[ad_1]

[ad_1]

Receive urgent alerts and special reports. The news and stories that count, delivered on weekday mornings.

SAN FRANCISCO – In December, the bitcoin seemed like the next big news. A bitcoin approached $ 20,000 and financial journalists were starting to seriously consider whether it could replace investments in safe space like gold. Companies were popping up to sell cryptocurrency to the general public.

But it has been practically downhill since then. A bitcoin is now worth just under $ 6,500 and the public interest has declined. Such is the life for bitcoin supporters.

"I saw bitcoins fall from $ 20 to $ 2 and $ 1,200 to $ 250," said Jeremy Gardner, managing partner of investment company Ausum Ventures and owner of Crypto Castle in San Francisco, a living space for people who work in cryptocurrency. "The hyper-growth followed by a heavy correction is not new."

Nick Colas , co-founder of the market analysis company DataTrek Research, has been covering bitcoin since 2013. He said that the volatility of the last few months should be a "no surprise" for a digital currency that reflects and flows based only on how people feel about. [19659004] "The problem with bitcoins is that the price is 100% driven by the psychology of the market," said Colas. "It's still a new technology and at the dawn of adoption, so there's not much public trust to support its value."

While the price of bitcoin remains its most visible feature, people working in the cryptocurrency world focus on other aspects, particularly if US regulators could soon open doors that would facilitate buying and selling of bitcoin-based assets.

Colas said that the recent decline in bitcoin is due to speculation that the securities The Commission would allow a fund traded in bitcoin exchange, which would allow investors to track the price of bitcoins without having to own the cryptocurrency. Such an instrument could make investment in bitcoins available to the masses.

Bitcoin rode that wave and then fell at the end of July after the SEC denied a request to the Winklevoss twins, who are known for claiming that Mark Zuckerberg stole their idea to create Facebook and settle down with him for 65 million dollars.

"The pace of this security is, rumors are circulating, there are new financial instruments that come to exchange it, and then there is not, then it goes down," said Colas. "Last year, the futures exchange in Chicago made bitcoin contracts and when nobody wanted to trade, the air came out of the bubble."

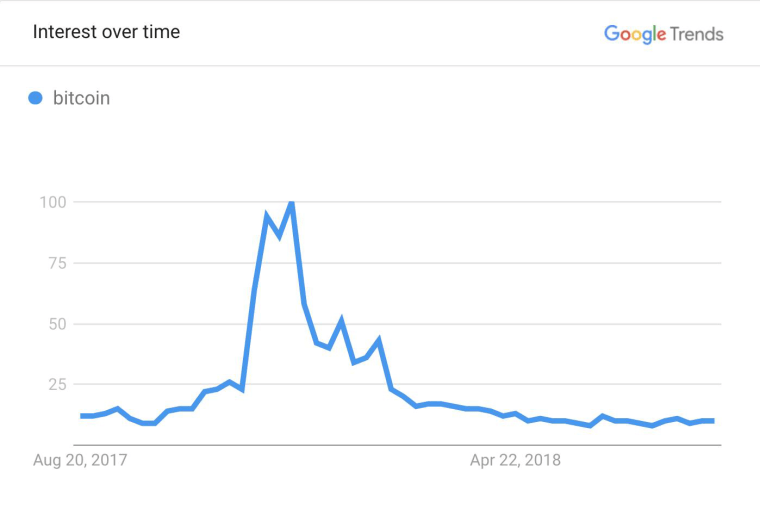

The ups and downs of bitcoin led to oscillations in the general public interest that reflected the price of bitcoin fluctuations, as shown by the following Google Trends chart.

Some bitcoin believers see the price as a distraction from the real potential of cryptocurrency – transforming the global financial sector and much of the economy itself. The Bitcoin believers who bought the cryptocurrency long before its rise and decline claimed to believe that the value is in the long-term potential of the blockchain, which is the underlying concept on which the bitcoin is built. A blockchain is a decentralized digital ledger that allows people to seamlessly exchange digital currencies without having to go through a bank, essentially ensuring that assets can be transferred securely.

"Bitcoin and crypto-asset count because they provide a digital sovereign Activities are classified in an increasingly Orwellian world," said Gardner

Ran Neu-Ner, host of the CNBC's "Cryptotrader" and founder of the blockchain investments OnChain Capital, said that the current price of bitcoin is not surprising and that it may not yet have reached the bottom, but added that it is still a believer in its future.

"We are dealing with a young but promising technology," Neu-Ner said.

Bitcoin and other cryptocurrencies are not "" Who's going to "make a quick buck and drive a Lamborghini out of the showroom," he said.

Those who bought a significant amount of bitcoins last year and are worried about its value "should re-evaluate and decide whether you believe in the long-term value of this technology," he said. "There's a way of saying in the bitcoin community -" hodl "- which means" hold. "If you have not yet bought it, then it's the perfect time to sell."

Neu-Ner suggested that people interested in bitcoins also buy a small amount to "teach the basics of how amazing this technology is."

"Once you understand the beauty of an asset that can be transferred from peer to equal frictionless and the ability to create smart contracts, you've probably crossed Cryptocurrency 101. "

As for Neu-Ner, who goes through CryptoManRan, said he happily bought more bitcoins.

"This market is completely oversold, but we can expect a recovery," he said. "If we're not at the bottom now, then maybe another wave, but for me as an investor, I'm starting to buy now."

[ad_2]Source link