[ad_1]

[ad_1]

Follow us as we talk to industry leaders on issues related to Bitcoin extraction and the implications for the world's most popular blockchain

This is the first part of a 2-part series examining the threat of Bitcoin centralization caused by the mining giant Bitmain and its aggressive expansion in North America. In the second part we interview two important mining companies, TMGcore with an American base and Bitfarm based in Canada, which talk about the activities of Bitmain in the area and provide information on their technologies and mining activities. Bitmain's answer to questions related to it, if provided, will also be included in the second part. Coming soon!

At the heart of the Bitcoin blockchain rests a revolutionary concept: decentralization. This single concept defines Bitcoin and distinguishes Bitcoin from the legal currencies of the world. Decentralization is the foundation on which the entire Bitcoin blockchain rests, and is the reason why Bitcoin was created in the first place – to offer an alternative to the centralized authorities that manage our current global monetary system.

Today this concept is challenged by the uncontrolled growth of Bitcoin mining giants like Bitmain, a Chinese-owned mining / manufacturing company, which continues to generate absurd amounts of profits, and which continue to monopolize the Bitcoin network in the pursuit of industry domain.

The extraction of bitcoins, once a freely available segment of the Bitcoin ecosystem, is now reserved almost exclusively for companies that have access to huge amounts of cheap electricity and millions of dollars of mining equipment. While Bitmain, based in China, grows dangerously close to controlling over 50% of the "hashing power" of the network, other industry players are starting to see the writing on the wall. Bitmain not only controls the lion's share of hashing power, but also produces most of the mining equipment. This means that if Bitmain does not provide its services to the network, either through disastrous actions, succumbing to government regulations, hostile acquisitions or simple calculation errors, the entire Bitcoin ecosystem will feel its effects, and its efficiency. of the network could be compromised.

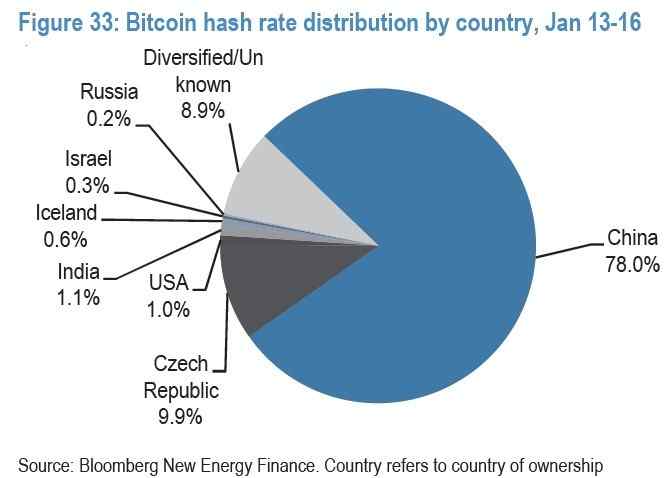

This risk is exacerbated by the fact that the main competitors of Bitmain are also based on China, in the sense that if the Chinese government decides to take the hammer on Bitcoin mining, or worse, takes control of these private companies, the Bitcoin network could become a pawn in the hands of a central government, erasing the central concept of decentralization from the Bitcoin network.

What is mining?

Mining is essentially the use of computer hardware to voluntarily verify transactions on the Bitcoin network. Computers have the task of "solving blocks" through the use of a proof-of-work (PoW) algorithm. Put simply, computers guess the answer to a very complex computational equation (here you can learn more about Bitcoin mining). The first computer (s) to solve the block receive a predetermined amount of Bitcoin for their service to the network, and the miners are also entitled to a share of the network transaction fees, incentivising their efforts. As more miners enter the network, these equations become more difficult and mining premiums decrease in an attempt to curb inflation and maintain the block creation rate at a static time (about 10 minutes).

When Bitcoin was introduced for the first time, Bitcoin mining was easily accessible and users could choose to extract BTC with their PCs, helping the network grow. These users represented a diverse collection of Bitcoin enthusiasts who saw their efforts as a core service for the Bitcoin network and eventually extracted Bitcoin because they believed in technology.

When the Bitcoin network was in its infancy, these equations were relatively simple and the competition on the network was very low. While Bitcoin grew in popularity (and value), a wave of miners caused a necessary increase in the difficulty of the Bitcoin hash algorithm, which eventually pushed the average miners out of the mining industry, since it was not more profitable for them to try to solve blocks with inadequate hardware.

Instead of marking decentralization as their main ethos, today's Bitcoin "miners" – big multi-million dollar companies – seem to mark pure profit as their ultimate goal. After all, now there is a lot of money in Bitcoin mining, and the bigger the share a company can control for hashing power, the bigger their share of profits is total minerals available.

Bitcoin Mining Giants

While the Bitcoin mining industry is not permanently controlled by one person or a company, there are some implications that indicate that the industry is pendant towards centralization. Factors that help determine who has the most control over the Bitcoin network can be classified into three categories:

- Who manufactures mining equipment,

- Who controls the hashing power of the Bitcoin e network

- Which governments control the regulation of the most prolific miners.

Who manufactures mining equipment: Bitcoin ASIC chips

Today, Bitcoin mining equipment uses only application-specific chip chips (ASIC chips). ASICs are chips designed to serve a single purpose and, in the case of Bitcoin mining equipment, are designed to quickly solve the mathematical equations necessary to verify transactions on the Bitcoin network. While there are more manufacturers of these chips, one manufacturer is going head to head above the rest.

Bitmain is by far the largest Bitcoin mining technology producer, producing 70% to 80% of the total market share. The company is extremely prolific in the mining sector of Bitcoin, which in 2017 alone gained somewhere between $ 3 and $ 4 billion.

Although Bitmain's share of Bitcoin mining hardware production is not complete, it represents a large enough percentage to consider this portion of the "centralized" industry. If Bitmain were to produce a miner or support software that had an inherent hardware flaw or a security problem, it could mean a disaster for the Bitcoin mining industry and the Bitcoin network as a whole. This potential vulnerability opens the Bitcoin network to a "point of failure", something that a truly decentralized network should not be subject to.

Who controls crushing power: mineral pools

Bitmain also controls the lion's share (estimated at about 45%) of the hashing power on the Bitcoin network. "Hash power" is a measure of how much energy the Bitcoin network consumes in order to work continuously. Part of this hashing power (or hash rate) is the amount of energy that a particular entity is investing in extraction Bitcoins; the more energy an entity invests in the Bitcoin network, the more likely it will solve blocks and receive mining premiums.

As an entity like Bitmain approaching a 50% share of Bitcoin hashing power, the network becomes vulnerable to attack. It is important to keep in mind that these attacks are not necessarily in the financial interest of Bitmain or anyone else. If Bitmain also controls 80% of the hashing power, it would probably earn more "playing honestly" and reaping the profits earned through legitimate mining practices rather than attempting to overthrow the network, double spending or refusing on purpose to provide mining services.

But having a single subject that controls more than half the power of hashing opens the door to serious attacks and if someone with bad intentions somehow gains control over the holder of the majority of hashing power, it could devastate the network. Furthermore, having this type of centralization within the Bitcoin network undermines the very function of Bitcoin, which is designed to provide a decentralized alternative to the current monetary system.

Which government regulates the most prolific miners: geo centralization

Perhaps the biggest risk that could come to Bitcoin from the centralization of mining is the geo-centralization of the nodes responsible for providing services to the network. With Bitmain's share of just under the control of the Chinese government, along with a large additional portion of other mining pools based in China, it is safe to assume that Chinese regulations could have an impact on the Bitcoin ecosystem if a & # 39; sudden regulatory pressure put on miners in China. This scenario is more likely than a casual attack, as China has been quick to put pressure on cryptocurrency markets in the past. Furthermore, with the increase in Bitcoin's popularity, we could see many powerful nations, such as China, trying to close the project to protect their currencies issued by central banks. The best defense against this type of normative pressure is a well-diversified network, something that geo-centralization completely compromises.

The aggressive expansion of Bitmain in North America

Bitmain was one of the first to adopt Bitcoin extraction on an industrial scale and its stronghold in the mining sector reflects an aggressive growth strategy. It is true that the company has received subsidies from the Chinese government in the form of low-cost electricity in the past, which has helped the company enormously to grow, but the most important factor contributing to Bitmain's success remains their early entry into the mining game. and Crypto-market in rapid growth.

Bitmain is now trying to diversify and expand its operations in North America, a market that does not offer the benefits of Chinese sponsorship. At the beginning of 2018, Reuters reported Bitmain's intention to expand into the Canadian province of Quebec, thanks to its mild climate and low hydropower. Recently, Bitmain has also expanded in the United States, opening offices in Silicon Valley, Arizona and Washington, with plans to expand also in Texas.

Poor business

Members of the North American mining community have been publicly critical of Bitmain. Citing unfair advantages, deceptive collusion with regulators, and an inconsistent ethos with the foundational concept of decentralization. These worried voices are asking for a sober analysis of the imminent monopolization of the Bitcoin mining industry. Although it is easy to ignore these concerns, Bitmain has a track record of intentionally deceiving its customers, its investors and blockchain development communities.

At the beginning of 2018, Bitmain's "profits-over-philosophy" approach to mining cryptocurrency led to the Monero secret currency, which chose to fully commit its project. Bitmain designed an ASIC miner to be used with the Monero mining algorithm, effectively creating an unbalanced coin mining ecosystem. Furthermore, even after the Monero project decided to make these new miners obsolete through a change in the algorithm, Bitmain still attempted to sell the miners to unsuspecting customers who were unaware of the machine's uselessness.

Even more recently, news about Bitmain's dishonest business tactics have appeared in newspaper headlines. The company is now accused of lying about the involvement of several companies that have been reported as investors in the Bitmain pre-IPO financing round. Notable firms, however, are now publicly denying their involvement with Bitmain, further fueling speculation among members of the crypto-community who continue to doubt Bitmain's ethics.

Interview with Bitfarm, TMGcore and Bitmain

Bitmain's mining fortitude is clearly a matter of concern on many fronts, potentially compromising the safety of the Bitcoin network and threatening the possibility of a uniformly distributed mining ecosystem. To help us better understand the issues of the Bitcoin mining industry and concerns about Bitmain's continued growth, Bitrates followed the American and Canadian industry leaders who gave an overview of the situation in North America, as well as a look at their own contributions to the Bitcoin Ecosystem.

In the second part of our series, representatives of TMGcore, a Texas-based mining company with an exciting and innovative development team, and Bitfarms, a mining operation based in Quebec with a good deal of support from their local market, they agreed to answer some of the most burning questions about the Bitcoin mining ecosystem, centralization and government regulation.

Disclaimer: the information contained in this document is provided without considering personal circumstances, therefore it should not be interpreted as financial advice, investment or offer recommendation or solicitation for cryptocurrency transactions.

[ad_2]Source link