[ad_1]

[ad_1]

In a joint report for the Monitoring, Evaluation, Research and Learning Technology (MERL) conference this fall, researchers who studied 43 cases of use of blockchains came to the conclusion that they had all delivered in default.

And when they contacted several blockchain providers about the project's results, the silence was deafening. "No one was willing to share data," the researchers said in their blog post.

In their research, Christine Murphy, social researcher at Social Solutions International and John Burg and Jean Paul Pétraud, partners of the US agency for international development, found a proliferation of press releases, white papers and articles written in a persuasive way that they advertised the many attributes of distributed ledger technology (DLT).

"However, we did not find any documentation or proof of the results that the blockchain would have had in these statements, but we did not find practical lessons or insights, as they are available for other technologies under development," the researchers said.

"Despite all the clamor about how the blockchain will bring unprecedented transparency to processes and operations in low-trust environments, the sector itself is opaque, and we have determined that the lack of evidence to support blockchain value claims in space of international development is a critical factor for potential adopters, "they added.

Blockchain pilots and concept demonstrations, however, are not worthless, the researchers have observed; in the end, the true value of blockchain implementations may not be the technology itself ", but rather as a push to question what we do, why we do it and how we could do it better".

The severe assessment of the blockchain by the research trio has been supported to some extent by industry analysts, who have said that the hype of marketing around it has created unrealistic expectations, mainly because business use is not yet fully cooked.

Avivah Litan, vice president of Gartner and distinguished analyst, said that the results of the report were not a surprise for her, lacking balance. The researchers did not bother to ask why the projects did not achieve goals, how to improve transactional efficiency, transparency and privacy, he said.

"At the start of 2018, we had already said … 99% of business projects are endless, 99% do not need technology, they do not leave the lab and are the result of the fear of CEOs losing – the FOMO phenomenon ", said Litan. "That said, it's a very precious technology: people started trying to use it before it was ready for the early evening, it's true in the world of cryptocurrencies and in the world of corporate blockchains".

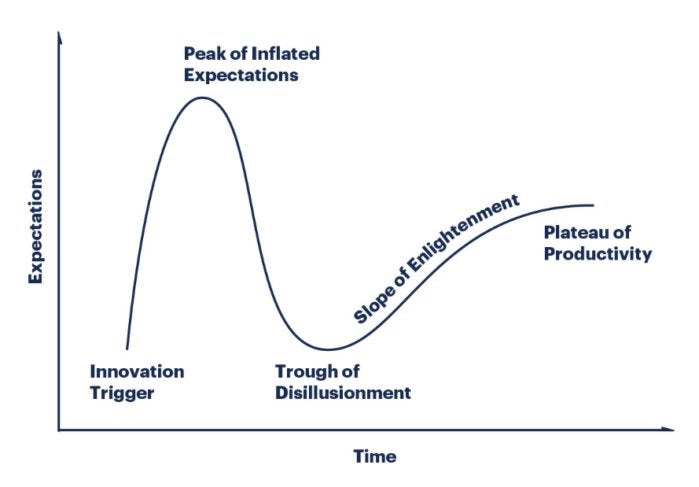

Gartner measures the maturation of the new technology through a "Hype Cycle, "a graphics-based life cycle that follows five steps: from Trigger technology, when proof-of-concept stories and media interests emerge, to the Plateau of Productivity, when mainstream adoption occurs – if technology is more than a niche.

Among these five Hype Cycles is the Trough of Disillusionment, when interest decreases as pilots and proofs of concepts do not arrive and technology providers solve problems and improve technology to satisfy users, or eventually they fail and become extinct.

Gartner

GartnerGarner & # 39; s Hype Cycle for new technologies.

The enterprise blockchain technology that is centrally administered as a traditional database but is still part of a peer-to-peer architecture that immutably stores encrypted transactions is directed to Trough of Disillusionment, said Litan.

"The winter Blockchain has arrived," said Litan.

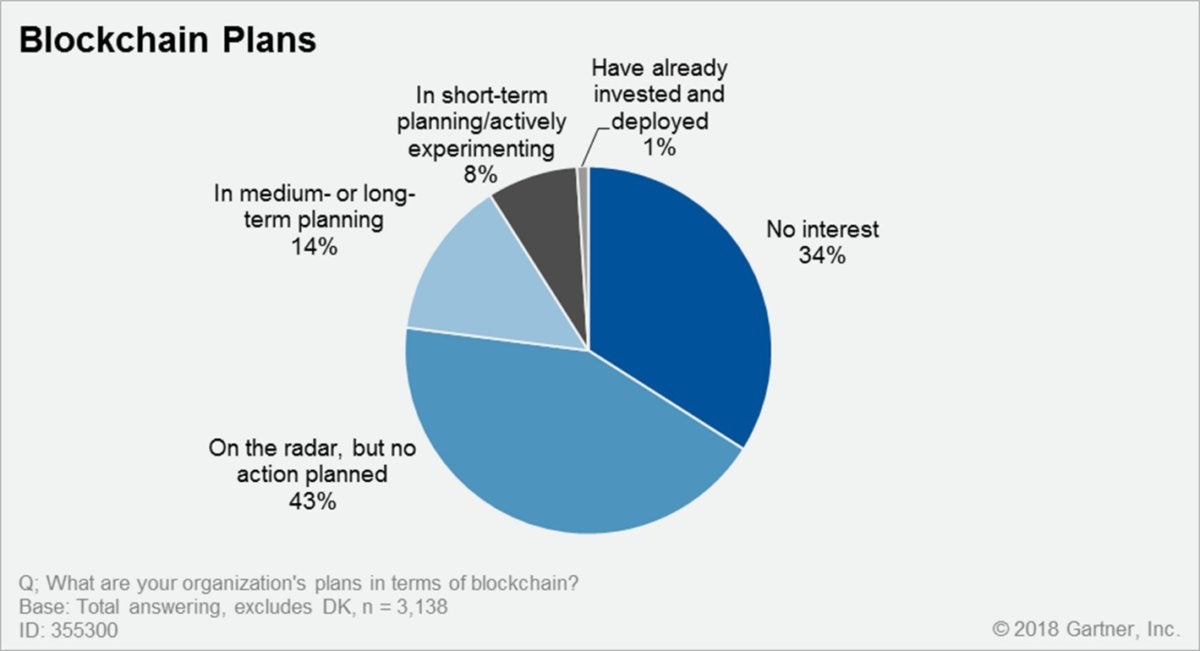

At the start of this year, a Gartner CIO survey revealed on average that only 3.3% of companies worldwide had effectively distributed blockchain in a production environment.

In a blog post, Litan listed eight obstacles needed to push the blockchain forward and meet the goals set by technology providers as a panacea for virtually any international transactional need – from cross-border payments to a paid supply chain Chase.

Gartner

GartnerA survey conducted by Gartner on CIOs last spring revealed that only 1% had a blockchain deployed in production environments; that number grew to 3.3% today, according to Gartner Analyst, Avivah Litan.

The challenges include a more efficient consensus algorithm, a more scalable design – including the ability to move most of the "off-chain" data into a separate database – and data privacy through zero evidence (ZKP), a technology cryptography that allows a user to prove that funds, assets or identifying information exist without revealing the information behind it.

"As long as these obstacles are not overcome, most authorized blockchain projects will remain in development or POC mode," said Litan. "More importantly, they will not support the key principle of decentralization, so under these circumstances, these projects are likely to use proven legacy database technology."

Industrial groups and sellers are working to overcome these obstacles. For example, Ernst & Young has created a public blockchain prototype that plans to launch in 2019, allowing companies to use ZKPs to complete commercial transactions in a confidential manner.

The Hyperledger Foundation and Enterprise Ethereum Alliance (EEA) – the two largest open-block blockchain consortia – have teamed up to address performance issues, including the development of "Layer 2" architectures to download blockchain data to facilitate scalability.

Maersk

MaerskNinety percent of the goods in global trade are transported each year by the oceanic shipbuilding industry. A new blockchain solution from IBM and Maersk will help manage and track the traces of tens of millions of containers worldwide by digitizing the supply chain process.

Martha Bennett, principal analyst at Forrester Research, noted that any blockchain or "DLT" project is a long-term strategic initiative, and disappointment is inevitable "when targeted miracles do not materialize.

"It is unrealistic to expect a solid cost model or a definitive statement of benefits because it is simply too early to do so," Bennett said via email. "To collect real evidence, we need a number of fully operational and downsized implementations that have lasted for at least a couple of years and have not yet arrived."

Just as there are many projects that exist only in the white paper or in the presentation format of the conference – where the language is all "potential" could have – "in the same way, there are many initiatives that are going on because it is clear to the participants that the benefits are achievable, "added Bennett.

For example, Walmart has piloted a supply chain of products powered by IBM's blockchain service over the past two years. The pilot was so successful, Walmart recently presented an edict to his suppliers: get product data in the system by September 2019 so that it can be monitored from one farm to another.

IBM

IBMAfter piloting a blockchain-based supply chain tracking system, retailers are telling suppliers to enter their product data into the system so they can begin tracking products from the farm to the store. The deadline: September 2019.

Software vendor Fintech MonetaGo distributed the first production block of Hyperledger Fabric for financial institutions to obtain financing approval. The network has been active since March and is used by Trade Exchanges authorized in India.

"The network boasts 100% uptime and is scalable to meet the growing needs of the Indian market," MonetaGo CEO Jesse Chenard said via email. "Once frauds, fuzzy matches and operational errors have been accounted for, the return on investment is approximately 631.46, understandably this number is extremely high due to the preferred price for the first participants in the network. , MonetaGo expects ROI to be 45. Which means for every dollar spent on blockchain technology, companies can expect to make around $ 45 back. "

The Linux Foundation, which oversees the Hyperledger Foundation, has indicated other successful pilots, such as the implementation of the supply chain blockchain by the diamond industry.

TrustChain

TrustChainTrustChain's blockchain network traces and authenticates diamonds, precious metals and jewels in all phases of the global supply chain, from the mine to the retailer.

"Recently we have concluded a survey on the perceptions of developers and financial decision makers of large companies that use or are considering blockchain: almost 90% of the 376 respondents who responded to the online survey in August and September provide a moderate to high growth in the corporate blockchain over the next two years, "a spokesman for the Linux Foundation said via email. "A similar majority sees the business blockchain as a core technology of the future that will allow the emergence of new business models".