[ad_1]

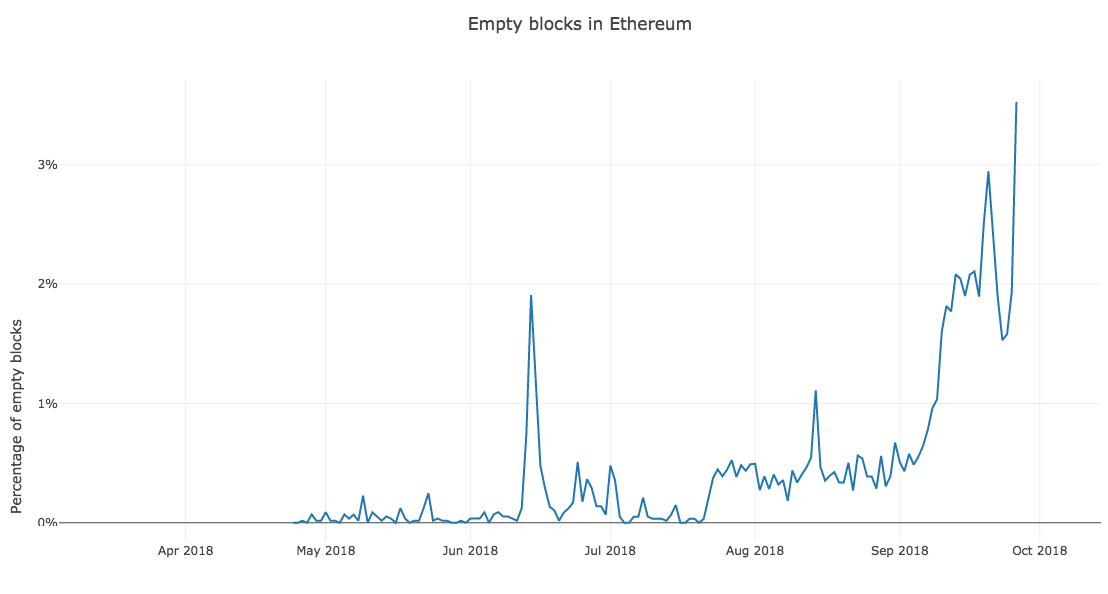

In the last three months, the metrics on the use of Ethereum have revealed a rather surprising trend; a sharp increase in the number of empty blocks extracted.

According to Alex Svanevik, Chief Data Scientist of CoinFi, this points to "spy mining" as the overall use of the block, the number of blocks processed per day and the average time between each block are all stable.

The technique used by illegitimate miners' pools is called "spy mining", which requires miners to be rewarded for mining without actually carrying out transactions on the block. In such cases, an "empty block" is created.

Along with this, selfish extraction is also gaining popularity within the pools and involves miners trying to find the successor of a new block without transmitting their existence to the network, giving them an edge.

After a detailed search, two miners' pools were found to dedicate themselves to this practice; F2Pool, currently the second largest mining pool in the world and Etherdig.

Since September, the number of empty blocks removed has increased by 637% Source: Decryptmedia

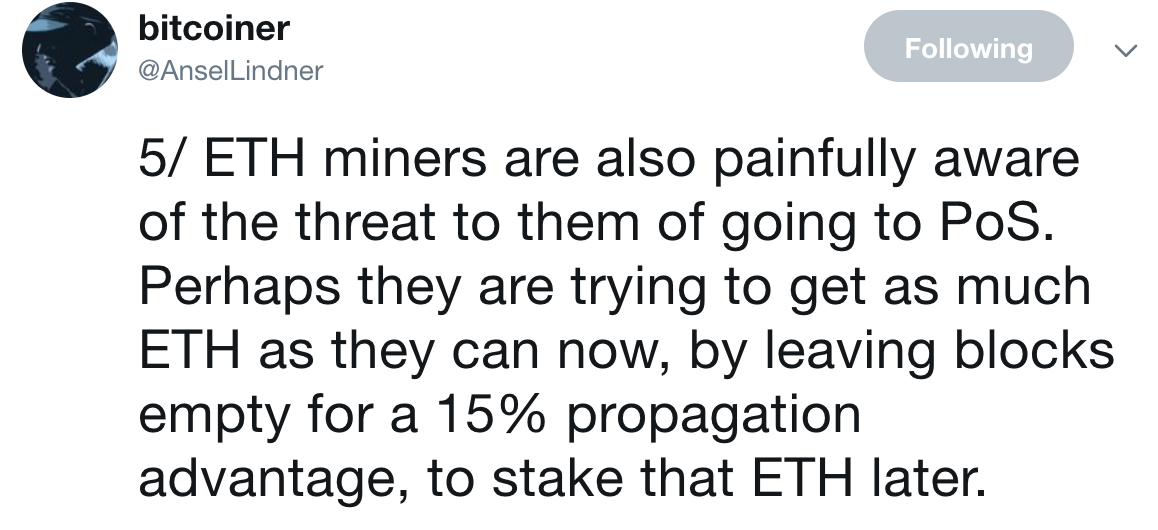

A fan of Twitter and crypto, Ansel Lindner made some crucial observations. He said that this was crowned by the miners "realizing that the value of ETH does not derive from transactions, but from marketing". Linder tweeted:

"Ethereum's marketing success is only partially related to the number of transactions – there must be enough volume to support the narrative, but not too much to make it extremely difficult to stay in sync."

He also noted that the recent decision by the developers of Ethereum to reduce the reward of the block to 2 ETH provides that the miners chase the volume, before the imminent gallows of Constantinople. This decision was made to solve problems in the blockchain and cryptocurrency space, with a focus on further updates.

Ansel Linder's tweet | Source: Twitter

In an effort to maximize their profits, F2Poll and Etherdig began to extract blocks without validating any transactions. This represents an unprecedented threat to Ethereum. Data show a 15% faster propagation rate for empty blocks, which means spy miners have also achieved a 15% increase in their total revenue.

If many miners resorted to this, transaction times could increase and also cause a sharp increase in gas tariffs. Also, if this continues, the most sincere miners would call it quitting and focusing on other tokens, affecting the security of Ethereum.

Etherdig collected the practice and extracted over 1,250 empty blocks, starting from mid-July of this year, according to a research by CoinFi, and Alethio, an analysis platform. The mining pool collected about 3,750 ETH, worth over $ 862,500 as a cost for the extraction of these "empty blocks". This is alarming given that the Ethereum blockchain processes 5,800 blocks a day, over 540,000 total transactions.

This practice stems from the computational run that miners involve daily. In an ideal scenario, mining can start only after a block has been transmitted.

The prerequisite for understanding this functionality is to understand that each block in a blockchain contains different amounts of data. Whatever their limit, it is not necessary for them to hold exactly as much data to check and add to a chain.

The checks take place when a miner encodes all data in the block, called a hash, closes the block and transmits it. This code is essential for the next block. However, some pools start blocking privately, prior to transmission. Although it is not possible to create a hash without first reading the block data, it is possible to create a new block from an existing hash before a transaction occurs.

Since there is no transaction in this new block, it can not be canceled as there are no irregularities in the transaction data. Miners put their hands on hashes through the pools.

To get an advantage, some miners find a new block and try to find his successor without transmitting to the pool.

Etherdig did exactly that and implemented a system that spied on the pools, which are private mining. This provided them enough information to create their own empty block. This practice is harmful because a data mining pool that controls the maximum computing power in the network can monopolize the mining of that network.

Each of the empty blocks extracted from Etherdig did not contain transaction data, but had the phrase "Interim Global Authority".

In the beginning, even the Bitcoin had undergone a similar scenario.

However, this was quickly corrected because the token was in its early stages and a line of code was sufficient to prevent the spread of malice. An update was made to the base code of the network, making it difficult for miners to leverage other pools.

Because the Ethereum developer base is wide [almost 250,000], it is a magnanimous task. It could go down the downward spiral because of its volume of developers, or it could rectify the system by exploiting the large community.

Source link