[ad_1]

[ad_1]

Latest news about Litecoin

For a long time, discussions have been on demonstrating work consent algorithms and their modus operandi. On the one hand, the transaction confirmation protocol has been in circulation since the beginning of the 1990s, obtaining only traction from the early 2000s after the launch of Bitcoin.

To read: Bitcoin maximalists reveal Key Test errors, but is it all FUD?

On the other hand, the system is a hallmark of decentralization, but it devours power because of the mathematics that requires energy. As we know, power is not cheap and this has been a matter of debate for the better part of the third and fourth of 2018. Litecoin is one of the many altcoins fueled by evidence of working algos but the rise of the so-called "efficient and scalable. " "The alternatives using pole testing or even dPoS have led to questions about the long-term viability of this decades-old system.

This is a stimulating observation. 🤔

By definition, a decentralized cryptocurrency must be susceptible to 51% attacks if with hashrate, quota and / or other resources that can not be acquired without authorization.

If an encryption can not be 51% attached, it is authorized and centralized. https://t.co/LRCVj5F0O1

– Charlie Lee [LTC⚡] (@SatoshiLite) January 8, 2019

It was even exacerbated by the modification of the Ethereum Classic and although Charlie Lee was the one who defended the platform saying that decentralization leads to susceptibility and as long as decentralization exists at some point, a network must be ready to strengthen its security against a double expense attack.

Read also: It costs $ 20 to launch a 51% attack on Einsteinum and less than $ 200 to force a hard fork into Feathercoin

It's a race for computational power. Depending on how convenient it is to rent hash power from sites like Nice Hash, then the double expense attack can get you into fast and devastating projects. For example, to successfully double spending on the Litecoin network, Crypto51 theorizes that it will cost $ 21,461 the hour, which is expensive but cheaper for certain groups or organizations.

Litecoin price analysis (LTC / USD)

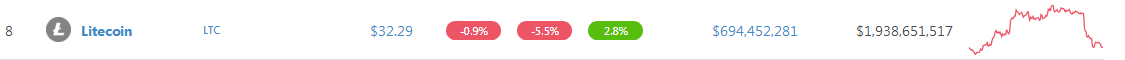

Meanwhile, Litecoin as the rest of the market is melting. At spot prices, LTC is down 5.5% from the green fund, but an encouraging 3 percent increase in the last week and still up for the eighth.

With the candle agreement, the pauses of our previous long positions have been hit and sellers appear to return to action, reluctant gains at the beginning of January 2019. However, we maintain a bullish forecast by changing only the projections if the prices fall below the $ 308 2018 lows on the back of above-average volumes.

Trend: short-term uptrend, long-term bearish, bear Breakout model

From a top-down approach, the path of least resistance is the crystal. Sellers are in control of trading within a bear breakout model. Although this is negative, the trend can easily change if the bulls accumulate sufficient momentum and exceed our short-term goals at $ 50 on the back of above-average volumes.

This will not only restore the confidence of the market, but will be a foundation from which prices can go up to $ 150 and even $ 200 by the end of Q1 2019. Apart from the price models, note that yesterday's sell off printed at Fibonacci retracement level of 50% of Nov-Dec Price fluctuations of 2018.

Volumes: rising bearish

Although there is trust and general expectation for the highest highs, bull volumes are thin. For the last two months, for example, we have not seen the printing of bull candelabra on the back of high volumes that exceed the recent maximum peaks of bear.

Yesterday's volumes were higher than the recent average – 449 thousand against 260 thousand and better than the recent volumes behind higher highs that complete the drives behind the bar of ecstasy November 20-751k against 259 thousand.

Since this peak in market participation coincided with the 50% Fibonacci retracement level mentioned above, the LTC bears could go back confirming yesterday's test and ushering in the next phase, the continuation of the trend typical of a breakout of mid-November 2018. That's when prices fell below $ 50.

Conclusion

Because of these technical factors, traders are better converting their holdings into stalls until after volatility. Probable stacks are at $ 30 but as above, releases under $ 30 could see LTC melt down to the 2018 lows of $ 20.

All charts are provided by Trading View-CoinBase

This is not an investment tip. Do your research.

[ad_2]Source link