[ad_1]

Mahfi Eğilmez *

Central Bank reserves are made up of the sum of gross foreign exchange reserves and gold reserves. Not all of these reserves belong to the Central Bank. Some of these are made up of mandatory reserves that banks must maintain with the Central Bank. We can consider them as a kind of custody currency. The amount of deposits in these foreign exchange and gold reserves has increased, as in recent years the CBRT has granted the flexibility to deposit foreign currency or gold on required reserves in exchange for TL deposits through the reserve option mechanism. Since some of the foreign exchange and gold reserves are entrusted, the total foreign exchange reserves of the Central Bank shows us the gross foreign exchange reserves. When we reduce the amounts deposited in the Central Bank by this, we reach the net foreign exchange reserve.

We must also deduct the amount of the exchange obtained by swap from the net reserves we have achieved by decreasing the custody reserves in the Central Bank. Because they refer to borrowed foreign currencies with a certain maturity. At maturity, if the other party does not want an extension, these amounts must also be repaid.

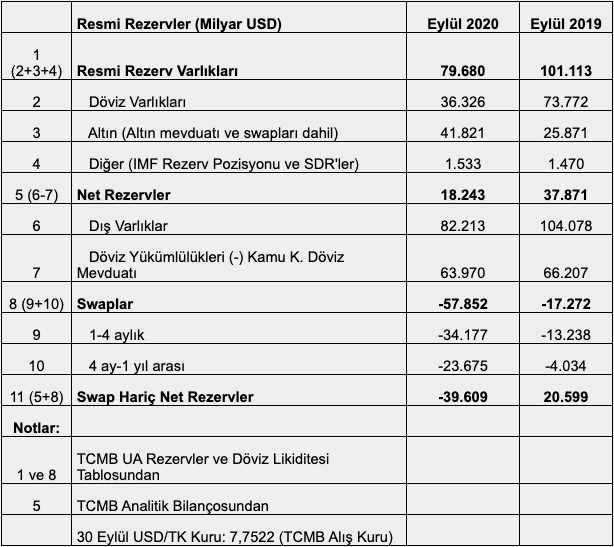

The table below shows the Central Bank’s reserves in September and compared with the results of September last year (Source: CBRT website’s electronic data distribution system).

The table shows the following: (1) Gross CBRT reserves decreased by $ 21.4 billion in one year. (2) While foreign exchange assets decreased by $ 37.5 billion, gold rose by approximately $ 16 billion. (3) The Central Bank’s net reserves (the amount remaining after deducting the custody reserves) decreased by $ 19.6 billion. (4) The resources provided through the swap increased by $ 40.6 billion. (5) If we look at the reduction in swap possibilities, the central bank’s net reserves fell from + $ 20.6 billion to $ 39.6 billion. In this case, the decline in net reserves excluding swaps was $ 60.2 billion.

Undoubtedly, there are many social and political reasons as well as economic reasons why the USD / TL exchange rate exceeds 8.15. The developments in this table have an important place among the economic reasons.

This article is taken from Mahfi Eğilmez’s personal blog.

Source link