[ad_1]

Ethereum vs Ethereum Classic: the difference between these cryptocurrencies with the same name is both philosophical and technical. After a $ 55 million cryptocurrency hack, the Ethereum network has split into two cryptocurrencies with separate blockchains, market capitalizations and ideologies. that's how Ethereum vs Ethereum Classical rivalry is born and because these currencies are far from the same.

A story of Ethereum

To understand the dichotomy Ethereum vs Ethereum Classic, you have to look back to 2016 when there was only Ethereum.

In 2013, Vitalik Buterin, Joseph Lubin and Gavin Wood presented the world with a new type of cryptocurrency. Using the blockchain, the technology of the distributed ledger underlying Bitcoin (BTC), Ethereum was built for peer-to-peer agreements and decentralized applications. More specifically, Bitcoin works like money or investment, while Ethereum is a platform for smart contracts and DApp.

- An intelligent contract is a code with pre-set conditions that, once satisfied, automatically applies the terms of an agreement.

- A DApp is a decentralized open source application that uses cryptocurrency tokens. You can use DApps as a payment platform, cloud storage, communication and much more.

In others to create intelligent contracts and DApp, Ethereum has its own programming language complete with Turing. This means that it can theoretically solve any problem if provided with adequate resources. In other words, the Ethereum network hypothetically has the power to meet the terms of any intelligent contract.

In the summer of 2014, Ethereum launched its ICO, initially listing 2000 ETH at 1 BTC. This ICO made $ 18,300,000, an unprecedented figure at the moment. Under the leadership of Buterin, the team behind Ethereum created the genesis block of Ethereum in 2015.

Although Bitcoin and Ethereum both use proof of work to verify transactions, they are structurally and ideologically distinct. For example, there can only be 21 million bitcoins. In comparison, the Ethereum network allows the extraction of 18 million Ethereum per year, forever.

Ether, the "fuel" that feeds the Ethereum blockchain

Ethereum (also known as ETH or ether) should never have been a digital currency like Bitcoin. Instead, ether is a cryptocurrency that someone receives once they have met the terms of an agreement. Ethereum transactions are generally automatic since they are satisfied by smart contracts rather than by people. Moreover, ether may represent something different from currency. This is especially true in the case of DApps.

In other words, ether fuels the virtual network of Ethereum, while Bitcoin works more like the legal currency, or the currency of the government, in the way people exchange it. ETH is also less liquid than Bitcoin, which means that it is more difficult and less common to convert ether into money.

The DAO attack

Why do we have Ethereum vs Ethereum Classic? It all goes back to a historical event in the history of cryptography known as The DAO hack, which occurred on June 17, 2016. Within hours, an anonymous hacker stole 3.6 million ETHs worth $ 55 million.

DAO: a decentralized risk capital fund

In 2016, a development team led by Slock. He presented the DAO to the Ethereum blockchain. The DAO, or decentralized autonomous organization, was venture capital that used smart contracts to allow investors to finance DApps without going through a centralized organization.

Here's how DAO worked: investors traded ETHs with DAO tokens. Using these tokens, they voted on which DApps should support the DAO fund. If a DApp received 20% of the votes, the intelligent contract at the base of the DAO would automatically release the funds to the app.

In its 2016 ICO, the DAO token raised $ 150 million in Ethereum, making it one of the most successful ICOs of all time. At the time of The DAO hack, 14% of all ether existed in the DAO network. But keep in mind that The DAO and Ethereum are not the same thing. DAO is an application created on the Ethereum blockchain, not on the blockchain itself.

The problem with DAO

Suppose an investor wanted to convert his DAO tokens into Ethereum. They would ask the smart contract to exchange their DAO tokens for ETH. After issuing ETH, the intelligent contract would update the ledger. This meant that the conversion of cryptography into the DAO network was a two-step process.

To withdraw funds, the hacker continued to request conversions from the smart contract. And adding a recursive function, an algorithm that refers to itself, they were able to continually withdraw funds before the smart contract could add the transaction to the blockchain. Within a few hours, the hacker stole $ 55 million, equivalent to 30% of the total DAO funds.

The network put these funds in an account with a 28-day holding period. Although the hacker was not able to collect $ 55 million stolen, the DAO was basically closed. Poloniex and Kraken cryptocurrency exchanges removed DAO tokens in September and December 2016, respectively.

Hard fork of Ethereum

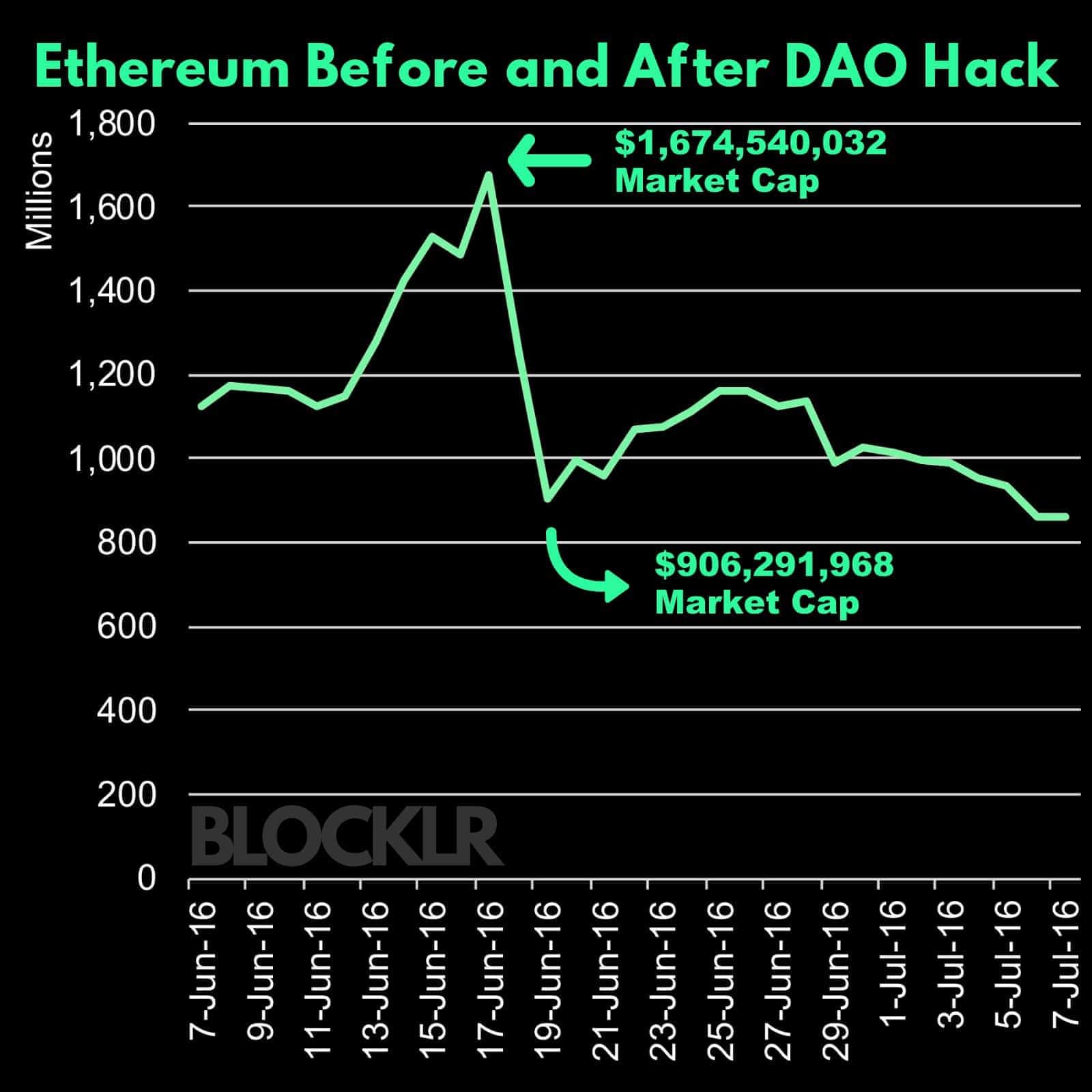

Data courtesy of CoinMarketCap (10/01/2018). Price in USD.

Within 48 hours of DAO's hack, the market capitalization of Ethereum fell by more than $ 768 million USD -45.9% in two days. As seen in the chart above, the Ethereum coin market has continued to decline over the following weeks.

About 90% of the Ethereum community supported a difficult fork. This is a change in the protocol of a blockchain so important as to require the creation of a completely new blockchain. The goal was to create a new Ethereum blockchain that would allow people to raise funds stolen from an account in which the network would allocate them.

However, not everyone is in agreement with the Ethereum hard fork. 10% of the Ethereum community believed that this contradicted the fundamental notion that the blockchain was immutable.

On 20 July 2016 the Ethereum vs Ethereum Classic gap was born. Ethereum (ETH) is the cryptocurrency used by the new bifurcated blockchain. As the name indicates, Ethereum Classic (ETC) is the oldest and smallest part of the community that rejected Ethereum's hard fork.

At the time of the Ethereum fork, anyone who owned Ethereum received the same funds in ETC as they did in ETH. This has also become a problem for more secure cryptocurrency exchanges. Although they had nothing to do with ETC, exchanges were technically responsible for giving customers access to ETC after the Ethereum fork.

Ethereum vs Ethereum Classic

Here's how to distinguish between Ethereum and Ethereum Classic:

1. The price of Ethereum is higher. Today, ETH and ETC cost $229.70 e $ 11.21, respectively. Their market limits are $23.50 billion e $ 1.2 billion.

2. Ethereum represented 90% of the Ethereum community at the time of the Ethereum hard fork. This means that Ethereum Classic was only 10% of Ethereum's investors.

3. Large companies use the Ethereum blockchain. The Enterprise Ethereum Alliance assists companies when it comes to the application of Ethereum's blockchain technology. Mastercard, BP, Microsoft and JPMorgan Chase have tested applications based on Ethereum.

4. Ethereum works more like software, while Ethereum Classic resembles a cryptocurrency for commerce. ETH is widely used to pay transaction fees and, more generally, keep the Ethereum network up and running. And because there are so many large companies in the Ethereum blockchain, the value of Ethereum is tied to the value of those companies that use the blockchain. In comparison, Ethereum Classic has a value based entirely on supply and demand like other money, cryptocurrency or other.

5. Ethereum vs Ethereum Classic: have different hash rates. A hash rate is a speed at which a network can complete a transaction. It depends on computational power. The greater the hash rate of a network, the faster it can create new blocks.

According to BitInfoCharts, the current hash frequency of Ethereum is 263.7Th / s (trillions of hashes per second). Ethereum Classic is currently 15.9Th / s. This means that miners are using much less computational power to extract Ethereum Classic from Ethereum. In general, the more hash rate, the more profitable, and therefore more competitive, the mining. For comparison, the current bitcoin hash rate is 55.1 E / s (quintillion of hashes per second).

6. The developers of Ethereum Classic largely remain behind the scenes. The faces of ETH-Vitalik Buterin, Joseph Lubin and Gavin Wood are public, while the leaders of the ETC are largely pseudonyms.

Ethereum and Ethereum Classic Similarities

With Bitcoin vs. Bitcoin Cash, Bitcoin's blockchain rejected the blockchain so the Bitcoin blocks could be much larger and the Proof-of-Work algorithms could be simpler. The goal was to make Bitcoin transactions faster.

In comparison, the blockchains of Ethereum vs Ethereum Classic are not so distinct. The similarities between these two blockchains include:

1. Ethereum and Ethereum Classic are open source. Anyone, anywhere, can download Ethereum as a software, modify it and redistribute it as it sees fit.

2. Creating a block requires the same amount of time. It takes about 15 seconds to create an Ethereum block on both blockchains. In comparison, it takes 10 minutes to create a Bitcoin block.

3. Transaction fees depend on the same factors. All Ethereum tariffs depend on the computational difficulty of the transaction, the amount of bandwidth it uses and the amount of space it needs. This is all calculated in gas, a unit that exists only in the Ethereum system.

The advantage of gas is that it allows the network to calculate tariffs without taking into account the floating price of ETC or ETH. To convert the gas to Ethereum, you must set your "gas price", which is the amount you are willing to pay for a transaction.

4. They use the same consent mechanism. Ethereum and Ethereum Classic use a form of work trial called Ethash.

5. Both cryptocurrencies are smart-contract, rather than currency, focused. This is because both are still in line with the original Ethereum white paper.

Ethereum continues to evolve

The rivalry between Ethereum and Ethereum Classic started with the Ethereum hard fork in 2016. Following a $ 55 million attack on The DAO, an etereum-based networked application, the Ethereum community has reached a crossroads. 90% wanted to force the cryptocurrency to return the lost funds; the remaining 10% thought that this contradicted the immutability of the blockchain.

As a result, today we have Ethereum vs Ethereum Classic. The first represents the new cryptocurrency of higher value, while the second is the "classical" version of Ethereum that existed pre-DAO hack.

Today, ETH has a higher hashing rate, a price and a market capitalization higher than ETCs. This is because most of the mining community of Ethereum has passed to ETH. In addition, large companies are building applications on the Ethereum blockchain, which increases the value of ETH. However, these currencies have similarly structured blockchains. Today they have the same time of completion of the blocks, open source technology, work trial structure and transaction fees.

But a great distinction between the two remains: the Ethereum blockchain has been bifurcated several times since 2016 and may soon fail. For example, Ethereum is said to update its code with "Constantium" in the autumn of 2018. In other words, the contrast between Ethereum vs Ethereum Classic may soon become more raw. But since smart contracts become legally binding, both Ethereum blockchains could benefit from them.

Source link