

Ethereum (ETH-USD), once considered the son of the next wave of technological innovation, had a bad 2018. After reaching a historical high above $ 1400 in January, ETH prices fell below $ 100. Like many others who believe in the opportunities of smart contracts based on Ethereum, a price close to $ 100 represents an excellent buying opportunity in ETH. However, there are reservations about this – that is, adoption and a new stakeout system that will be presented in 2019.

We will start with the great news of Ethereum this week: layoffs at ConsenSys, a company run by Joseph Lubin, a co-founder of Ethereum. A complete review is here; but the conclusion is that Lubin founded it as an experiment that went great, with money supported by an increase in the price of ETH. With ETH prices exceeding 90%, the company's track is in danger.

The fact is that, in 2017, money entered the ETH ecosystem, with dozens of ICOs launching new coins on ERC-20 (a blocker compatible with Ethereum). Now that the money has slowed and companies have had to sell ETH turned up in initial coin offerings, causing a massive surge of panic sales, pushing the price lower.

This has significantly impacted ETH prices in mid-2018. A bubble can burst when investors fail to see the return of value from a speculative investment, but a bubble opens faster as hundreds of companies need to liquidate resources. to pay inflated personnel. But this is a temporary problem.

Because the ETH prices have been downloaded, the use of the network and the fundamentals have strengthened. The author of the linked article writes:

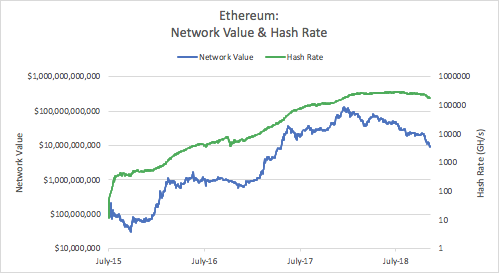

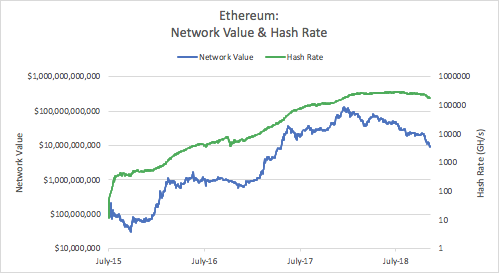

Since the respective maximum prices, the network values of Bitcoin and Ethereum are down respectively by 81% and 93%, while the demand for the respective native features is down respectively by 74% and 7% .

This is important. The value of ETH is based on the demand for use of blockchain which requires "gas" payments from its tokens. If and as smart contracts begin to accumulate in the chain, the supply economy should raise prices for others wishing to use the self-execution innovation of scheduled Ethereum contracts.

Here is the same chart of the author of the use of ETH over time:

Naturally, Ethereum will have to maintain its status as the first option for smart contracts. There was a not inconsiderable amount of chatter and online coverage on apps that switch to coins like Tron and away from Ethereum. This is supported by Tron's leader, Justin Sun, who is a prolific speaker of the Vitalik Buterin of Ethereum. But Sun is trying to increase the adoption of Tron among Internet users and Buterin is trying to understand something much more difficult. An entire system of economic incentives for Ethereum token holders.

What this refers to is the "stakeout" system that the Ethereum team should present next year. This will replace the intensity of "mining" resources and provide ETH holders with economic premiums to "hold" or "bet" their coin cache. The rate of these prizes, and the value seen, cling to an ETH pole instead of holding it liquid in or around exchanges. This, perhaps more than anything else than the broad adoption of the Ethereum protocols, has the opportunity to change the prices of the Ethics to a tremendous extent.

Even the technicians have some support for ETH. There are support lines for $ 96 and $ 104 on pairs of dollars. Calls for a price increase once the pipelines of smart contracts were opened in 2019 also defined an optimistic tone for ETH.

The look for ETH is long-term and an investor may need to stand behind price fluctuations even beyond the ETH 2018 range of $ 86- $ 1400. Still, it's hard to imagine how the combining a cashless future and the kind of Ethereum interruption has around it not creating a valuable technology beyond the $ 9 billion capital market that ETH tokens currently have. Despite the year similar to the bubble, we called ETH a buy under $ 200 and we continue to see it as such.

Bitcoin may have descended from the stratosphere, but there is still an abundance of opportunities in cryptocurrencies. At Coin Agora, our focus is on altcoins – small-cap crypts that have enormous potential to upset corporate ecosystems. Invest with us for the opportunity to enter the ground floor. Our mission is to help you find small, new and growing coins and collect rich returns. Let us help you overcome the noise and find the winners – join the Coin Agora community today!

Revelation: We are / are long ETH-USD.

I wrote this article alone, and expresses my opinions. I'm not getting any compensation for this (other than Seeking Alpha). I have no business relationship with any company whose actions are mentioned in this article.

[ad_2]Source link