[ad_1]

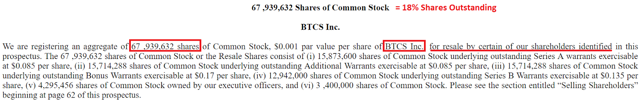

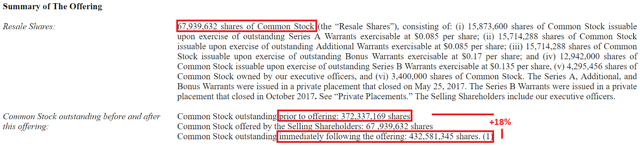

Among the price declines, BTCS Inc. (OTCQB: BTCS) operates an innovative business model consisting of the acquisition of Bitcoin USD (BTC-USD), Ethereum USD (ETH-USD) and holdings in companies of blockchain. Operations do not seem to be the reason behind the erosion of value, but the damaging management of the shareholding structure. BTCS has recently increased the share count as shareholders have sold shares from the exercise of warrants and convertible shares. In a recent S-1 / A deposit, BTCS recorded a further increase of approximately 18% in the number of shares equal to about 432 million shares. The number of outstanding shares seems to be the most important feature to study on this name.

Source: S-1 / A Archive

Business

Founded in 2013, BTCS Inc. ranks as one of the first US listed companies to engage in digital assets and blockchain technologies. The BTCS business plan is explained with the following words in the prospectus:

"Subject to additional financing, the Company expects to acquire additional digital assets to provide investors with indirect properties of digital assets that are not securities, such as bitcoin and ether. The Company intends to acquire digital assets through open market purchases.In addition, the Company can acquire digital assets by resuming its activity of transaction verification services through data centers outsourced and remuneration in digital assets protecting the respective blockchain. "Source: Prospectus

BTCS can not acquire any currency from the initial offer of coins ("UCI") .The fact that the SEC compels the ICO promoters to register under the Securities Act and under the laws on government securities is fundamental to understanding this behavior, BTCS provides the following words:

"The So. has not participated in any initial offer of coins as it believes that most of the offers imply the offer of digital Securities and requires registration under the Securities Act and under government securities laws or may be sold only to investors accredited in the United States. The Company will carefully examine the purchases of digital securities to avoid violating the 1940 law and seek to reduce potential liabilities under federal securities laws. "Source: Prospect

BTCS is currently seeking acquisition targets in the digital assets and blockchain with the following characteristics: First, the goal must be fully involved in the acquisition of business initiatives related to blockchain technology.In addition, potential target companies must have sufficient funding to provide working capital and cover the public expenses of the company.

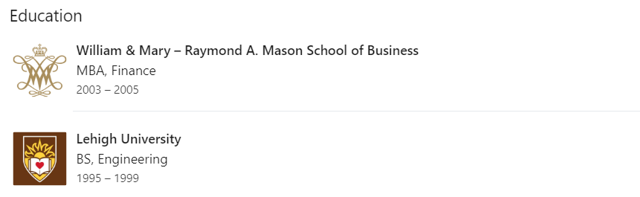

With this business model in mind, the most important asset of the company should be the financial advisors who select the offers.The man responsible for this task is Charles Allen, Chief Executive Officer, Chief Financial Officer and Chairman of BTCS It seems to have, first of all, large cre academic departments in finance. The image below was obtained from his Linkedin:

Source: Linkedin

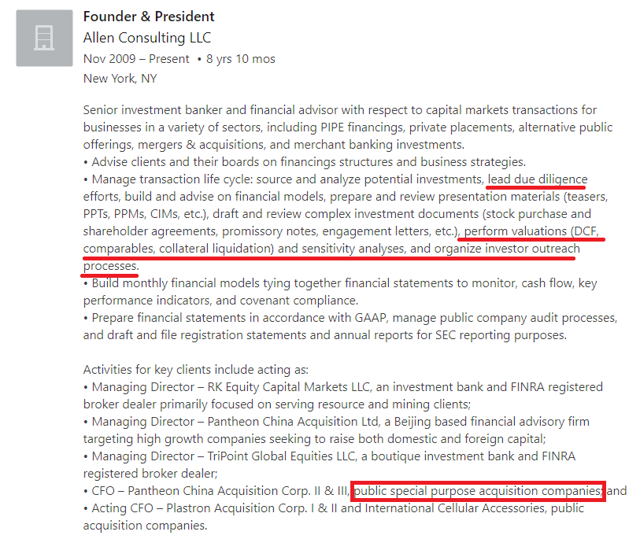

With this, his experience Professional includes financial evaluation posts, due diligence and contract management. This is exactly the professional profile that investors should look for with this name. The picture below shows one of Charles Allen's posts:

Source: Linkedin

Many liquid assets and recent conversion of convertible notes

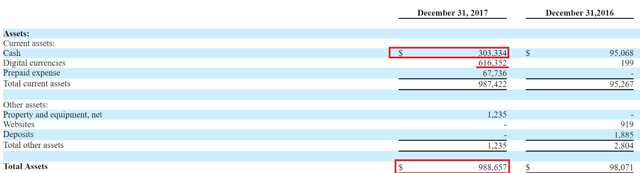

With this, the balance sheet seems beneficial. BTCS holds $ 0.3 million in cash, $ 0.6 million in digital currencies and a total of $ 0.98 million in total assets. Taking into account this amount of liquidity and liquid investments, BTCS seems ready to acquire other companies. Keep in mind that digital currencies could be quickly converted into dollars if BTCS selects a target acquisition.

Source: S-1 / A archive

The company did not provide specific information on the amount and type of digital currencies held. However, in the last annual report he stated that BTCS has only two types of securities; bitcoin and ether.

"The Company currently has two specific types of virtual currencies: bitcoin and ether." Source: 10-K

With this, BTCS also holds a maximum 40% stake in securities to comply with the Company's investment Act of 1940. The company explains this feature with the following words:

"To avoid of being an involuntary investment company under the Investment Company Act of 1940, we actively focus on ensuring that our ownership of assets that are not securities, except always 60% of our total assets, excluding cash. "Source: 10 -K

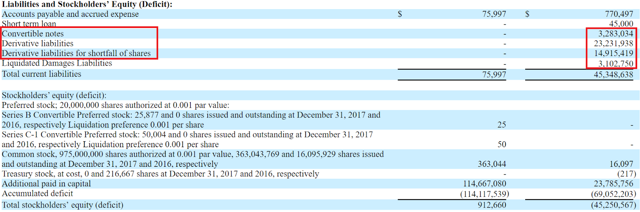

The liability side showed improvement in 2017. Large amounts of convertible bonds and derivatives were converted. The total amount of liabilities fell from $ 45 million to $ 0.07 million as shown in the picture below. It is beneficial because current shareholders should not fear dilution of shares from these convertible securities. Furthermore, the budget seems much clearer now.

Source: S-1 / A archive

Income statement

The 2017 income statement shows a massive reduction in the total revenue. With revenues of $ 0.35 million in 2016, BTCS recorded revenues of $ 4.480 in 2017. The reason for this negative result is the suspension of the company's transaction verification services facility in North Carolina. As the company explained, the profits of bitcoin mining were no longer as significant. Please read the following words:

"On 20 July 2016, BTCS Digital Manufacturing (" DM "), a wholly owned subsidiary, the Company suspended its North Carolina transaction verification services operations. Reduction of the reward for the 25-bitcoin to 12.5-bitcoin block, often called halving, along with the failure of the facility's cooling system, led DM to fail to meet some of its financial commitments. the activities in DM ceased. "Source: 10-Q

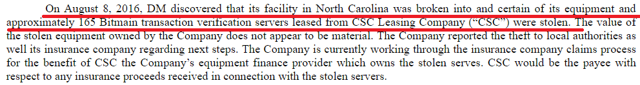

With this, the digital manufacturing plant in North Carolina not only ceased its activities in July. Just a few weeks after the company's transaction verification services were suspended, BTCS suffered a robbery by losing 165 Bitmain transaction verification servers:

Source: 10-Q

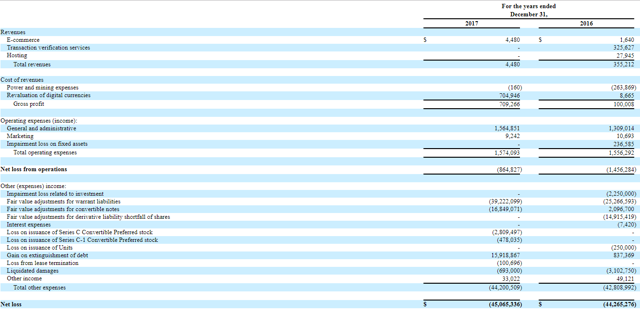

With these dramatic operational circumstances, net losses are stood at – $ 45 million in 2017, about the same as reported in 2016. Take a look at the income statement below:

Source: S-1 / A archive

Why was net income so similar in 2016 and 2017? The fact is that revenue and operating expenses are not as significant. The higher expenses shown in the income statement are adjustments for the changes in warrants, convertible notes and other convertible securities. With this in mind, the most important part of the BTCS financial statements is the equity structure. Both the net losses and the erosion of the value of inventories were due to changes in the company's equity

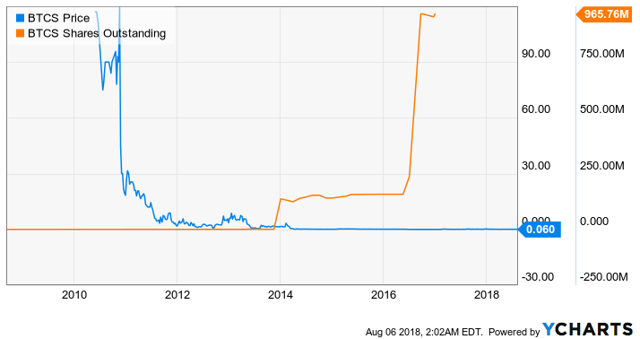

Increase in the number of shares and the resale of recent shares

The recent decline in the share price was created by the issue of an action. The chart below shows how the number of shares has increased more than three times in the last three years:

Source: Ycharts [19659029] Warrants and convertible notes are the reason behind the increase in the number of shares. In a recent deposit, the company announced the resale by shareholders of 67 million shares on exercise of warrants. As a result, the number of outstanding shares is expected to increase by 18% to 432 million. The following image gives further details on this new offer:

Source: S-1 / A archive

Estimate : 73x 2016 Sales and book value 27x per share

With 432 million shares at $ 0.06 per share, market capitalization is $ 26 million. With $ 0.3 million in cash and almost no debt, the value of the business is $ 25.7 million. Using the company's revenue in 2017, the EV / Sales seems too high, so we use the revenues of 2016, $ 0.35 million. With this figure, taken when things were fine for BTCS, the multiple is 73x, which is also very expensive.

In addition, with assets of $ 0.98 million and 432 million shares, equity per share is $ 0.0022. Taking into account the fact that the shares are traded at $ 0.06, or 27 times their book value per share, the company currently seems quite expensive.

Finally, BTCS Inc. seems to have acquired shares in other blockchain companies for the time being. This feature makes it difficult to judge the work of BTCS management and the future. The CEO seems very prepared, but if he does not bring any agreement, the market can not evaluate his skills. We hope the company is able to conclude a transaction soon.

Conclusion

BTCS is managed by a brilliant CEO and has an interesting business model. That said, the management of the shareholder structure and the resale of shares by the shareholders are destroying a lot of value. 432 million shares at $ 0.06 seem too much money for a company that only realized $ 0.3 million in revenues in 2016 and $ 4,480 in 2017. It currently trades at 27x its book value per share, BTCS does not It seems interesting from the point of view of the value of the investment. Smart investors will look for other securities in order to gain exposure to the cryptocurrency sector. Finally, long-term shareholders may opt to liquidate their stake before the 18% increase in the 18% share of the shares leads to a fall in stocks.

Disclosure: I / we have no positions in any mentioned title and no plan to start any position within the next 72 hours.

I wrote this article alone, and expresses my opinions. I'm not getting any compensation for this (other than Seeking Alpha). I have no business relationship with any company whose title is mentioned in this article.

Publisher Note: This article covers one or more securities that trade less than $ 1 per share and / or with a market capitalization of less than $ 100 million. Please be aware of the risks associated with these stocks.

[ad_2]

Source link