[ad_1]

[ad_1]

In 2019, the most innovative work involving ledger accounting technology (DLT) – blockchain – will focus on the tokenisation of resources, or on the ability to represent digital or physical assets and legal currencies such as tokens that can be sold or traded on a network .

DLT has the ability to take anything from a work of art to gems and real estate, and to represent them as cryptographic hash resources on an open peer-to-peer electronic network that does not have an authority central, like a bank, that governs their trade or sale.

Representing digital or physical resources as tokens on a DLT-based network allows participants to reinvent processes and develop new business models – an area unexplored from both a commercial and a technology perspective, according to a new Forrester Research report.

The 2019 Forrester forecasts for CIOs have placed the blockchain among other emerging technologies, such as artificial intelligence (AI) and augmented reality (AR), which will only be accepted by businesses if they solve real problems. Otherwise, the seller's hype could trigger a negative reaction that damages the general adoption.

Although better known as the basic technology behind bitcoins and other cryptocurrencies, blockchain is essentially a database built on a distributed peer-to-peer topology, where data can be stored globally on thousands of servers – and anyone on the network can see the voices of everyone else in real time. Therefore, it is virtually impossible for an entity to gain control or play the network because other users would be immediately aware of the attempt.

Despite the constant claims to the contrary, DLT has not yet had a revolutionary impact on any industry or process, according to Forrester, which argues that the blockchain industry should take a realistic approach to commercialize its capabilities and anticipate challenges in the unfold.

For example, blockchain is a team sport; if you do not have players other than you, it does not work, according to Martha Bennett, a leading Forrester analyst and principal author of the report. (Forrester prefers the term DLT on blockchain because he believes it is a more "neutral and accurate" description).

Bennett, who has a conservative view of the DLT, sees the blockchain today as analogous to the Internet in the early 1990s, when people recognized its potential but could not predict the activities it would generate, like Facebook, Instagram or WattsApp . Technology experts may have imagined an Amazon in the early days of the Internet, but they had no idea how it would dominate the online sales market, he said.

"The technology is still under development and at an early stage, but there is a huge amount of innovation in the ecosystem," Bennett said.

Digitize cars, real estate – and even works of art?

The new ownership and service models created by tokenization are already gaining momentum: the digitization of assets that can be sold or traded on DLT.

For example, blockchains that symbolize real estate are rapidly emerging; allow traditional investors and consumers to buy shares in a property and receive a return on rent or mortgages. The money paid for the shares allows owners to make additional investments.

Jointer.io

Jointer.ioThe Jointer web page allows property owners to digitize their real estate properties.

The problem with buying shares in a single property, Regev argued, is that you have to trust the owner's words that he or she has the equity they claim. For example, if a building owner owes a mortgage lender to 80% of the value of the property, an investor's own equity is far below the total value of the building. Investors may not even know if a property has a privilege or other financial obligations.

"And how will you force an owner to pay a dividend each time they make a distribution for themselves? [digital token] it is not really connected to the bank account that collects rent, "said Regev." You must trust the owner to transfer the money from the bank account to a reserve controlled by smart contracts. "

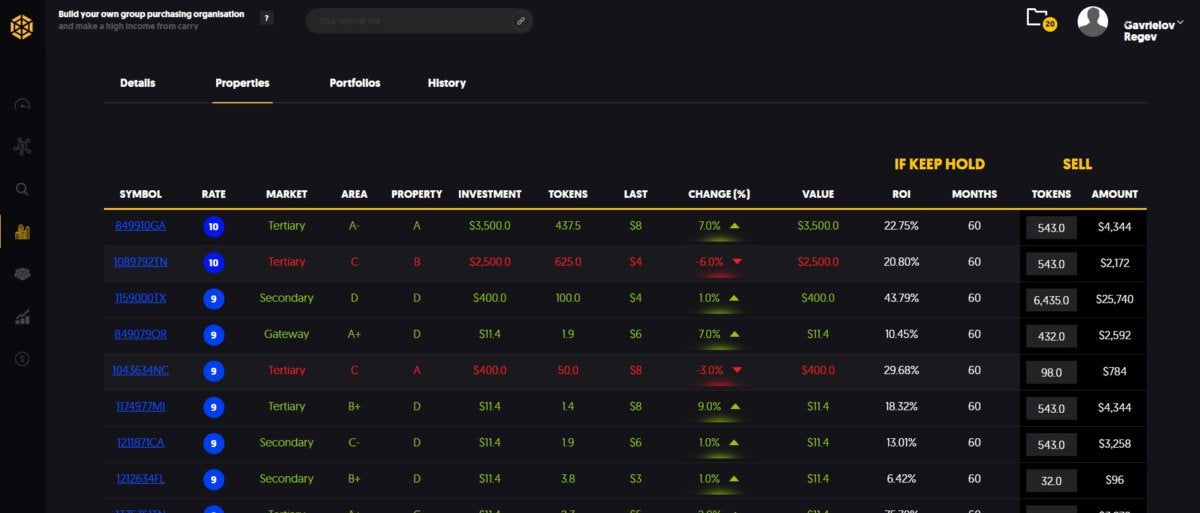

Jointer.io

Jointer.ioProperty index of Jointer.io

"People cheat other people," he continued. "It's only a matter of time before someone can cheat someone using security tokens: someone will sell a property that does not exist or maybe it's empty … or it will sell the same equity in a property twice. , the [Securities and Exchange Commission] it will jump inside. "

So instead of offering a single building, Jointer is creating indices from property groups – collective apartments or commercial real estate. Investors can then choose indexes based on regions such as New York or San Francisco or Houston.

"The idea is that you're no longer tied to a specific property, so you do not care if the property is above the market [value] or below it, if the owner sells all equity or does not have any equity …. You move to the index of similar properties, "said Regev. All properties – the strength of their income – which is managed by institutional interests, will be transferred to a main reserve controlled by smart contracts. "

The shares of these properties – represented by coins – can therefore be used by the participants as securities to obtain loans or simply as a financial asset on which they receive a return. For example, large investors get a return of 90% of the assets, while the other 10% goes to Jointer, said Regev. Smaller investors receive returns based on smaller portions of the asset.

Property owners – those who put their real estate in the pool – get the service for free. For the public, Jointer offers to lend funds to real estate blockchain projects while the return is based on multi-family property indices.

Turning cold cash into digital tokens

Another example of an emerging market is the tokenisation of fiat coins, or traditional forms of money represented by digital tokens like bitcoin, Litecoin or Ethereum & Ether.

Coinbase, CEX.IO, Challengy and CoinMama are among the leaders in the digital exchange market.

Digital portfolios, or accounts that allow participants to purchase tokens with real money, are rapidly emerging as a new market that removes the intermediary – a central bank or another government authority – from transferring funds between participants and beyond geographical boundaries.

Four years ago, Overstock.com created Medici Ventures, a venture capital arm for DLT investments. The Salt Lake City branch focuses its investments on six key emerging areas of blockchain technology: capital markets; identity management; property; vote; underlying technologies, money and banking services.

One of the companies in which Medici holds a 35% stake is Bitsy.com, which has just launched an all-in-one beta application designed to make it easier for consumers to exchange digital currency – and therefore more easy to use with bitcoins on Overstock. com. The app allows consumers to use the new crypto-wallet service.

"We did not feel any of the others [digital exchanges] they were good, "said Jonathan Johnson, president of Medici Ventures." When Bitsy came to us with their business plan, we said, "Wait a second, this is the answer to this question." This is the easiest access route and access ramp to the crypt. "

Bitsy

BitsyBitsy smartphone user interface.

The main advantage of the Bitsy exchange is that users have both public and private hash keys that allow the sale of digital tokens.

"With traditional bitcoin portfolios, users do not have the actual possession or control of the bitcoins they buy: their portfolio provider is the owner of Bitcoin and provides a contractual claim to the consumer, who must therefore trust that company." declared Patrick Byrne, founder and CEO of Overstock.com. "Bitsy portfolios, on the other hand, allow users to own and have complete control of their cryptocurrency without the risk of losing keys, thus creating a new standard for digital portfolios."

In the last year, purchases made on Overstock.com using bitcoins doubled to around 0.2%, Johnson said. While that is still a small percentage of overall sales, it is constantly growing.

"We are at the forefront of blockchain technology, which enables the transfer of digital resources, whether it be bitcoins or other cryptocurrencies, ratings, title deeds or titles," said Johnson. "We think that the Internet allows information to flow freely and without friction, the blockchain will allow resources to flow freely and without friction".