[ad_1]

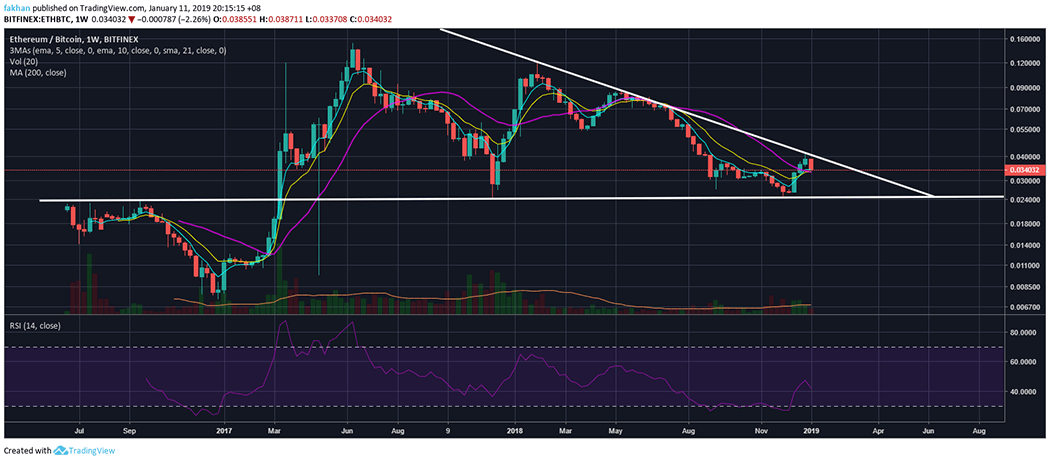

Ethereum (ETH) drops to EMA 5 weeks against Bitcoin (BTC) but may fall further to test EMA at 21 weeks. This level is unlikely to be violated and the price should start a recovery from there. The support we currently see for ETH / BTC on the weekly chart dates back to before 2017 when it was a resistance. The price went through this level successfully in March 2017 and this resistance turned into a long-term support that the price was successfully tested once in December 2017 and then again in December 2018. Both times, this level he held strongly and the price rebounded strongly after testing this level.

The weekly chart for ETH / BTC shows that Ethereum (ETH) has been trading in a downward triangle against Bitcoin (BTC) for almost two years. This means that now Ethereum (ETH) should break its downtrend and start its climb against Bitcoin (BTC) in the coming months. The circumstances of this rally against Bitcoin (BTC) could not have been better. Ethereum (ETH) is going to go on with its update to Constantinople which will prepare it for a gradual transition to Proof of Stake (PoS) from Proof of Work (PoW). This transition to Proof of Stake (PoS) should make the Ethereum blockchain (ETH) more attractive to developers and investors. The development of Dapp on Ethereum (ETH) should also increase after this transition.

Blockchain technology in general and Ethereum (ETH) in particular have been around for a long time now. Ethereum (ETH) has gone through phases of conception, testing and development, but now it is time of adoption and cases of real use. In the beginning, investors and developers were both interested in blockchain as technology and wanted to see what kind of blockchain existed, what features they had, what challenges they faced, and everything else. However, today investors and developers in this space are more focused on what they can use the blockchain. Smart contracts can be used for payment, legal correspondence, supply chain management, etc. To revolutionize a large number of industries.

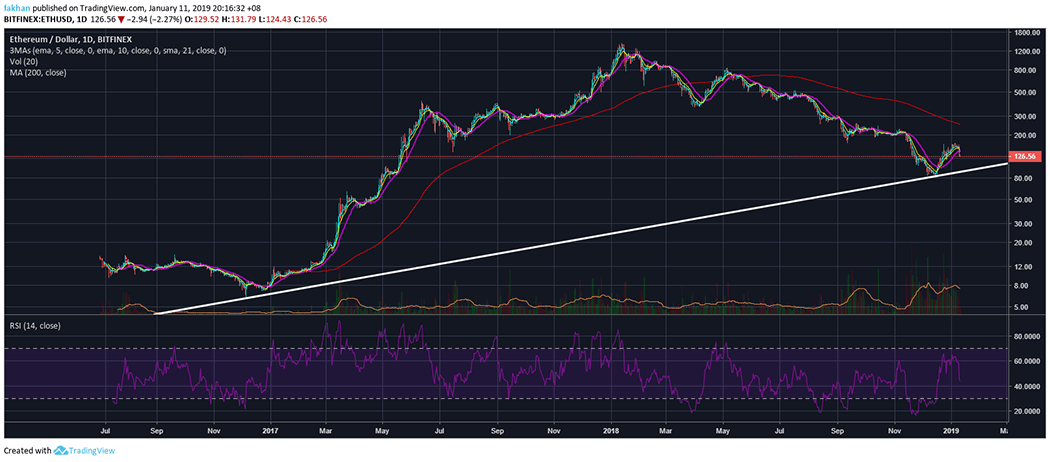

The daily chart for ETH / USD shows that Ethereum (ETH) has already hit the bottom and is now close to starting a new cycle in the weeks and months ahead. How and when you appreciate the price is not yet clear but it is clear that Ethereum (ETH) is moving towards mainstream adoption. Crypto enthusiasts are no longer interested in using Ethereum (ETH) from Microsoft, Amazon or other technology giants because it is far beyond that stage. It does not need the recognition of any of these great corporations to thrive. In fact, Ethereum (ETH) investors are more interested in seeing a large number of new Dapps built on the Ethereum blockchain (ETH) that disrupt the modus operandi of technology and finance giants. This will not only help to eliminate a trust-based economy, where everything from the US dollar to the stock held, is valuable only if it says a higher authority, but will also lead to more innovation, transparency and ownership.

Source link