[ad_1]

[ad_1]

Bitmain, Crypto Mining Giant, on Target for $ 10-B in Revenue this year

$ BTCUSD

TechCrunch has learned through a fundraising overview of the company that the seller of equipment Beijing-based mining Bitmain achieved a quarterly turnover of about $ 2-B in Q-1 of Y 2018.

Despite a collapse in bitcoin prices from the start of the year, the company is on the good way to become the first blockchain-focused company to reach $ 10-B in annual revenue, assuming that the cryptocurrency market decreases further.

Luck earlier reported that the company had profits of $ 1.1-B in the same quarter, a number in line with these revenue numbers, given a net margin of around 50%.

growth is extraordinary.

From the same source as seen by TechCrunch, Bitmain's revenue last year was $ 2.5-B, and about $ 300-M in the previous year. Apparently, the company has raised a major venture of $ 300-400-Mfrom investors, including Sequoia China, with a valuation of $ 12-B.

For comparison, the popular Coinbase cryptocurrency portfolio earned $ 1 billion in revenue in 2017.

In addition, Nvidia (NASDAQ: NVDA), a California company that also manufactures computer chips, generated revenue of $ 9.7 billion in its fiscal year 2018. Nvidia's revenues were $ 3.21-B in the fiscal year Q-1 2019 and historical revenues show a general seasonal increase in revenue from Q-1 to Q -4.

The same overview also shows that Bitmain is exploring an IPO with an evaluation between $ 40-50-B. This would represent a significant increase from its most recent assessment, and it is almost certainly dependent on the viability of the broader blockchain ecosystem.

Many of Bitmain's competitors have applied for IPOs since the start of Y 2018, but most of them are significantly

For example, Canaan Creative, based in Hong Kong, has applied for IPO in May, and the last was pointing to $ 1 to 2-B in raising funds with Y 2017 income of $ 204-M. [19659002] When contacted for this story, Bitmain declined to comment.

Bitmain is the world's leading cryptocurrency mining chip known as ASICs, or Application Integrated Circuit, was founded by Jihan Wu and Micree Zhang in 2013, and the company is currently at HQ in Beijing.

Cryptocurrency mining is the process of controlling and adding new transactions to the immutable bitcoin ledger, called blockchain. The blockchain is made up of digital blocks, where transactions are recorded. The act of mining consists essentially of using mathematics to solve a cryptographic hash, or a unique signature, if desired, to identify new blocks.

The process of general extraction requires enormous processing power and involves substantial energy costs. In return for these expenses, the miners are rewarded with a bitcoin number for each block they add to the blockchain.

Currently, in the case of Bitcoin, the reward for each uncovered block is 12.5 bitcoins. At the current final Bitcoin average price of about $ 6,300, which is about $ 81.00 for the acquisition every 10 minutes, or $ 11.5-M per day.

Bitmain has several segments of activity.

The first and foremost is selling Bitmain chip-powered mining machines that usually range from a few hundred to a few thousand dollars each. The latest model of Antminer S9 is listed as $ 3,319.

And secondly you can rent the mining machines of Bitmain to extract the cryptocurrencies.

And third, you can participate in my Bitcoin as part of the Bitmain mining pool.

is a joint group of cryptocurrency miners who combine their computational resources on a network. Bitmain's two mining pools, Bitmain AntPool and BTC.com, collectively control over 38% of the world's Bitcoin extraction power for BTC.com.

Despite the rapid rise to success, Bitmain ultimately depends on the price of cryptocurrencies and overall fluctuations in the encrypted market.

When there is a bull market in cryptography, investors would be willing to give a different rating to the company than if it were in a Bear market. In a bear market, margins are reduced for both the company and its customers, as the economy of mineral cryptocurrencies is no longer as convincing.

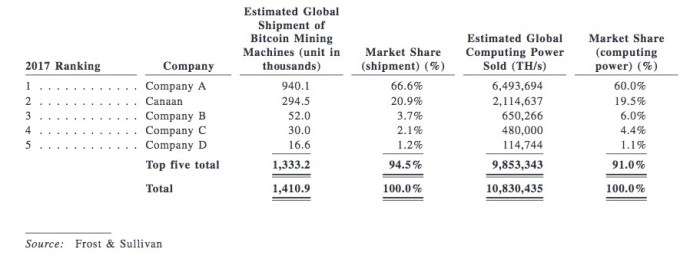

We have gone through several encryption cycles. According to Frost & Sullivan, in Y 2017, it is estimated that Bitmain has 67% of the market share in Bitcoin mining hardware and generated 60% of computing power.

From the IPO deposit of Canaan Creative. Company A is Bitmain.

One of the key challenges for any cryptocurrency mining producer like Bitmain is that the company's rating is largely based on the price of cryptocurrencies.

The 1-H market of Y 2018 has shown that no one really knows when bitcoin prices and the cryptocurrency market will resume again.

Also, according to Frost & Sullivan, the ASIC-based blockchain hardware market, which is the market segment that includes Bitmain and Canaan, see its compound annual growth rate (CAGR) slower at around 57 , 7% per annum between Y 2017 and 2020, down from 247.6% between Y 2013 and 2017.

It seems that Bitmain has planned in advance to prepare these macro-risks and exposures. The company has raised important private funding and has expanded its business to extract new currencies and create new chips outside the cryptocurrency applications.

First of all, with its existing mining facilities, Bitmain can substantially extend to all SHA256-related currencies. [19659004] So coins like Bitcoin, Bitcoin Cash and Litecoin can be extracted from Bitmain's equipment. The limitation here is largely how fast can build more mining equipment and mining centers. The company has expanded its geographic reach by developing new mining centers.

Recently, Bitmain has revealed that it will build a $ 500-M blockchain data center and a Texas mining facility as part of its expansion into the US market, with the goal of operations beginning by 2019. [19659032] In addition, Bitmain is trying to launch its own AI chips by the end of Y 2018.

The AI chips are called Sophons, originating from Key Alien technology in the famous trilogy, the Three-Body Problem, by Liu Cixin.

If things go as planned, Bitmain's Sophon units could form neural networks in data centers around the world. Bitmain CEO Wu once said that in 5 years 40% of revenue could come from artificial intelligence chips.

Finally, Bitmain was acquiring liquidity. A lot of things from some of the biggest and biggest investors in Asia.

Two months ago, the China Money Network reported that Bitmain raised a round B series, led by Sequoia Capital China, DST, GIC and Coatue into a $ 400- M raise, putting the company at the value of $ 12- B.

Last week, the Chinese technological conglomerate Tencent and the Japanese SoftBank, another technology giant whose 15% of Uber makes it the largest shareholder of the hail app, have joined the basic investor.

For Bitmain, there are many reasons to remain private as a company, including maintaining its private financial statements and tackling market fluctuations and continued volatility and uncertainty in the world of cryptocurrencies. However, the downside is that early employees may not get cash in their stock options until much later.

Wu said that an IPO of Bitmain would be a "point of reference" for the company and cryptocurrency space. However, with the current rich funding of the encrypted private market, it is not so bad the idea of continuing to raise private funds and stay out of the public eye.

Once Bitmain's financials become more diversified and the cryptocurrency will be more widely adopted around the world, the world may then be ready for this $ 10-B + revenue blockchain company.

by Joyce Yang

Paul Ebeling, Editor

Have a formidable weekend.

Tags 10B Bitmain crypto Giant mining revenue target year