[ad_1]

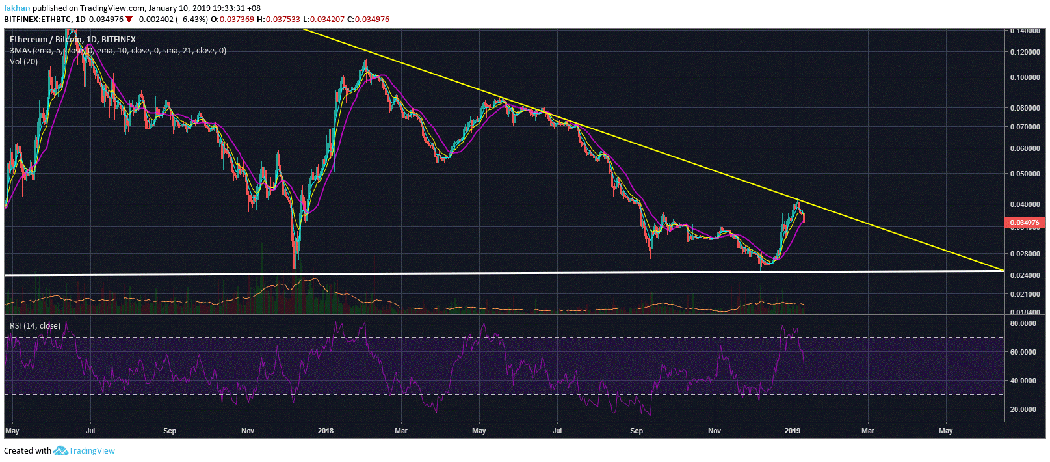

Ethereum (ETH) decreased by more than 10% against the US dollar (USD) and almost 7% compared to Bitcoin (BTC) in the last 24 hours. The daily chart for ETH / BTC shows that the price has now come across a resistance of the trend line. However, there is still some resistance to further decline since the 21-day EMA has yet to be overcome. Ethereum (ETH) is currently in a position where it is prepared for both results. If Bitcoin (BTC) increases, Ethereum (ETH) may break the resistance of the trend line against Bitcoin (BTC) to start a new cycle. However, if Bitcoin (BTC) falls, we will see ETC / BTC follow to repeat the previous minimum formed in December 2018. The recent refusal of Ethereum (ETH) to the resistance of the trend line was a likely outcome considering that the RSI had already entered in overbought territory and also formed a double maximum.

The recent rally started after the low of December 2018 was strong. It was the first time since April 2018 that ETH / BTC had finally passed the 21-day EMA. The model of decline that came into force after the rally ended in May 2018 can also come into force this time. The oscillations will not be so big and the moves are not as aggressive, but the pattern will probably be the same that will eventually lead ETH / BTC to repeat the previous lows in the middle of 2019. This would also set the stage for the beginning of a long season altcoin scheduled around mid-2019, which should see coins like Ethereum (ETH) start new cycles against Bitcoin (BTC). If this scenario were to happen, we would see that the RSI will form a giant head and shoulders reversed, which means that the price will be ready for a big step towards its historical maximum.

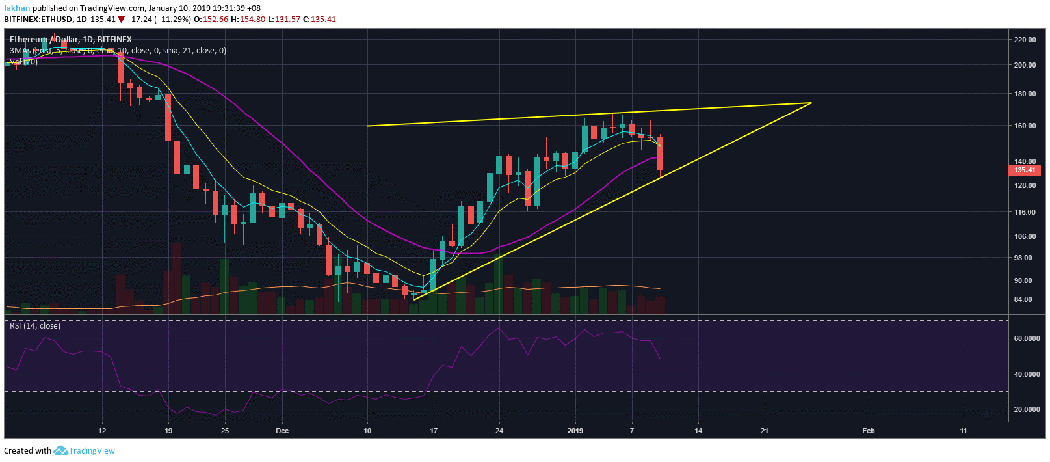

Chart for ETH / USD (1D)

Ethereum (ETH) is a promising project with many potentials. His reputation has recently been marked by controversy, conspiracies and scams against ICOs, but when it came to light, he solved a big problem that Bitcoin (BTC) could not solve. Furthermore, it paved the way for the emergence of a whole new cryptocurrency market. It is because of this development that we are talking about the possibility of an Apple token or a Tesla token today. Sooner or later, the cryptocurrency market will reach trillions of dollars in valuation and therefore we will certainly have these tokens that replace traditional titles. After the previous financial crisis, Bitcoin (BTC) was born to solve the problem of money and positioned itself as new money.

Ethereum (ETH) on the other hand never claimed to be money. It was intended to solve the double problem of spending in other ways that Bitcoin (BTC) could not. For example, with the Smart Ethereum (ETH) contracts, you can be sure that if you are dealing with a Lisk token (LSK), you actually hold the token. There is no doubt about the fact that you have the real token. However, if you go to your broker and buy Tesla shares, you can not say that you are the only person who owns that particular title. This is not limited to stocks only; the same applies to gold and other markets that have been damaged to the end. If it were not for Ethereum (ETH), we could never have solved this problem or created a completely new market that challenges the monopoly of big corporations that have enslaved us for decades with impunity.

Source link