[ad_1]

[ad_1]

You hear it wherever you go:

"Bitcoin is dead"

"Cryptocurrency is a passing fad"

Do not listen to the haters and opponents. Cryptocurrency is alive and well. It's not going anywhere. Each market has periods of bull and bear. It's natural and extremely healthy because the market corrects itself after a massive bull run. Welcome to the current state of the crypt around August 2018.

The decline of Bitcoins – or increasing?

Let's put things in perspective

Bitcoin is down 65% compared to historic highs! The cryptocurrency industry is in a spiral of death.

Not so fast.

We just have to consider the behavioral aspect of investors and have the patience and foresight to take advantage of the underlying impact that will eventually have worldwide. The cryptocurrency industry is still ready for massive growth.

Need Underlying

Above all, the need for cryptocurrency remained unchanged. I spare you the pain of listening to a history lesson about the lack of monetary policy caused by the collapse of the Roman Empire or how the censorship of the media has tormented nations for centuries.

financially, the need for a decentralized reserve of value outside the control of the government and central banks proved to be a financial crisis after the financial crisis. Billions of people around the world remain unscrupulous due to the lack of access to traditional banks.

Cryptocurrency has the power to address and correct the failures of the current global financial system.

sociallycryptocurrency and blockchain technology offers new solutions to many of the world's problems. From immutable records that can be used for the election of decentralized applications that can not be blocked by third parties, crypto has the ability to improve and connect the world in a similar way to the Internet initially.

Prices

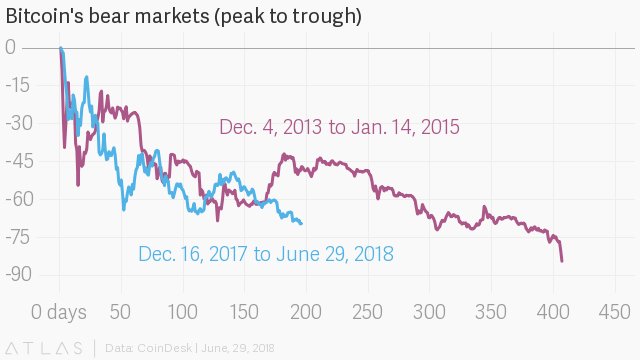

For those not in cryptocurrency for technology, this is not the first time that the cryptocurrency market has gone through a horrible bear market. Bitcoin has crossed a similar bear market throughout 2014.

Let's put prices in perspective. If you invested in Bitcoin a year ago at $ 2500, today you would have more than doubled your investment. This is an incredible return that can not really be matched by any other class of activity.

Although it is impossible to pinpoint the exact moment when the Bitcoin bear market will end, current price levels are extremely attractive for new long-term cryptocurrency investments.

Looking at the Bitcoin alone, viewers might find the market a bit bearish.

The future of the cryptocurrency industry

The future of cryptocurrency depends mainly on two components: institutional influence and mass adoption.

Institutional players

New money from institutional investors will probably be the springboard that ignites a new bull market in the cryptocurrency space.

Experts such as Michael Strutton have predicted that an additional $ 100 to $ 400 billion would enter the market if the SEC eventually approves a Bitcoin ETF. This increase in the flow of money would have easily put the price of Bitcoin above historical highs.

Regardless of this, if the SEC approves a Bitcoin ETF or cryptocurrency, there are numerous, important institutional actors who revolve around the cryptic market like sharks waiting for the opportune moment to be wisely involved in a rapidly growing class of profitable business.

It is not a question of Self institutional investors will end up being involved in the cryptomarket, but when?

Widespread adoption

Probably the most important for the long-term success of the cryptocurrency industry is its widespread adoption by the masses.

Vitalik Buterin has recently highlighted the need for the crypt to be more usable by the average consumer on his twitter:

Long-term thinking – where will the crypt be if it is not widely accessible?

Current status of adoption

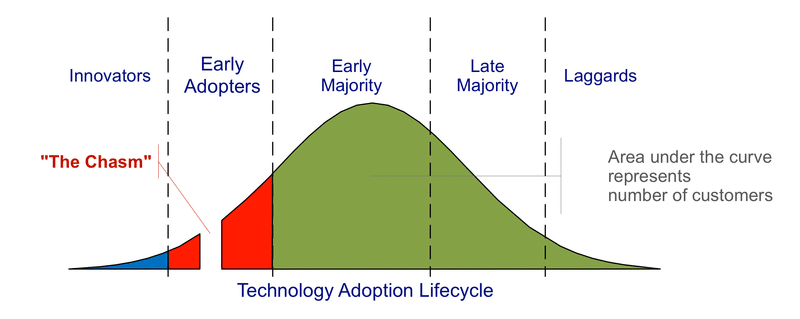

The following is the Technology Life Cycle Adoption Model that is often used in marketing to express the current state of acceptance of emerging technologies or products. The cryptocurrency industry is still in its infancy. As the graph shows, it failed to cross the "ravine" towards traditional adoption.

Currently, cryptocurrency is still in early adoption, as price volatility and technical complexity continue to dissuade many large companies and retailers from accepting encryption as payment.

Despite the commercial risks associated with the cryptocurrency, important companies such as Overstock, Expedia and Subway have come forward to accept it in hopes of attracting a new and growing customer base.

Over time, we should expect larger companies and smaller shops to start cryptocurrency as a way to gain an advantage over their competition.

The next step of Crypto should cross the chasm.

Conclusion

Although it is impossible to determine the exact time when the current crypto-bear bear market ceases, the market is currently positioned for long-term growth as institutional investors enter the industry and large retailers begin to accept it as a form of payment.

Do not panic. The cryptocurrency bull market will eventually come back.

Editor's note: maybe. This is not a financial advice.

reported

[ad_2]Source link