[ad_1]

Ethereum (ETH) is about to come across a historic resistance to the trend line that will result in a short-term retracement. This short-term retreat will likely drag ETH / USD slightly below the 21-day EMA, which will result in a strong change in sentiment and the bears will return more confident. There is little to doubt that we will eventually have a new $ 70 test before an actual trend reversal. Both bulls and bears are aware of this. However, everything is reduced to the times. There is a strong chance that bears will take this as a sign of weakness and the number of shorts will increase again, which would result in a short mini-hold.

The actual short compression we are anticipating for some time is not expected in a short time. It will happen around $ 70 when the bearish moment is at its height. It could be this month or sometimes in the next year, but it will happen. Before a turnaround, there is always a tug of war between the bulls and the bears. Both sides do their best to push the price in opposite directions. As Ulysses S. Grant says: "In every battle comes a time when both sides consider themselves defeated, then he, who continues the fight, wins." The same thing happens every time during a reversal of tendency. So far, we have not seen the bulls fight for nothing. In fact, during the last rallies, the number of longs has decreased more than the number of shorts.

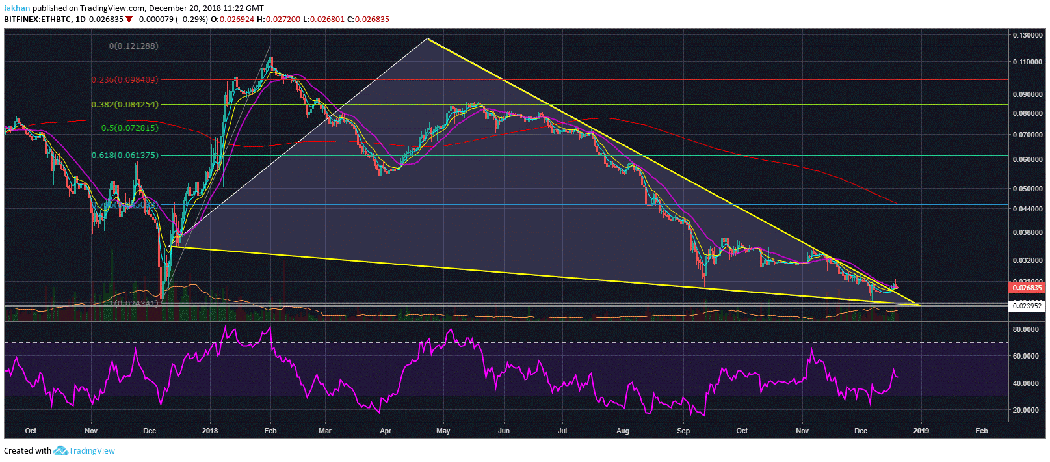

Ethereum (ETH) seems to have hit the bottom against Bitcoin (BTC) but has not yet tested the lows of December 2017. The daily chart for ETH / BTC shows that the price is now above the giant fall wedge, but it may fall along the top of this emerging wedge to retest the December 2017 minimum. At the moment, ETH / BTC is resting above the 21-day EMA support but as soon as it breaks below it, we will see the price drop up in December 2017 in no time. A rebound from that level will be fast and at that moment we will see the formal beginning of a new trend. RSI for ETH / BTC also aims for a short-term withdrawal.

The interesting part here is that both ETH / USD and ETH / BTC have ideal configurations for a massive bear trap. If we look at the daily chart above for ETH / BTC, we can see that RSI is preparing the ground for a head and shoulders formation. Since bears really love their heads and shoulders in this market, if we see a following and a consequent increase in the number of shorts, it would be the ideal configuration for a massive short squeeze that would completely ruin the bearish resolution and set the ground for the 39; effective start of a new trend.

Source link