[ad_1]

[ad_1]

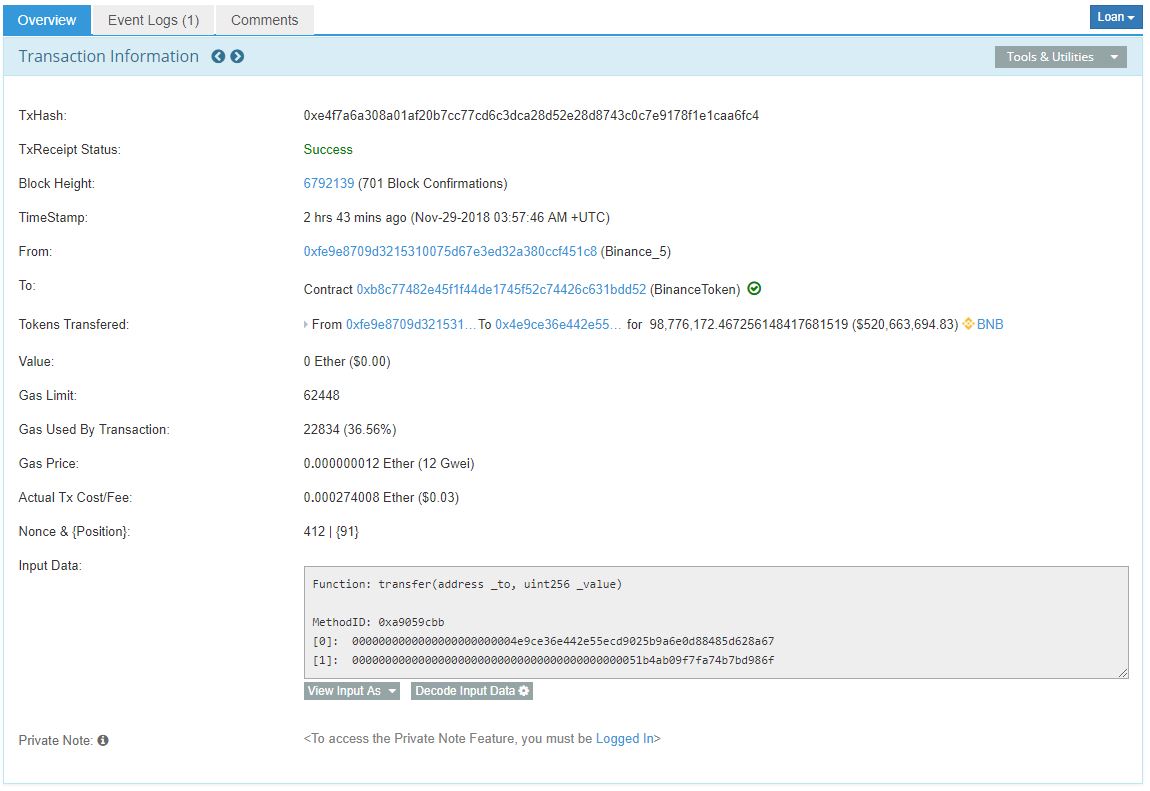

76% of Binance Coin (BNB) has been moved to $ 0.03

Wednesday night, Whale Alert, a popular encrypted wallet that recorded Twitter management, began recording a series of multi-million dollar transactions in quick succession. While the transactions, which were primarily ERC-20 token transfers, at first seemed normal, while the social media channel continued to tweet incessantly, it became apparent that something was out of place.

After multimillion-dollar transfers of 0x (ZRX), BNT, WTC, Whale Alert, they reported that 98,776,172 Binance Coin (BNB), almost all of the assets in the asset, was transferred from Binance to an "unknown portfolio".

.7 🚨 🚨 🚨 🚨 🚨 🚨 🚨 🚨 98.776.172 #BNB (512.314.962 USD) transferred from #Binance to the unknown portfolio

Tx: https://t.co/nBWgwWsBwk

– Whale Alert (@whale_alert) November 29, 2018

This incredible amount of BNB, which equates to a US dollar value of $ 512 million, has been shifted by $ 0.03 into the gas commissions on the Ethereum blockchain, clearly highlighting the value of the crypt as almost instantaneous, without boundaries, resistant to censorship, without authorization, decentralized and valuable medium without trust.

With which centralized financial system can you send $ 512 million in a minute? Even Bitcoin, probably one of the slowest blocks, facilitates multi-million dollar transactions in ten to twenty minutes, embarrassing centralized ecosystems like SWIFT.

"Unknown address" increases by $ 1.2 billion in Ethereum tokens

In response to the astonishing $ 520 million transfer from BNB, @IamNomad, a cryptic longtime fanatic, commentator and analyst, joked that "the entire capitalization of Binance Coin has moved," asking whether this transaction was somehow linked to the potential use of Binance "new cold wallets."

Hey @cz_binance your entire market cap has moved .. is this to new cold wallets? https://t.co/26ds9RmCve

– I am Nomad (@IamNomad) November 29, 2018

Nomad, trying to find the answers, apparently went to ask the Binance support team, asking the world-renowned exchange staff for the suspicious transaction. According to the commentator, the platform team stated that "the funds are SAFU", in an obvious reference to one of the most popular crypts of 2018. Obviously not satisfied with this response, Nomad asked if there was a migration to the new infrastructure / BitGo's services, or even if Binance had "rekt".

However, Changpeng Zhao, CEO of Binance, has evidently tried to calm the scruples of investors with the influx of outbound Binance transfers, taking to Twitter to comment on the unique situation. Zhao, formerly Bloomberg, noted that the address in question, which now holds a total of ~ $ 1.2 billion in Ethereum-based tokens (presumably all the assets of Binance's customers and many of the Coin Binance of the exchange) , it is part of the platform's efforts to strengthen its operational security.

Nothing to worry about. Check the Tx logs, very well from the new address to our old wallets. There is no need to spread FUD. We are constantly working to further strengthen our security. https://t.co/UnNJ5mH54g

– CZ Binance (@cz_binance) November 29, 2018

So, for now, it seems that this case of Crypto Mysteries has been solved …

Falling transaction costs: bullish for Crypto

Regardless of the details of this recent event, Binance's ERC-20 transactions, all completed for less than a few dollars … total, underline the growing theme of transaction fees, even in increasingly popular networks, such as Bitcoin and Ethereum.

Binance has just created the largest unspent transaction output existing today (but not always) at 109k BTC (nearly $ 600M) .https: //t.co/Ot2ST37flU

– Antoine Le Calvez (@khannib) November 15, 2018

In mid-November, just a few weeks ago, Binance issued a record transaction, sending 109,000 BTC, worth $ 600 million at the time, for only $ 8.

So I ask you again, with which centralized financial system can you send $ 600 million in a dozen minutes?

Again, the answer to this question is probably na-da, hence the value of cryptocurrencies and blockchain technology. But again, some problems still need to be resolved, like the problems with the fluctuations in the value of digital assets.

Title Image Courtesy of Jonatan Pie on Unsplash

[ad_2]Source link