[ad_1]

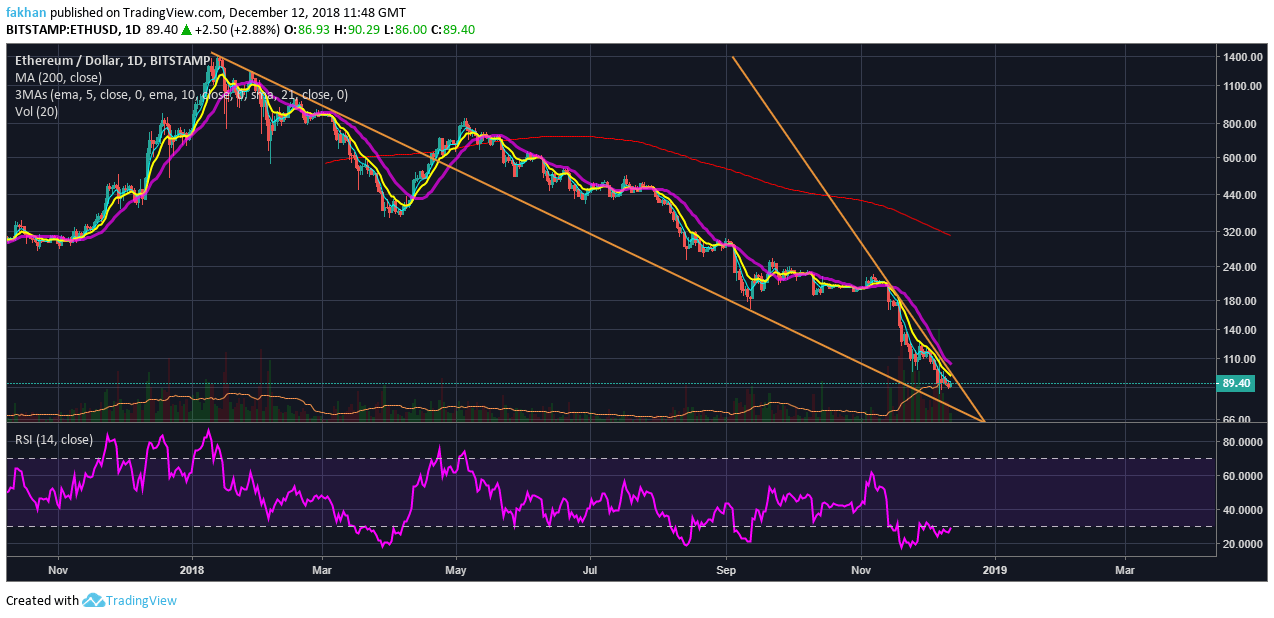

Ethereum (ETH) is on track for a sharp decline this week as the bulls have failed to defend the price above $ 90. Earlier this week, Ethereum (ETH) had entered a soaring channel that it raised buyers' hopes but was short-lived as the price fell below that channel as Bitcoin (BTC) started to fall. The overall picture is still quite clear and Ethereum (ETH) has certainly completed its correction for the most part. It is not very likely that the price will drop significantly from current levels, but a decline to $ 80 seems inevitable. ETH / USD has now reached the extreme end of the wedge that is falling and is going to be a major reversal in the coming weeks.

However, whales are likely to drag the lowest price one last time this week so they can trigger panic selling in order to lower the level. As the price decreases, the number of weak hands also increases. People who trade Ethereum (ETH) at these levels are not those that can easily be moved by market sentiment or emotions. They know what they are doing and they understand that the price will drop to $ 80 or less before an inversion can occur. This is why they are not going to take action to get a falling knife and then the bears will have their way with Ethereum (ETH) one last time. That said, overzealous bears are more likely to become slaughter meat if they push them too far.

In one of our previous analyzes, we explained the analogy of a helical spring in financial markets. If you push the price of a resource at once without taking account of small retreats, it is very likely that you will soon get tired of all the thrusts and the coil spring will hit you in the face. That said, if there's a large number of people pushing that spool and you're resisting that thrust, you'll probably be nailed to the ground along with that reel. So, it is only a matter of understanding in which direction the market moves, but we must be careful about the general picture. Just like in this case, Ethereum (ETH) has a last wave to fall, but if you're trading it down, you have to be very careful while the trend is going to reverse.

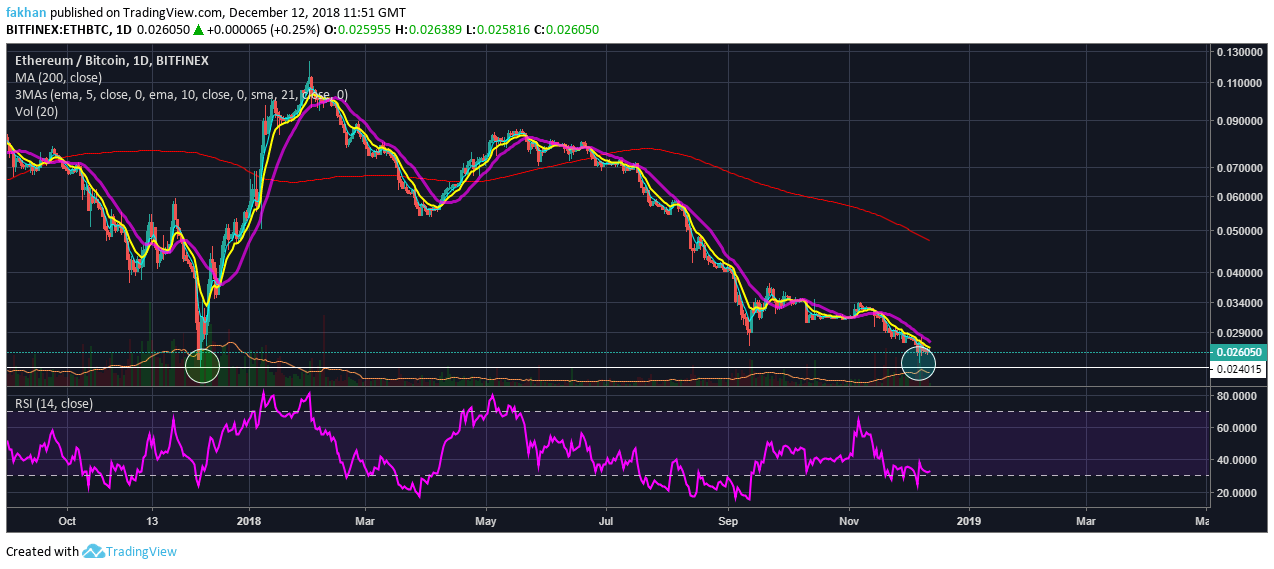

Just like Bitcoin (BTC), Ethereum (ETH) got up last week leaving a gap to be filled later. While Bitcoin (BTC) left that gap against the US dollar (USD), Ethereum (ETH) left that gap trading against Bitcoin (BTC). If we look at the daily chart for ETH / BTC, we can see that the price hit 0.024 BTC before its big rally in November 2017. However, Ethereum (ETH) conveniently left a gap when it fell to test this level last week. This gap will not be left there, it will be tested and soon. ETH / BTC is ready all day but everything will change very soon when the price falls against Bitcoin (BTC) to fill this gap in the coming days.

Source link