[ad_1]

Crypto's market sees a violent downward movement, BTC falls by 4%

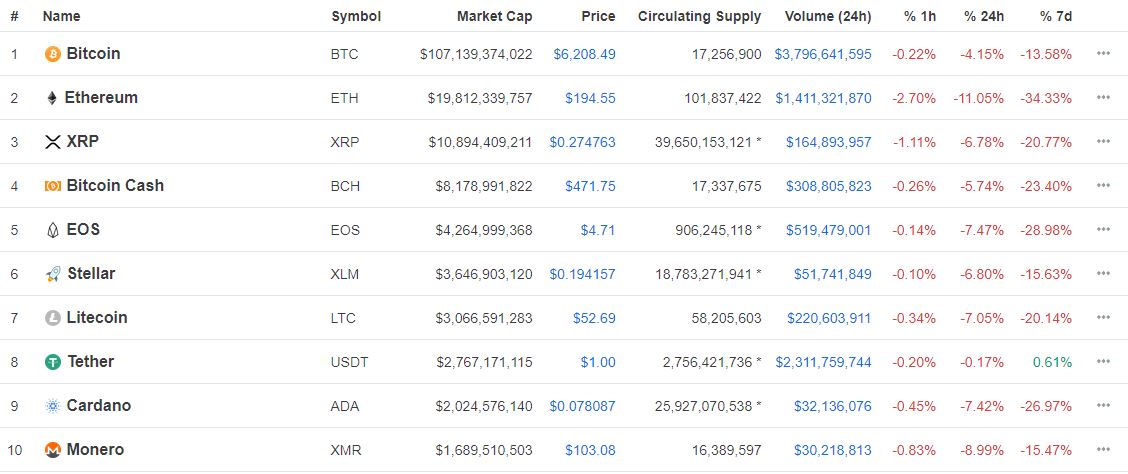

After days of side price actions, traders woke up on Saturday with a terrifying sight, with the cryptocurrency market continuing to fall due to a new sales period. side pressure across the board. So basically, when the optimists thought it could not get worse, it did, and much worse. In just one hour, BTC fell from $ 6,420 to $ 6,140, as sales volume grew over a series of trades.

As with other recent bearish movements, altcoins have actually underperformed Bitcoin, with a majority of cryptographic assets recording losses of 6% or more, while Bitcoin has sat at 4% in less than the day.

In this move, however, there was an altcoin that stood out among the crowd of hundreds. As the observers of the chart are probably aware, this sore thumb was Ethereum, or the price of ETH to be exact. For the first time in months, if not for a year, ETH has fallen below the price of $ 200 and is now at $ 192 and seems to be destined to fall further.

There was no clear catalyst for this continued bearish move, but many pointed out that the market weakness imposed by the previous move probably prompted Saturday's fall. Analysts now have eyes on support levels $ 6,000 and $ 5,800 for BTC, which will both be points of interest if the market continues to record losses.

Some pessimists have pointed out that if Bitcoin closes below $ 5.800, it may signal that this nascent asset class is ready to move into a multi-year bear phase. But for now, it remains to be seen if this is just an unfounded statement or a belief that holds faith.

Fundstrat's sluymer: "There is no strong technical installation for Bitcoin"

Following the decline of BTC from $ 7,100 to $ 6,300 in Wednesday, Robert Sluymer, a well-known analyst at Fundstrat Global Advisors, he spoke to MarketWatch to discuss his views on how traders should deal with the market in its current state. The Fundstrat analyst said:

It was a very damaging decline. There is no solid technical setting for bitcoins, we remain with lower lows and lower lows.

The analyst added that outside of day trading, it makes no sense to hold a "physical" BTC token for a long time, as the indicators clearly show that BTC is evidently more bearish than it is bullish. However, there is apparently also a risk for daily traders, as pointed out by Sluymer, stating: "If you do [day trade] you have to stop".

Strangely, the feeling of the Fundstrat analyst is polar in the face of the feeling held by the long-time Bitcoin bull Tom Lee, who is the collaborator of Sluymer. But this makes sense, since the former Fundstrat analyst focuses exclusively on technical aspects (which have been tendentially bearish), while Lee has his eyes on key indicators (which signal more positive technicians) and lesser-known technical indicators. and underused.

Photo of Alessia Cocconi on Unsplash

loading …

Source link