[ad_1]

[ad_1]

NEW YORK, Sept. 28, 2018 / PRNewswire / – Elementus, a next generation blockchain analytics company, a new release on the state of the ICO market, revealing the true size and scope of the market for initial coin offerings.

"I have all but disappeared," he said Max Galka, CEO of Elementus. "But the data tells a different story."

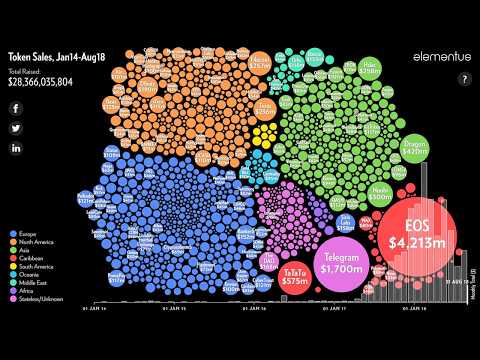

An Animated History of Token Sales, Jan, 2014 – Aug, 2018

According to the report, whose figures were derived via the company's blockchain query engine, ICO funding reached nearly $ 1.5 billion in August of 2018, a month-over-month increase of 44%. At the same time, the percentage of ICOs that successfully raised at least $ 100k fell to 22%, a lower success rate than any prior month, implying an increasingly competitive field.

"All signs point to maturing ICO market," Galka continued. "The latest figures suggest more realistic risk assessment by investors."

In addition, pre-product startups, which were dominant in late 2017 and early 2018, took place in London Football Exchange, Dfinity and tZero, all of which closed $ 70m + offerings last month.

"The reason for these misleading stats is the inaccessibility of blockchain data, which is stored in a convoluted, nonreadable format that not human use. "

Our mission at Elementus is based on the web of the web. -chain data. "

He cited two examples of reported ICO statistics

- Reported estimates of cumulative ICO fundraising through August range from $ 14 billion to $ 21 billion. The amount derived from the blockchain is far higher, $ 28.4 billion.

- Reported estimates of the number of ICOs that have raised at least $ 100k range from 682 to 876. Again, the number derived from the block by the Elementus query engine is 1,823.

For further details and supporting charts / graphics, please visit: https://elementus.io/blog/ico-market-august-2018/

For more information about Elementus, please visit: https://elementus.io

SOURCE Elementus

Related Links

https://elementus.io