[ad_1]

In the first part of this series, I discussed how some investors and developers wondered if EOS posed a threat to Ethereum. In particular, EOS 'kill & # 39; Ethereum? Would EOS bring blockchain activity and its price to zero?

I discussed how speed problems with EOS can influence the scalability of Ethereum, both because it lacks transaction capacity, and because speed directly affects usability. For example, some projects that need a fast transaction speed may choose not to develop on Ethereum, or even move existing projects from Ethereum to EOS.

However, I also questioned whether all projects needed this speed and offered a perspective where many players could exist in any product space, including platform coins.

The perspective of last week has been from the point of view of my life and experience in design and product strategy. In this episode, I wanted to come to this question from the point of view of a trader, not just that of a retail investor like me, but also from the point of view of big and institutional traders.

Many investors look to potential investments in blockchain from a fundamental perspective: which projects are convincing? Which projects have a great team on site? Few investors seem to come to the market by asking which coins will be a good trade, or that the mechanics function as a negotiable asset

Liquidity is the king

If you are a great trader, do not just spend your time watching a project, or just studying his chart. You have to worry more deeply about liquidity than investors and retailers. Can you enter the market without moving the price too much? Can you get out of an exchange based on available liquidity, or could you get trapped in a position?

On this basis, hands down, Ethereum has an advantage over EOS. I have reviewed the 30 days of volume listed on CoinMarketCap. Ethereum reported an average turnover of 24 hours on 1.8 billion dollars, while EOS reached an average of over 700 million dollars. This means that every day in Ethereum have been exchanged more than 2.5 times more volume. In addition, Ethereum trades in more fiat pairs of EOS. This is important if a big trader has to escape from an industry-wide downdraft.

However, it is not clear how much of this volume is due to Ethereum tokens (ERC-20), like OMG, ZRX and the like, so we need to go further. But it is likely that, as EOS sees more token born on its blockchain, it should also see an increase in volume. In my opinion, the volume combined with the US dollar and bitcoin is the most important metric to take into account, and Ethereum still has a slight advantage over EOS in this regard.

Of course, most big traders trade over-the-counter (OTC) through a prime broker or other institutional-level service provider such as Cumberland Mining, but these service providers should still go on the stock exchange to fill their orders, therefore I consider the liquidity of exchange a tie for the banks.

It could be said that liquidity generates liquidity. What I mean is that liquidity is a necessity to bring a great player into a trade; in the process they bring their own liquidity, thus causing a feedback loop. By comparing the two, while liquidity in EOS is growing, Ethereum is still ahead.

The need for coverage

Another need that large institutions have is the need for coverage, especially in encrypted ones. Because many cryptos are held in a high security environment, off-exchange, US dollar coverage is needed to manage the position. Some people think that the bitcoin market on futures has been created as the main means of investing in bitcoins. Although it is circumstantial in my reasoning, I think it is not so. I think it was created more as a means for large holders for coverage if needed, and I can almost guarantee that the big banks and hedge funds have contributed to the approval and planning.

I am sure there is no mistake as to why the Ethereum futures market can start from CBOE, and why the CME is registering a reference rate. It is simply that great players are interested in the product. Note that the launch of futures is not confirmed but was reported by Business Insider on the basis of discussions on CFTC sources.

Please do not confuse what I am saying. I'm not saying this because institutions are entering a trade, which are bullish. However, I believe that institutions that enter a trade preclude the end of that market. Once large players are interested in an asset, that liquidity they bring is a lifeline, at least to keep it in negotiation.

Price projections

If you are familiar with my work, you know that I structure all my trading, both long and short-term, using Elliott Wave's theory. It was through the use of this method that I made a call at the beginning of 2017 that Ethereum would have seen four digits, but I did not expect it to be that fast. Certainly not all my calls come true, but I look at a myriad of patterns and price levels incorporated into the original prediction.

It is thanks to this method that I started to believe that EOS will see $ 600 and over, probably in a few years, but do not mention me on this because I'm less confident about the times. Also, through this method, I also expect Ethereum to have much more to do as long as it does not violate $ 122 without a strong reaction.

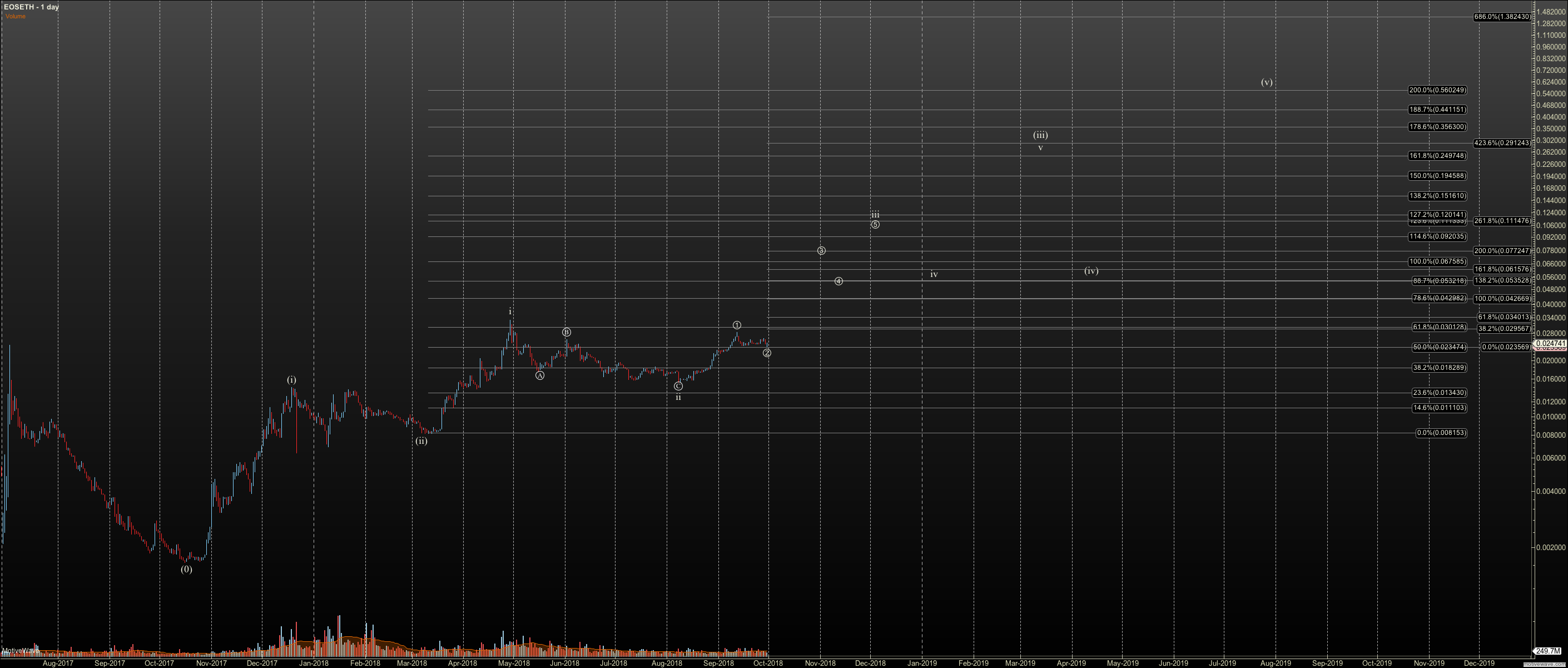

To compare the two in Elliott Wave, we must ignore the price in US dollars and "count" a pair chart, especially the EOS / ETH pair. From this graph, we can see that EOS outperformed Ether at the end of 2017. More specifically, we have five wave patterns that we usually look for, so we can expect EOS to continue to outperform.

If our two waves hold, as shown, at .0082, I get 0.56 as the final prediction. Note that this does not refer to the dollar price. I suppose they will both be higher in US dollars at the time, but it may not be the case.

The rally I expect to start early should bring this pair to .07 EOS on Ether from the current .02. In other words, EOS will greatly exceed the ether in the short to medium term.

Source: Motivewave

Conclusion

To conclude this article and return to our initial question, my conclusion is that EOS will not kill Ethereum. However, unless Vitalik and the team can not increase scalability issues with Ethereum, EOS will take some of the new Ethereum projects. I do not know if this will be due to the wear and tear of the project or to more new projects starting on EOS compared to Ethereum. That said, this is an affirmation that is limited to my experience with both products, which I hope to have clarified in the first episode. Given the difference in liquidity, I expect Ethereum to continue to withdraw institutional money.

At the moment I am much more confident about my price projections, at least until something new comes up in the price structure. However, so far, both the EOS and Ether charts are bullish in US dollars and should be for some time, albeit with the usual deep corrections that are the norm in all cryptocurrencies. This is my wheelhouse, and so I'm putting a little more of my dollars invested in EOS at the moment.

Revelation: We are / are long EOS-USD, ETH-USD.

I wrote this article alone, and expresses my opinions. I'm not getting compensation for this. I have no business relationship with any company whose actions are mentioned in this article.

[ad_2]

Source link