[ad_1]

Credit Loan Regulation over 100 million won / annual salary for banknotes

We increase 1.5 trillion in one week … Execution before the announced 30 days

Bank Loan Window / Photo = Yonhap News

The banking sector is tightening credit restrictions for high-income people starting this week. With crowds of people trying to get the latest car loan, banks are trying to “ tighten up ” ahead of the time announced by the financial authorities.

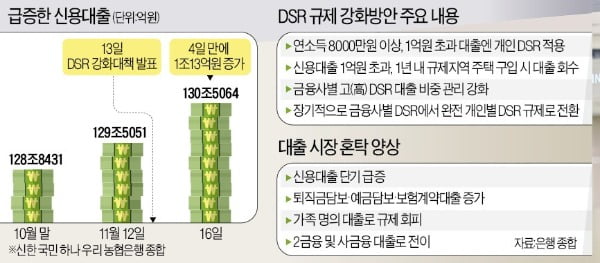

The financial authorities announced on the 13th that the “Total Debt Principal Repayment Ratio (DSR) 40%” regulation on credit loans exceeding 100 million won for high-income workers with an annual income of over 80 million won will be implemented by the 30th. However, after the regulatory announcement by the authorities, people who were trying to get on the last train of credit loans created a lot of problems at the bank. Credit loans increased by 1.5 trillion won in one week. The DSR is the value obtained by dividing the principal and interest repayment not only for home mortgage loans, but also for all household loans such as credit card loans and annual income. Represents the level of the loan burden on income.

According to the banking sector on the 22nd, depending on the bank, it is planning to implement stronger self-regulation than the authorities’ guidelines, such as applying a 40% DSR regulation on loans over 100 million won regardless of income .

KB Kookmin Bank plans to apply regulations when credit loans exceed 100 million won regardless of income. It means that from tomorrow (23) loans exceeding 100 million won and over 200% of annual income will be strengthened. The “DSR 40% or less” regulation is applied to borrowers (those who borrow money) with loans exceeding 100 million won (KB Kookmin Bank and other combined bank credits). They have decided to only pay within 200% of their annual income.

Woori Bank is also planning to implement credit loan regulations in excess of 100 million won as of the expected effective date of 30. The Nonghyup plans to suppress credit loans by reducing the loan limit and preferential interest rate one after another. Since 18, preferential interest rates for high quality credit and general credit have been reduced by 0.2 percentage points (p) and 0.3 percentage points, respectively. Nonghyup applied the maximum for each credit loan product, such as 200 million won for Supofroron for professionals and 250 million won for Medipron for doctors. Now, it is blocking credit loans of more than double the annual salary (200%) regardless of the product.

The reason the banks are ahead of the authorities’ regulations is that temporary demand loans have increased significantly to get on the last train. According to each bank’s credit lending statistics, the credit balance of the top five banks KB Kookmin, Shinhan, Hana, Woori and NH Nonghyup reached 131,354 trillion won as of November 19. This is an increase of 1.53 trillion won in just 7 days from 129.5053 billion won the day before the regulatory announcement (12th).

Notably, the number of non-face-to-face online loan applications increased on the 14th and 15th day of the weekend when the branches were closed. Internet bank Kakao Bank showed a temporary increase in the number of customers requesting loans from 15 to 16, resulting in a delay in access.

The number of new negative books opened in one day by the five main banks also increased. It went from 1931 on the 12th to 4082 on the 18th, almost doubled. It seems to have influenced the fact that the limit of all negative bank books opened by the application of the regulation adds to the total amount of loans.

Hankyung.com News Room [email protected]

Ⓒ Hankyung.com prohibits unauthorized reproduction and redistribution

Source link