[ad_1]

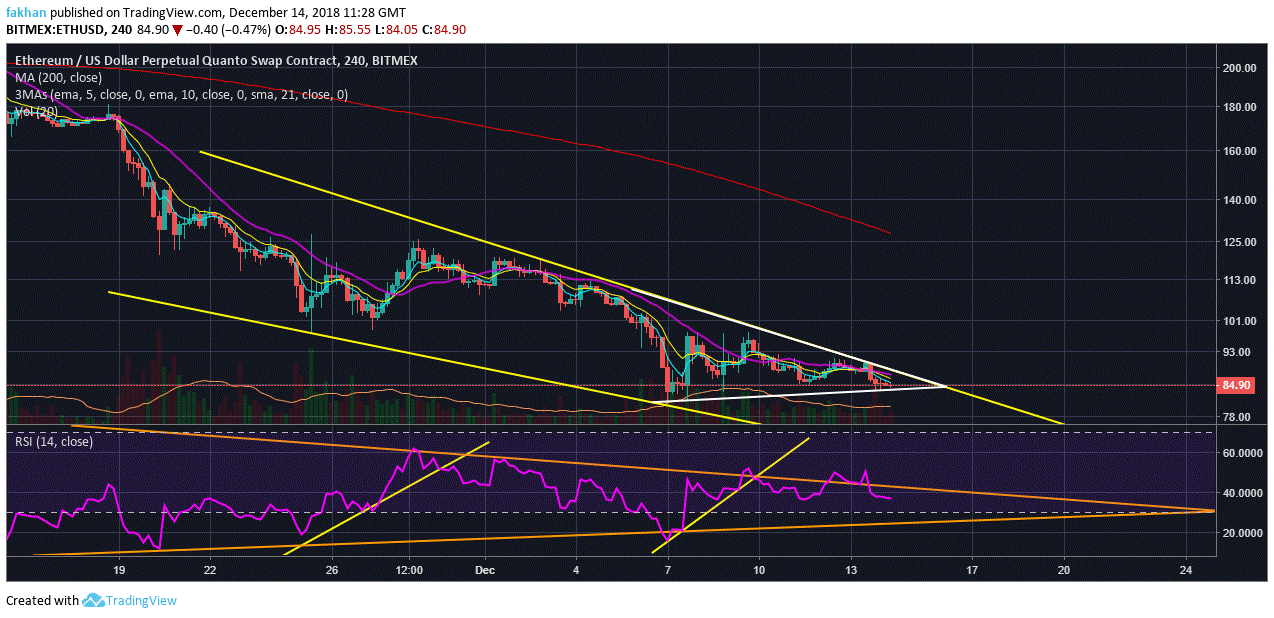

Ethereum (ETH) is ready for a fall in the coming days. Table 4H for ETH / USD indicates only one possibility and this possibility is a fall in the near future. In recent weeks, Ethereum (ETH) has faced rejection on several fronts. First it was rejected long-term trend line extending until Ethereum (ETH) broke under its market structure. Secondly, he had to fight 21 EMA resistance. When he failed to cross it, he declined far beneath it to settle at the bottom of a symmetrical triangle. As we have seen in the past, these symmetrical triangles have a history of continuation patterns.

If the price falls before entering the symmetrical triangle, there is a strong probability that it will continue to fall after emerging from that symmetrical triangle. As we can see on the ETH / USD chart, the price has declined since the beginning of this month before it entered the symmetrical triangle. This continues to show that price action may have been contained within a triangle for now, but this is only to cool down the technical indicators in order to prepare Ethereum (ETH) for the fall that could not take in one go. The volume of trading has begun to decline once again, as happens every time that Ethereum (ETH) reaches the full extent of its movement within that triangle.

As trading volume decreases, it means that it is easy for some big hands to increase the price in both cases, especially at weekends when trading is low. As long as Ethereum (ETH) attempts to block a fall below $ 80 to repeat the annual lows, the bulls will not enter the scene and the bears will continue to seek further disadvantage. This type of situation does not benefit bears or bulls and at the end the price moves in a definitive direction. At this moment, this direction seems to be on the downside. Ethereum (ETH) is all set to drop below $ 80 during the next few days. It is likely that the price will repeat the previous minimum again before it can fall further or start a reversal of the trend.

As trading volume decreases, it means that it is easy for some big hands to increase the price in both cases, especially at weekends when trading is low. As long as Ethereum (ETH) attempts to block a fall below $ 80 to repeat the annual lows, the bulls will not enter the scene and the bears will continue to seek further disadvantage. This type of situation does not benefit bears or bulls and at the end the price moves in a definitive direction. At this moment, this direction seems to be on the downside. Ethereum (ETH) is all set to drop below $ 80 during the next few days. It is likely that the price will repeat the previous minimum again before it can fall further or start a reversal of the trend.

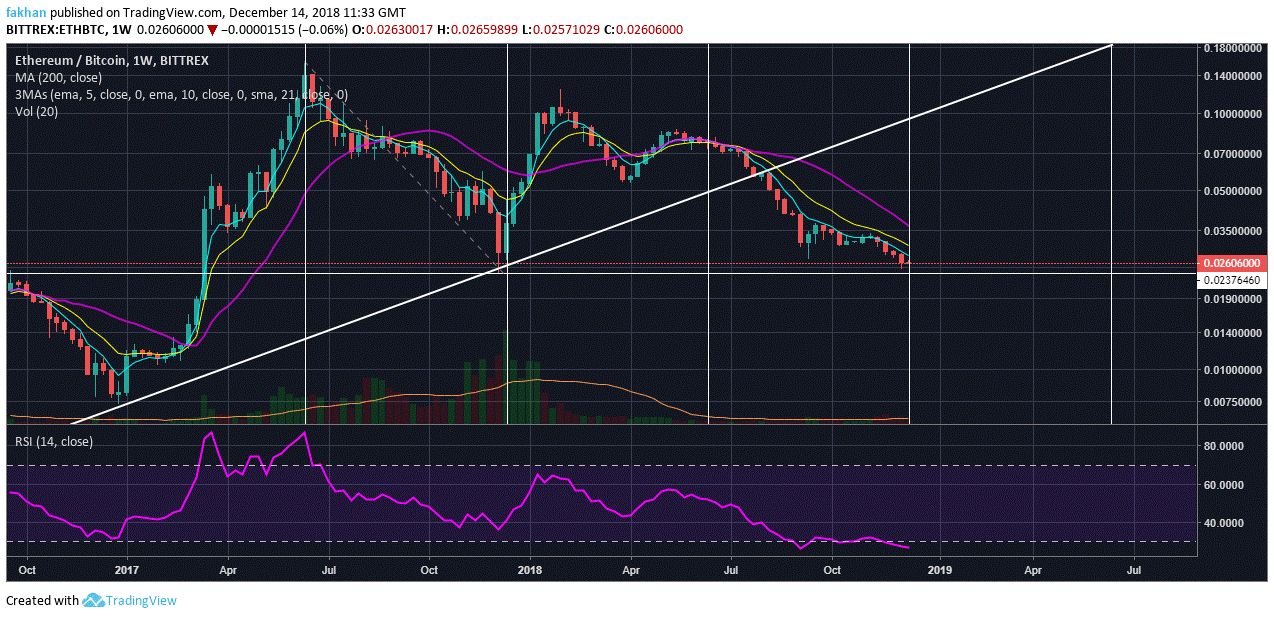

Ethereum (ETH) has a lot of room for a fall against the US dollar (USD) like the rest of the cryptocurrency market. However, there is also room for a decline against Bitcoin (BTC). ETH / BTC still has to test the lows of 2017 The price does not necessarily have to decrease significantly to test that level. It may not seem like a big deal, but this is exactly what the bulls and bears need right now to solve the fate of Ethereum (ETH). If the price tests this level and rebounds strongly on it, it will convince the bears that there is no room for further disadvantages. It will also convince the bulls to intervene to pave the way for the long-awaited turnaround.

Source link