[ad_1]

[ad_1]

During a gold rush, the Silicon Valley line is always investing in pick and bads rather than in mines. Sometimes it only pays to do both.

TechCrunch learned from an overview of the company fundraiser that the Beijing mining equipment salesman, Bitmain, has grossed quarterly revenue of around $ 2 billion in the first quarter of this year. Despite a fall in bitcoin prices from the start of the year, the company is on track to become the first blockchain-focused company to reach $ 10 billion in annual revenue, assuming that the cryptocurrency market does not fall further. .

previously reported that the company had $ 1.1 billion in profits in the same quarter, a number in line with these revenue numbers, given a net margin of about 50%.

This growth is extraordinary. From the same source as seen by TechCrunch, Bitmain's revenue last year was $ 2.5 billion and about $ 300 million just the previous year. Apparently, the company has raised a major round of $ 300-400 million from investors, including Sequoia China, with a valuation of $ 12 billion.

For comparison, the popular Coinbase cryptocurrant portfolio has grossed $ 1 billion in 2017. In addition, Nvidia, a California-based company that also produces computer chips, generated revenues of $ 9.7 billion in its fiscal year 2018 (calendar year 2017). Nvidia's revenues were $ 3.21 billion in the 2019 fiscal year (February-April 2018) and historical revenue shows a seasonal increase in revenue from the 1st to the 4th quarter.

The same overview also shows that Bitmain is exploring an IPO with an estimate between $ 40-50 billion. This would represent a significant increase from its most recent assessment, and it is almost certainly dependent on the viability of the broader blockchain ecosystem.

Many of Bitmain's competitors have applied for IPOs since the beginning of 2018, but most of them are significantly smaller in size. For example, the Hong Kong-based company, Canaan Creative, applied for an IPO in May, and the last was pointing to $ 1 billion and $ 2 billion in fundraising with revenue of $ 204 million USD .

When contacted for this story, Bitmain refused to comment on the specific numbers that TechCrunch has acquired.

Brief Overview of Bitmain

Bitmain is the world's leading cryptocurrency mining chip known as ASIC or application-specific integrated circuit. It was founded by Jihan Wu and Micree Zhang in 2013, and the company is currently based in Beijing.

As the story continues, in 2011, when Wu read Satoshi Nakamoto's whitepaper on Bitcoin, he emptied his bank account to buy them. Back then, a bitcoin could be bought for less than a dollar. And in 2013, Wu and Zhang decided to build an ASIC chip specifically for bitcoin mining and founded Bitmain. Wu was only 28 years old.

Cryptocurrency mining is the process of checking and adding new transactions to the immutable bitcoin ledger, called blockchain. The blockchain is made up of digital blocks, where transactions are recorded. The act of mining consists essentially of using mathematics to solve a cryptographic hash, or a unique signature, if desired, to identify new blocks.

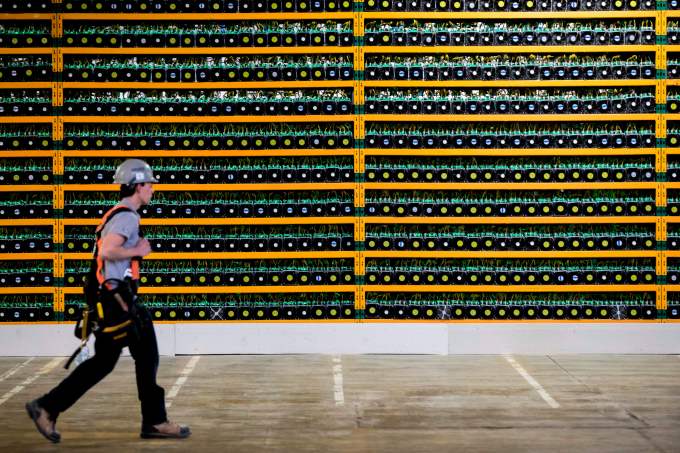

The process of general extraction requires enormous processing power and involves substantial energy costs. In return for these expenses, the miners are rewarded with a bitcoin number for each block they add to the blockchain. Currently, in the case of Bitcoin, the reward for each uncovered block is 12.5 bitcoins. At the current final bitcoin average price of around $ 6,500, that's $ 81,250 to be won every 10 minutes, or $ 11.7 million a day.

Bitmain has several segments of activity. The first and foremost is the sale of mining machines equipped with Bitmain chips that usually range from a few hundred to a few thousand dollars each. For example, the latest Antminer S9 model is listed as $ 3,319. Secondly, you can hire Bitmain mining machines to extract cryptocurrencies.

Third, you can participate in my bitcoin as part of the Bitmain mining pool. A mining pool is a joint group of cryptocurrency miners who combine their computational resources on a network. Bitmain's two mining pools, Bitmain AntPool and BTC.com, collectively control over 38% of the world's Bitcoin mining power for BTC.com at the moment.

Bitmain's future is closely linked to the Crypto market

Bitcoin mining is a huge business with influence on energy prices all over the world. (LARS HAGBERG / AFP / Getty Images)

Despite the rapid rise to success, Bitmain ultimately depends on the price of cryptocurrencies and the overall fluctuations of the cryptographic market. When there is a bull-encrypted market, investors would be willing to give the company a different rating than if it were in a bear market. In a bear market, margins are reduced for both the company and its customers, as the economy of mineral cryptocurrencies is no longer as convincing. For example, at the end of 2014, the mountain. Gox, a famous Bitcoin exchange at the time, has been violated, causing cryptocurrency prices to fall.

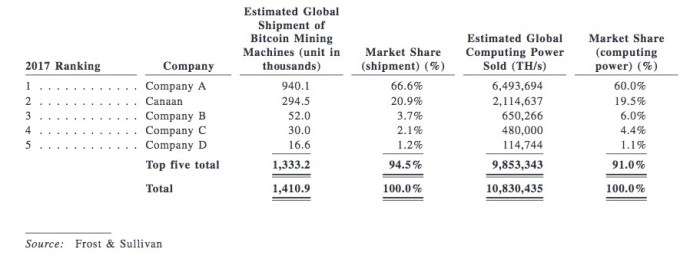

Later, Bitmain went through a bitcoin drought when Bitcoin prices hit the low points and its ASIC chips did not see much demand. It was not interesting for miners to pay the expensive electricity bills to extract a declining digital currency. But fast forward to now, we have gone through several bulls and endure encryption cycles. According to Frost & Sullivan, in 2017, Bitmain is estimated to have about 67% of the bitcoin mining hardware market share and generated 60% of computing power.

Canaan Creative IPO depositing. Compay A is Bitmain

One of the key challenges for any cryptocurrency mining manufacturer like Bitmain is that the company's rating is largely based on the price of cryptocurrencies. The market in the first half of 2018 showed that nobody really knows when bitcoin and cryptocurrency market prices will start again. In addition, according to Frost & Sullivan, the ASIC-based blockchain hardware market, which is the market segment that includes Bitmain and Canaan, will see its compound annual growth rate (CAGR) slower at around 57.7% per annum between 2017 and 2020, down from 247.6% between 2013 and 2017.

However, it seems that Bitmain has planned well in advance to prepare for these macro risks and exposures. The company has raised important private funding and has expanded its business to extract new currencies and create new chips outside the cryptocurrency applications.

Firstly, with its existing mining facilities, Bitmain can substantially extend to all coins related to SHA256. So coins like Bitcoin, Bitcoin Cash, Litecoin, can be extracted from Bitmain's equipment. The limitation here is largely how fast can build more mining equipment and mining centers. The company has expanded its geographic reach by developing new mining centers. More recently, Bitmain has revealed that it will build a $ 500 million blockchain data center and a Texas mining facility as part of its expansion into the US market, with the goal of starting operations at the start of 2019.

Secondly, Bitmain is also trying to launch their AI chips by the end of 2018. Interestingly, the AI chips are called Sophon, originating from the alien key technology of the famous trilogy, the Three Body Problem, by Liu Cixin. If things go as planned, Bitmain's Sophon units could form neural networks in data centers around the world. The CEO of Bitmain, Wu, said that in 5 years 40% of revenue could come from artificial intelligence chips.

Finally, Bitmain is acquiring liquidity. A lot of things from some of the biggest and biggest investors in Asia. Two months ago, China Money Network reported that Bitmain raised a series B round, led by Sequoia Capital China, DST, GIC, Coatue in a $ 400 million increase, bringing the company to a value of 12 billion dollars . Just last week, the Chinese technology conglomerate Tencent and the Japanese Softbank, another technology giant whose 15% of Uber makes it the largest shareholder of app drive-hailing, joined the investor base.

For Bitmain, there are many reasons to remain private as a company, including maintaining its private financial statements and addressing market fluctuations and continued volatility and uncertainty in the cryptocurrency world. However, the problem is that the first employees may not get cash in their stock options until much later.

Wu said that an IPO of Bitmain would be a "point of reference" for both the company and the cryptocurrency space. However, with the current rich funding of the encrypted private market, it is not so bad an idea to continue to raise private funds and stay out of the public eye. Once Bitmain's financials become more diversified and the cryptocurrency will be more widely adopted around the world, the world may be ready for this $ 10 billion blockchain company.