[ad_1]

[ad_1]

Latest Bitcoin news

For beginners, the slogan is simple: not your keys, not your coins. And I mean private keys. You lose it and there your coins. They will not be recovered and will remain in digital eternity forever, unless, of course, the Bitcoin developer community decides to do something about it, perhaps by going to Craig Wright's route and demanding the recovery of lost coins.

To read: In early 2019, the launch of Bakkt was postponed again and an update to be provided

Well, it seems that HitBTC is under fire to supposedly prevent verified account holders from withdrawing their coins. Surprisingly, this blockade is six months after John McAfee launched the alarm by asking interested parties not to register. He also called the "corrupt society" exchange and those who now have to write mail not to "ask me to help me" from him.

has @hitbtc failed #ProofOfKeys? I do not have an account. He asked a friend to start a withdrawal. WARNING! 🚩

Result: "Withdrawals are temporarily disabled on your account." Https://t.co/J3HMHKA1ah@maxkeiser @ToneVays @theonevortex @SatoshiLite @Excellion @CaitlinLong_ @nvk pic.twitter.com/wsXKiOlEJF

– Trace Mayer [Jan/3➞₿🔑∎] (@TraceMayer) 2 January 2019

Coincidentally, this comes two months after Trace Mayer, a cryptocurrency educator and investor who promotes the adoption of Bitcoin, has started a campaign asking coin owners to withdraw their funds from centralized and other services that claim to keep the private keys as they mark a decade after the creation of the Bitcoin genesis block.

Read also: Legendary Investor: Bitcoin (BTC) May Bottom In 2019, incoming bullish phase

Nicknamed the "Proof of the keys", the goal is to regain control, especially for the hodlers who opted for Bitcoin over fiat. According to Mayer, the entities that do not allow free access to the private keys of the coins are "monetary enemies" while those with control call them fervently Elite.

Here is the video:

If this is the case, could HitBTC hide something (insolvent)? Remember, in their six years of existence, the exchange has been dodged by many complaints and polemics that have dried up trust.

The exchanges will act just like the banks in the same situation. The "key test" was created for exchanges. I'm not ready for everyone to take out the coins.

No exchange, bank or anything like that is set for that. At least I know this.

– Hawkeye 4 Life (@ mdiaak54) 2 January 2019

Bitcoin price analysis (BTC)

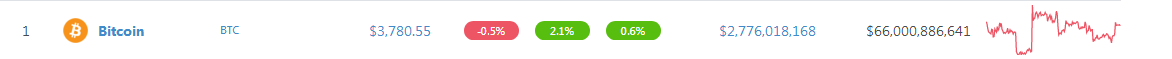

Wise price and Bitcoin is stable and recovering. After two weeks of higher highs, there is an inevitable correction but, all things considered, the bulls seem to have control. It rose by 2.1 percent in the last day, slightly down in the last hour and up 0.6 percent in the last week, this is at the time of the press.

Trendy arrangement and candles: up-close, at your fingertips

After 12 months of hammering, BTC finally hit the bottom in mid-December a month after the November confidence events. It was expected and the chronology shows that prices often slow down, easing the general trend before resuming the initial move in the phase of recovery of the trend.

This is why, despite the general bullish atmosphere, a top-down approach pointing to bears and the upward trend, we must see strong moves above the highs of December 2018. In the 4HR chart, the path of least resistance is active and the trend line linking December 15th to $ 3,220 with the recent lows is on a positive slope to support our preview.

Volumes: increasing

Prices are confined to a bull's flag and the 61.8% Fibonacci retracement level, pegged to 28-29 December on a low high around $ 3,800, marks the base of this flag. It is our support line and perhaps the foundation of the next wave of highest highs that comes from the high volumes between December 15 and 20.

So the average was 16k against 6.5k. But with price leveling, volumes shrink and the boost to yesterday's session in New York is 3 times the average at 6.5k compared to 2.2k, which is pretty low . It is excessively bullish and, unless there are declines below the December 28th low at $ 3,800, BTC could even recover over $ 4,000 to $ 4,500.

This is our BTC / USD business plan:

Buy: $ 4,100

Stop: $ 3,800

Target: $ 4,500, $ 5,500, $ 6,000

All graphics courtesy of Trading View-BitFinex

This is not an investment tip. Do your research.

[ad_2]Source link