[ad_1]

| After | Price | Modify |

|---|---|---|

| 1 day | $ 101.5648 | 0.23% |

| 1 week | $ 101.4071 | 0.08% |

| 1 month | $ 106.0268 | 4.64% |

| 6 months | $ 177.9917 | 75.66% |

| 1 years | $ 387.7907 | 282.70% |

| 5 years | $ 1,478.1341 | 1,358.73% |

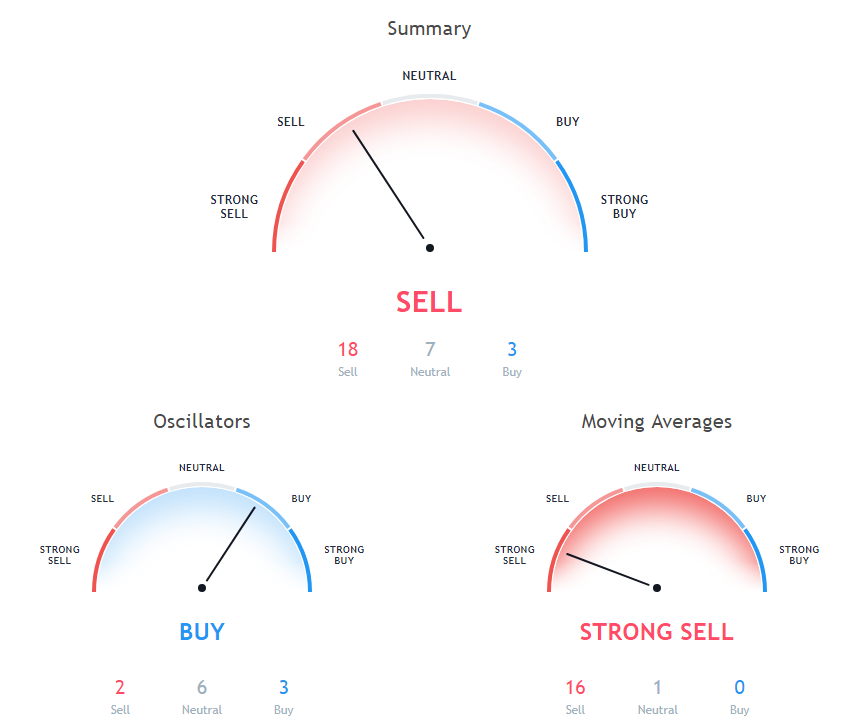

The stochastic oscillator is a momentum indicator that compares the closing price of a security with the price range in a given period. The stochastic oscillator shows the Neutral signal, with a value at 13.29.

The Relative Strength Index (RSI) is an important indicator for measuring the speed and variation of price movements. Its value ranges from zero to 100. The value around 30 and below is considered an oversold region and over 70 as oversold regions. Relative Strength Index is showing Buy signal, with value at 25.92.

The Commodity Channel Index (CCI) is a momentum oscillator used in technical analysis to measure the deviation of an instrument from its statistical average. Index of the goods channel indicates a 'neutral action, with a value of -101.01.

The 20-day weighted moving average indicates a sales share with a value of 124.53, while Ethereum is trading below it at $ 101.33. 10-day exponential moving average is at 113.34, showing the sales signal, Ethereum is trading below it at $ 101.33. 20 days of exponential moving average indicates a sales share with value at 128.43, Ethereum is trading below it at $ 101.33.

100 days Simple Moving Average indicates Sell since Ethereum is trading at $ 101.33, below the MA value of 200.01. 200 days of simple moving average means a sales action with value at 327.22, Ethereum is trading below it at $ 101.33. The moving average of the 9-day hull indicates a sales share valued at 102.71, while Ethereum is trading below it at $ 101.33.

5 days of exponential moving average is at 107.27, showing the sales signal, Ethereum is trading below it at $ 101.33. 200 days of exponential moving average indicates Sell since Ethereum is trading at $ 101.33, below the MA value of 303.72. 5 days of simple moving average means a stock sale with value at 108.34, Ethereum is trading below it at $ 101.33.

50 days of simple moving average means Sell since Ethereum is trading at $ 101.33, below the MA value of 172.88. 30-day exponential moving average means Sell since Ethereum is trading at $ 101.33, below the MA value of 142.03. Simple 10-day moving average means a sales share with value at 112.93, Ethereum is trading below it at $ 101.33.

The 50-day exponential moving average is at 163.49, showing the sales signal, Ethereum is trading below this at $ 101.33. 20 days of simple moving average means Sell since Ethereum is trading at $ 101.33, below the MA value of 125.15. 9 days Ichimoku Cloud Base Line is at 155.62, showing the Neutral signal, Ethereum is trading below it at $ 101.33.

Read also: Frequently Asked Questions about Cryptocurrency

30-day moving average at 151.42, which shows the sales signal, Ethereum is trading below this at $ 101.33. 100 days of exponential moving average means a sales share with value at 213.69, Ethereum is trading below it at $ 101.33.

Other technical analysis of prices for today:

The price of Bitcoin (BTC) came back after trading towards $ 3,620 – Bitcoin price analysis – 6 Dec 2018

Ripple (XRP) Price declined and traded towards the $ 0.3250 level – ripple price analysis – December 6, 2018

Source link