[ad_1]

[ad_1]

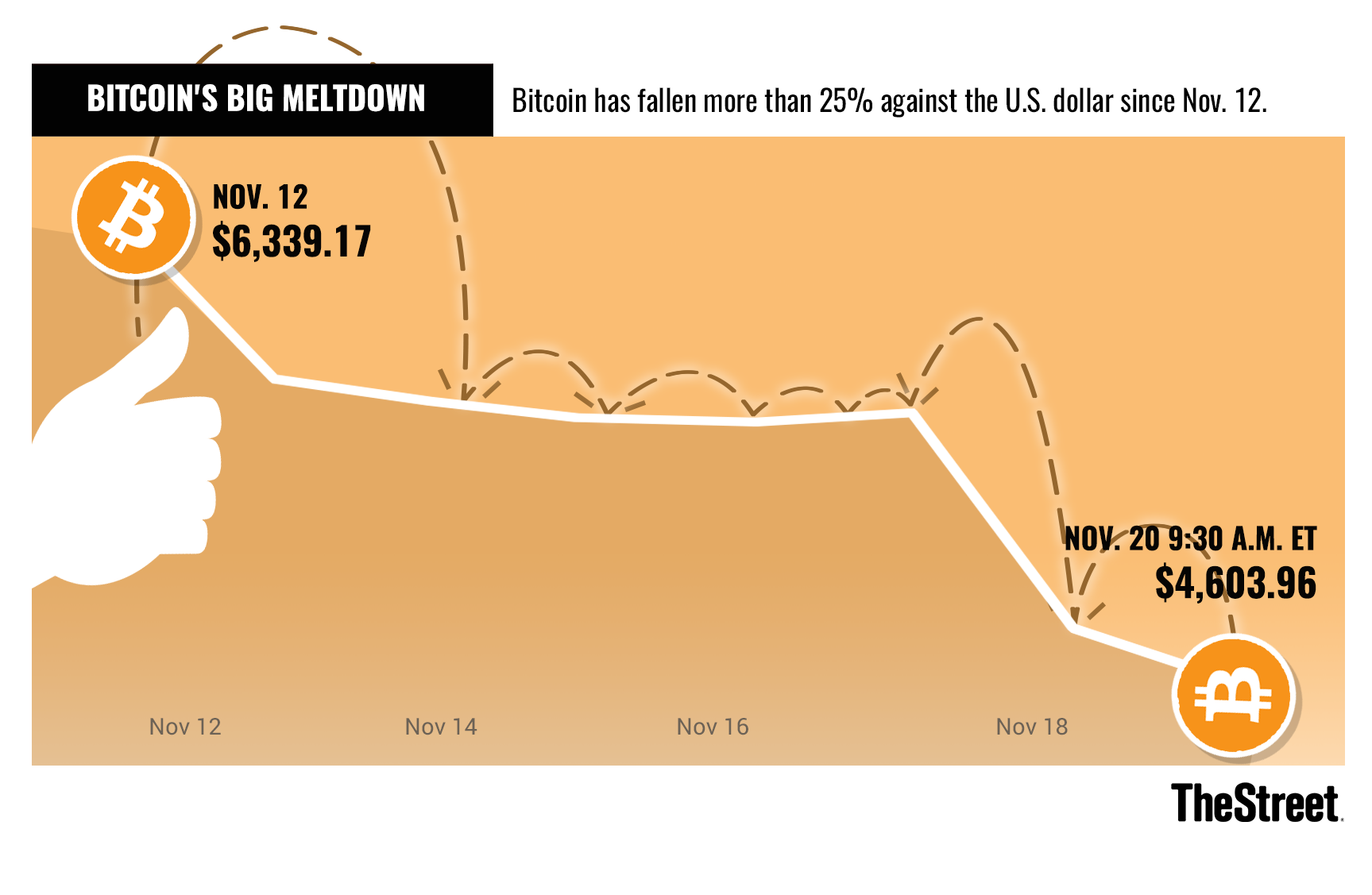

Bitcoin holders still rallied their Tuesday, as the price of the digital currency dropped by another 14%, pushing the decline to more than 30% over the last seven trading days and bringing it to a minimum of 13 months.

Starting at 4:00 pm on Tuesday, the price of Bitcoin was $ 4,277, putting the cryptocurrency en route to the worst monthly loss in the year. The main cryptocurrency currently trades over 32% on the monthly opening price of $ 6,320, according to CoinDesk's market data.

A split of the Bitcoin Cash cryptocurrency in two versions last week, as well as the stop orders that started at $ 6,000, are among the several factors contributing to the Bitcoin selloff last week, according to market observers.

Speculation that greater regulatory control will push issuers of initial coin offerings, or ICOs – the method by which digital currency creators offer units of a new cryptocurrency or crypto-token in exchange for cryptocurrencies like Bitcoin or Ethereum – has also the decline has been stimulated. The addition to the declines is a general exodus from technological actions, which have undergone significant declines in the last week.

Cryptocurrency investors, however, saw more specific reasons behind the fall – in particular the mass sales stimulated by shares of the US Securities and Exchange Commission last week that prompted issuers to repay their token holders with cash and then to reissue their offers as "titles". "

"The SEC's Friday announcement that two specific tokens have been told to repay their US dollar token holders and then re-file as securities is where the selling pressure comes from," noted Fred Pye, President of 3iQ Corp., a Canadian investment fund manager who focuses on investing in cryptographic assets and other disruptive technologies. "Tokens must convert into Ethereum or Bitcoin, and then cash in USD, which is why we are seeing such a sharp decline."

The decline is in contrast to his performance a year ago, when the cryptocurrency rose to a record high of $ 19.511. It fell to $ 13,500 at the start of this year and then stopped at around $ 6,400 for most of October, before prices began to fall again in early November.

Other major cryptocurrencies declined mid-morning, with Ethereum down 13% to $ 130.53, Litecoin down 9% to $ 32.40 and down 11% to 43 cents.

To be sure, the recent price declines have not put in place those involved in the blockchain and other technologies focused on cryptocurrency and related companies, including MLG Blockchain of New York and Toronto, a consulting and consulting company that assists in the sales of token, ICO and blockchain – start-up start-up.

"The recent volatility of speculative blockchain activities does not change the underlying value of created networks," said founder and CEO Michael Gord. "The big blockchain companies of tomorrow operate and build without considering the short-term price of their token".

(Update prices in all starting from 16:00 ET)