[ad_1]

[ad_1]

Circle, the criptovalute startup funded by Goldman Sachs, recently published its list of achievements for the year 2018. The company claims to have performed a crypto over the counter (OTC) with a notional volume of $ 24 billion .

Circle makes $ 24 billion in OTC cryptocurrency trading

Circle has announced its results in 2018 in a blog post published by the company on Thursday (3 January 2019). Circle Trade, the company's OTC branch, performed over 10,000 OTC transactions worth $ 24 billion.

Commenting further on the growth of the Circle Trade platform, the announcement notes:

Circle Trade has become a basic liquidity provider for the entire crypto ecosystem – including miners, exchanges, project developers and founders – and for the new base of cryptic VC investors, cryptographic funds, hedge funds and family offices in Worldwide.

The figures published by Circle are indicative of the recent trend observed in the OTC arena. In December 2018, Bitcoinist reported a boom in OTC Bitcoin trading according to the search for diar. Other important players like Coinbase also show an increase in trading volumes during OTC hours.

The $ 24 billion notional trade could even indicate that Circle has executed more OTC exchanges than Coinbase and Greyscale (GBTC) combined. Data from diar showed the OTC volume of Coinbases at around $ 12 billion with $ 11 billion for GBTC.

For 2018, Circle OTC desk @circlepay made 10,000 OTC exchanges, 600 distinct counterparts, 36 different cryptographic resources, volume $ 24 volume: //t.co/XLIn3qAa8a

– Su Zhu (@zhusu) January 4, 2019

A couple of acquisitions

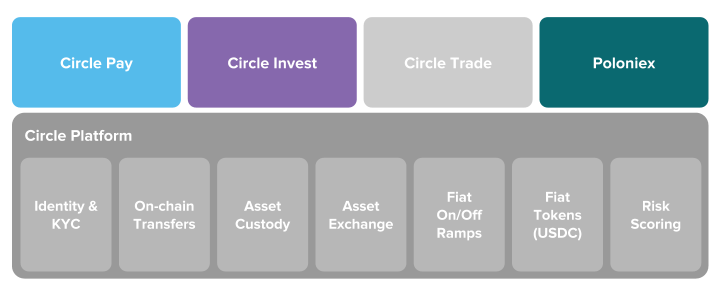

The acquisition of Poloniex by Circle was probably one of the significant developments that took place in 2018. In February 2018, the company announced his acquisition of Poloniex, one of the largest cryptocurrency exchange platforms of the era.

According to Circle, he has made great efforts to improve the platform's compliance standards. In May 2018, Bitcoinist reported on the noise caused by the new KYC requirements introduced at the time. Many legacy account holders felt that the move broke various insurances provided by the company at the end of 2017.

For Circle, the steps taken have yielded especially in the customer service area. The blog post revealed a 99.5% decrease in the number of tickets opened by the acquisition.

In 2018, Goldman Sachs-backed Circle also acquired SeedInvest as part of its commitment to become a regulated broker-dealer. With the tightening of regulations in the US cryptic landscape, startups like Circle and Coinbase are pursuing regulatory approval to expand their catalogs of cryptocurrency products.

Launch of the stable currency and growth of the company

Even Circle has ventured into the stablecoin arena with the to launch of USD Coin (USDC). This development led to the creation of the CENTRO Consortium, a joint venture with the San Francisco-based exchange giant, Coinbase.

According to the announcement, USDC is now the second largest stablecoin collateralized after Tether with a market capitalization of over $ 280 million. Multiple cryptocurrency exchange platforms also support stablecoin.

2019 will be Circle's sixth year, and the company says it wants to focus on creating capacity for industry, regardless of market conditions. Circle says:

We see the future of the global economy as open, shared, inclusive, distributed and powerful – not just for selected guardians but for all those who connect.

What do you think of the numbers of the Circle 2018 despite a decline in overall prices? Let us know your thoughts in the comments below!

Image courtesy of Twitter (@ Zhusu) and Circle, Shutterstock

[ad_2]Source link