[ad_1]

[ad_1]

Ethereum and Tron lead the highest majors while the market rebound continues. The Chinese banking system turns to the blockchain for commercial financing.

ETH

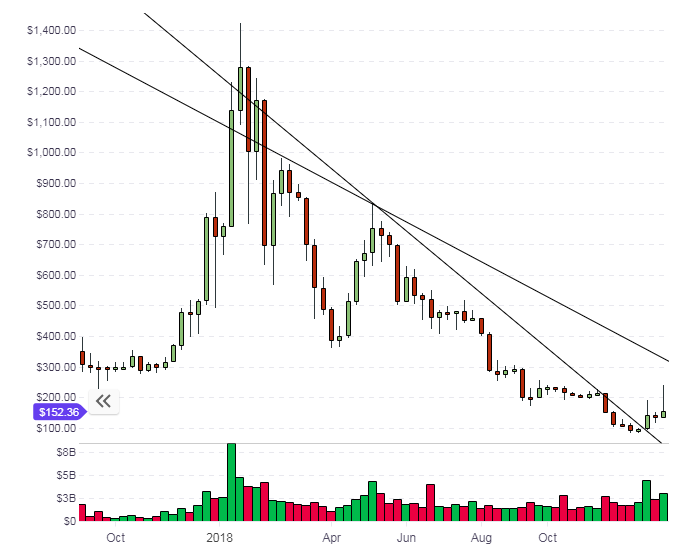

Ethereum rose for the third consecutive week with a closing above the $ 150 level while the cryptocurrency rebound continues in 2019. ETH had dropped to $ 80 in mid-December, so the recent rebound represents a 100% gain. Ethereum's bullish action saw it outperform XRP and take second place on the cryptocurrency list by market capitalization with a valuation of $ 16 billion.

The reason for the move is the impending gallows of Constantinople, which should take place between 14 and 18 January. The update should bring big changes to the blockchain with proposals to facilitate the transition from proof-of-work (PoW) to the most energy-efficient proof of interest (PoS), which is in line with the goals of the founder Vitalik Buterin.

ETH has received a boost from the news that the encryption exchanges with Huobi and OKEx have announced their support for the hard-fork. The currency has a key resistance ahead of the $ 200 level. Going over, we would see $ 300 and April lows of $ 370 as short-term hurdles. The ETH rebound continues to provide support for Ethereum Classic which returns above $ 5.00.

TRX is also more than doubled compared to the lows of mid-December to create a possible fund. Recent news for TRX is the creation of a BitTorrent cryptocurrency on the Tron network. Tron acquired BitTorrent in an agreement last June and the BitTorrent Token (BTT) is the first major move to capitalize on the 100 million BitTorrent users.

The CEO of Tron Founder and BitTorrent Justin Sun commented on the move:

With a giant leap, we can introduce blockchain to hundreds of millions of users around the world and empower a new generation of content creators with the tools to distribute their content directly to others on the web.

BTT will be a TRC-10 token and will have a total supply of 990 billion.

TRX currently trades at $ 0.023 and a weekly close above $ 0.04 would open a potential shift to its previous highs close to $ 0.09 and a possible sign test of $ 0.10.

NEO

The NEO is one of the best-performing coins on Monday with a 10% gain in the morning. The currency is currently at number 17 on the list by market capitalization and is currently dragging NEM of only $ 25 million.

The price of NEO has played psychological round numbers well, so the immediate resistance is $ 10.00 with the $ 15.00 and $ 30.00 key levels to breach. A $ 15.00 move would see NEO jumping to challenge the IOTA with its $ 1 billion capital market in 12th place.

The focus of NEO on digital resources and smart contracts means that it does not get the same attention as currency / payments currencies. This makes the assessment more attractive than some of its peers if its vision of a "smart economy" is realized. "Complete decentralization" is another goal for the network and should be completed in 2019 through the distribution of consent nodes.

CHINA

The China Banking Association (CBA) announced a blockchain platform for the settlement of commercial loans. Coin Desk has reported that over 10 major banking institutions have joined the program, including HSBC and Bank of China. ACB noted that the pilot programs issued a letter of credit (LoC) and asset-backed securities, with the participation of ICBC and China Merchants Bank.

The announcement also announced plans for a launch among SMEs in 2019:

In 2019, after the platform will proceed smoothly, the China Banking Association intends to further expand the platform coverage, absorb the majority of small and medium (SME) banks to enter the platform, expand the platform business type and actively cooperate with competent agencies such as taxation and customs to give full play to the platform of industrial organizations.

The activities of the banks show that the Chinese financial institutions believe in the future of the blockchain to feed the "Belt and Road Initiative", despite the prohibitions and hostility of the national government. It could be the stage for the government to soften their tone and lift the ban on cryptography, which could transform the future of cryptocurrencies with the types of volumes seen in the rally of late 2017.

Disclaimer: the information contained in this document is provided without considering personal circumstances, therefore it should not be interpreted as financial advice, investment or offer recommendation or solicitation for cryptocurrency transactions.

[ad_2]Source link