[ad_1]

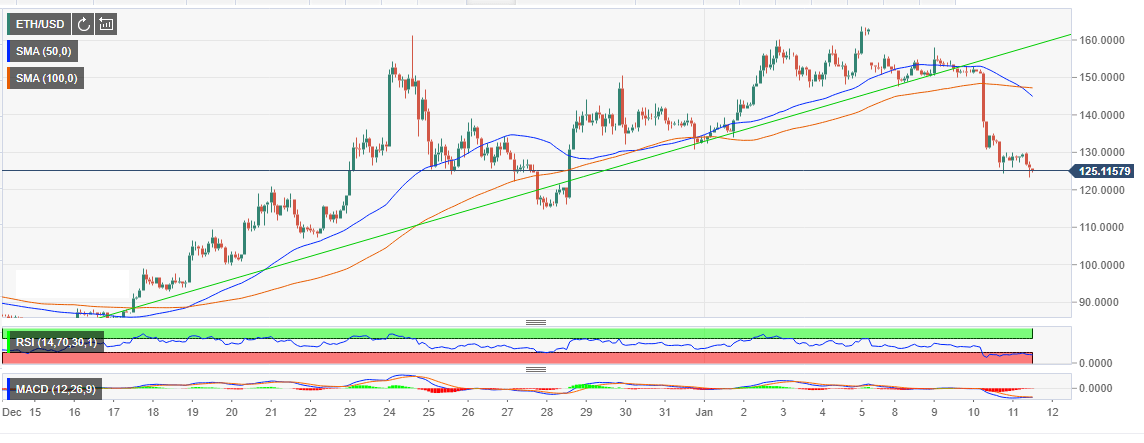

- Ethereum tested $ 160 before succumbing to bear pressure in the market.

- The bulls must defend the support at $ 125 to avoid further breakdowns.

The Ethereum bulls are still suffering under the tight grip of the bears. This week's trading saw Ethereum fall mercilessly after testing the highs around $ 160. The fall could not be stopped at $ 150, culminating in a further fall below $ 130.

At the moment, the activity is still reducing with losses of more than 2% of the day. The bulls are fighting to keep Ethereum above $ 125. However, looking at the chart, it is likely that ETH / USD will continue to deflate. For the first in 2019, the Relative Strength Index (RSI) has not only explored oversold levels, but is not even able to recover. The same downward trend is reflected in the Moving Average Divergence Convergence (MACD) which fell to -6.4 for the first time this year.

Technically, Ethereum is falling and it will take a significant catalyst to revive the move upwards. In addition, the 50-day Simple Moving Average (SMA) has surpassed 100-day long-term SMA, noting that bears will likely continue to gain ground against short-term buyers. The crypt has in a short time been the best performer of 2019 at the worst success.

To get out of the bear area, there must be a move above $ 130. This will allow the resource to gain strength and embark on a journey upwards of $ 160. In the meantime, it is essential that the bulls find a support for $ 125. Otherwise, we could witness a collapse towards the $ 100 mark.

ETH / USD 1 hour chart

Receive Crypto updates 24 hours a day on our social media channels: give a follow-up to @FXSCrypto and our Telegram channel of Trading Crypto FXStreet

[ad_2]

Source link