[ad_1]

【Shen Wan HongyuanBonds】 Meng Xiangjuan, Yao Yang, Wu Wenkai

Summary

Hot spot analysis: the number of insolvent state-owned enterprises and the government’s fiscal balance of payments are highly correlated

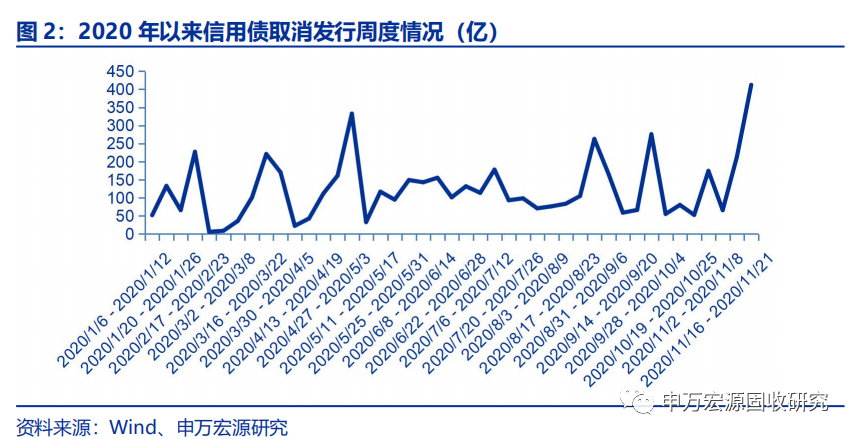

Net funding of credit bonds has been meager this week and the number and size of canceled or deferred bond issues are increasing. Since the default of “20 Yongmei SCP003”, a total of 76 bonds with a total size of 62 billion have been canceled or deferred. As of November 20, a total of 92 bond issues have been canceled or postponed this month, for a total size of nearly $ 70 billion. It is already this year.Since then, the number and extent of the bond issue have been canceled or postponed.

Since the beginning of this year, 670 bonds with a total scale of over 530 billion have been canceled or issued. Of these, medium-term notes were the most canceled, followed by short-term bonds and corporate bonds. It is worth noting that Fujian Strait Bank Co., Ltd. canceled its secondary bond issue on November 16. Capital debt, which is relatively rare.

Comparison of three cancellation cycles during the predefined concern period:(1) In 2016, the default of Dong Special Steel and China Railway Group caused concern: the cancellation of the weekly credit bond issuance ladder went from less than 10 billion yuan to around 50 billion yuan. (2) In 2020, Yongmei’s default will raise concerns: the size of the cancellation of the credit bond issue that week went from around 15 billion yuan a week to around 40 billion yuan. (3) In 2019, Baoshang was taken over and raised concerns: the most affected by the Baoshang incident is still the issuance of interbank certificates of deposit from medium- and low-tier banks. The extent of non-issuance of interbank certificates of deposit increased dramatically from 10-15 billion yuan that week to around 90 billion yuan.

Industrial debt strategy:The outbreak has impacted most sectors. Although the default rate for the year has not increased, the recent consecutive insolvencies of Brilliance and Yongmei have had a greater impact on market sentiment. The credit spread is still at a historically low level and the allocation of industrial bonds is relatively cheap. , It is recommended to adhere to the short term medium and high quality coupon strategy and the industry setup recommends non-ferrous metals, chemicals, real estate, machinery and construction.

Debt strategy for urban investments:Urban bond investments can continue to sink moderately in locations, and you can choose locations with intermediate spreads, such as Hubei, Jiangxi, Shanxi and other locations. In view of our turnaround year view in 2021, urban bond investments will face valuation fluctuations and will continue to be cautious Urban investments will be cautious in 2021 and are currently reducing their holdings.

High-frequency monitoring of industry prosperity:

High frequency tracking:Uplink:Car License Plate Price of Tier 1 Metallurgical Coke, Closing Price of Tier 1 Metallurgical Coke, Composite Steel Price Index, Armor Futures Price, Armor Spot Price,BRENT crude oil, ethylene, butadiene, ethylene glycol, copper LME, aluminum LME, zinc LME, lead LME, copper, aluminum, zinc, lead, Baltic dry bulk index, Shanghai export container transport index, China export container transport Price indexDish:Bohai Rim Thermal Coal,NEWC steam coal, coking coal pit price, coking coal truck price, PX, methanol, urea, soda ash, domestic cement average price;Downside:Toluene, polyester filament,MDI。

Weekly review of credit obligations:

Industrial bond market:This week, credit spreads have increased overall, grade spreads have increased and term spreads have narrowed. Specifically, among the credit spreads, the short-term one-year (AA) and (AA-) ratings increased the most, reaching 24BP. Among the quality spreads, the 3-year spread increased by 23BP. Among the maturity spreads, (AA), (AA-) from 5 years to 3 years and from 5 years to 1 year decrease by 23BP. In terms of excess spreads, 4 of the 19 industries fell, 15 increased, and steel rose by 26BP. This was mainly affected by Yongmei’s default. The bond yields of the steel industry increased by a large margin. Among them, bonds linked to Baotou Steel, Hegang and Shanxi Iron and Steel Generally up by 50BP or more; the paper industry down 50BP, mainly because Chenming bond yields exceeded 10% and were excluded from the sample.

Urban investment bond market:Urban investment bonds performed better this week than industrial bonds. Low-rated urban investment bonds performed best.

Credit debt risk warning: Ziguang Group Co., Ltd. and Fujian Fusheng Group Co., Ltd. defaulted for the first time.

text

1. The cancellation of the issue has increased significantly since Yongmei’s default

On November 10, since the default of Yongcheng Coal and Electricity Holding Group Co., Ltd.’s “20 Yongmei SCP003” bond, three debt issuing companies that defaulted for the first time appeared on the credit bond market, namely “17 Chenglong 03” of Jackie Chan Construction Group Co., Ltd. On November 13, “17 Ziguang PPN005” of Ziguang Group Co., Ltd. breached the contract on November 16 and “18 Fusheng 02” of Fujian Fusheng Group Co., Ltd. hacked on November 19. The recent frequent occurrence of credit bond defaults has also had a greater impact on the primary bond market. Net funding of credit bonds this week was -89.4 billion and the size of net funding fell significantly. It was the worst week of net funding this year. This week a total of 225 billion credit bonds were issued and a total of 314.4 billion credit bonds were repaid, of which 300.1 billion were redeemed at maturity, 5.6 billion were paid in advance and 8.7 billion were resold.

This year’s net financing of credit bonds generally showed that the first half of the year was much better than the second. There haven’t been many weeks of big negative net funding. With the exception of this week’s credit default, most of them were affected by holiday factors. The beginning of the year was influenced by the Spring Festival. The degree of net funding was negative, the end of September and the beginning of October were affected by the long November vacation, apart from that there was no significant negative net funding.

Net funding of credit bonds has been meager this week and the number and size of canceled or deferred bond issues are increasing. Since the default of “20 Yongmei SCP003”, a total of 76 bonds with a total size of 62 billion have been canceled or deferred. As of November 20, a total of 92 bond issues have been canceled or postponed this month, for a total size of nearly $ 70 billion. It is already this year.Since then, the number and extent of the bond issue have been canceled or postponed.

Since the beginning of this year, 670 bonds with a total scale of over 530 billion have been canceled or issued. Of these, medium-term notes were the most canceled, followed by short-term and corporate bonds. It is worth noting that Fujian Strait Bank Co., Ltd. canceled its secondary bond issue on November 16. Capital debt, which is relatively rare.

From a structural point of view, among the credit bonds canceled or postponed since November, the scale of industrial bonds is larger than that of urban bond investments; from a rating point of view, the main AAA rating is canceled 43.5 billion, and the AA + canceled 14 billion. Mainly; from the point of view of corporate attributes, local state-owned enterprises were mainly written off, with 52 billion canceled; by geographic distribution, the most deleted provinces and cities were Beijing, Guangdong, Fujian, etc., including 5 enterprises in Henan province canceled issuance, Shanxi provinceYangquan coal industry(Group) Co., Ltd., Shanxi Coal Import and Export Group Co., Ltd., Jinneng Group Co., Ltd. and other companies have canceled the bond issue.

2. Concerns about the acquisition of Baoshang Bank in 19

On May 24, 2019, Baoshang Bank was jointly taken over by the Central Bank and the China Banking and Insurance Regulatory Commission and mandatedBuilding bankCustody of Baoshang Bank business, the incident has an impact on market sentiment, we will focus on the impact on the primary market here.

After Baoshang Bank was taken over, the impact on issuing interbank certificates of deposit was greater than the impact on issuing credit bonds. Prior to May 24, 2019, the scope of the failed weekly interbank depository receipts issue was approximately 10 to 20 billion. The scale of issuance failures began to skyrocket after May 24, 2019, and the highest wassuance failed in the week of June 8, 2019, with 86.6 billion interbank certificates of deposit.

The acquisition of Baoshang Bank will also have some impact on the issuance of credit bonds. Prior to May 24, 2019, the weekly credit bond issue cancellation or deferral scale was around 5 billion, and the cancellation scale after May 24, 2019 began to rise and the maximum issuance bankruptcy in the week of 8 June 2019 was 15.2 billion.

3.Concerns caused by the default of Northeast Special Steel and China Railway in 2016

From March to April 2016, the first corporate bond default in cyclical sectors, such as ZiboHongda MiningCo., Ltd., Guangxi Nonferrous Metals Group Co., Ltd., Northeast Special Steel Group Co., Ltd., China Coal Group Shanxi Huayu Energy Co., Ltd. and other companies defaulted on bonds for the first time in this period. We hereby look at the cancellation of the primary market credit bond issue during this period. It happens.

Northeast Special Steel defaulted on its bonds for the first time on March 28, 2016. Prior to the default, the weekly scale of canceled or deferred issuance of credit bonds was approximately $ 7 billion. After the default, the scale of canceled issues began to climb, reaching a maximum in 2016. The size of failed issues in the week of June 11 was 49.1 billion.

Affected by bond defaults in cyclical sectors such as Northeast Special Steel, many companies in cyclical sectors have canceled bond issuance, such as Bengang Group Co., Ltd., Guangzhou Aluminum Group Co., Ltd., Pangang Group Co., Ltd. and other companies.

4. Credit Debt Risk Warning

5. Monitoring of industry news

Massive information, accurate interpretation, all in Sina Finance APP

.

[ad_2]

Source link