[ad_1]

[ad_1]

Bitcoin investors are getting calcium of digital butts recently. Difficult. Bitcoin prices have plummeted by over 20% in the last two days.

Ethereum, Litecoin, Ripple and other cryptocurrencies suffered similar bending. The reason for the last pullback? A Business Insider reports that the investment bank giant Goldman Sachs ( GS ) could abandon plans to launch an encryption bank.

Goldman Sachs told CNNMoney that he had not yet made a final decision on bitcoins or other cryptocurrencies.

"In response to the customer's interest in various digital products, we are exploring the best way to serve them in space." At this point, we have not reached a conclusion on the scope of our digital resource offering, "Goldman said. Sachs in a statement.

But if Goldman Sachs is retiring, it's not good news.

Naeem Aslam, chief market analyst at ThinkMarkets UK who is bullish on bitcoin, said in an e-mail that "there is no doubt that the price of bitcoin is supported by this clamor that institutional banks will be involved. "

Stories emerged for the first time on a possible push by Goldman Sachs to bitcoin ( XBT and other cryptocurrencies last December, shortly after the two big trading companies futures – CBOE ( CBOE ) and CME ( CME ) – establishes exchanges for bitcoin contracts.

Goldman Sachs confirmed in May that he was considering using his money to start trading with bitcoins, according to the New York Times.

Bitcoin prices, which were poised near a record high of around $ 20,000 in December, they have lost more than two-thirds of their value since then and are currently trading at around $ 6,400.

Hussein Sayed, chief FXTM currency brokerage strategist said in a report Thursday that the possible prices could fall below $ 5000.

So It could be sensible for Goldman Sachs to take a more cautious approach in this extremely volatile market. Most of the bitcoin news was recently negative.

Google ( GOOGL ) Facebook ( FB ) and Twitter ( TWTR ) have banned some cryptocurrency ads.

The Securities and Exchange Commission has blocked a number of money-swapping proposals with bitcoins over the past few months, including the plans of the ETF ProShares and Direxion giants and one supported by the Winklevoss brothers of Facebook.

Several publicly traded companies have also tried to cling to cryptography craze, leading to more concerns that bitcoin could be a bubble. Overstock ( OSTK ) has de-emphasized a large part of its online retail business in difficulty to focus on cryptocurrencies.

Bioptix, a producer of hormones for farm animals, changed its name to Riot Blockchain ( RIOT ) . The stock rose – until the company revealed that the SEC was probing it.

The Long Island beverage company Iced Tea became Long Blockchain ( LBCC ) . Since then it has been removed from the Nasdaq and is now traded as a so-called stock of bulletins at a price below 20 cents per share.

Some companies have even started to sell digital tokens through initial coin offerings to raise money.

Eastman Kodak ( KODK ) – yes, the film and film production company – created its own KodakCoin. There is even a pot for the legal marijuana and cannabis industry.

Many of these initial coin offerings are legitimate. But there have also been scams. The SEC has also created a fake ICO called HoweyCoins to show how easy it is for investors to be deceived.

And several titans of businesses have also blasted bitcoins.

JPMorgan Chase ( JPM ) CEO Jamie Dimon called bitcoin a "fraud" that was only good for drug dealers and North Korea.

Investor of the billionaire Saudi Prince Alwaleed, whose Kingdom Holding Company holds shares in Apple ( AAPL Citigroup ( C ) and Twitter ( TWTR ) told CNBC at the end of last year that he thought the bitcoin was an "Enron in the making" that would implode.

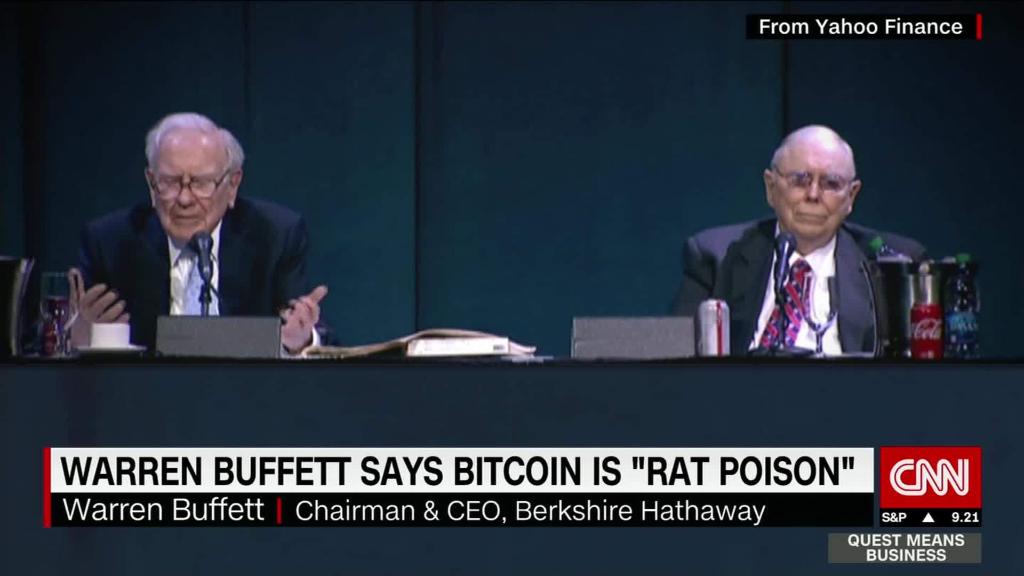

Warren Buffett and Charlie Munger of Berkshire Hathaway ( BRKB ) also warned investors to stay away from the bitcoin.

Buffett told CNBC all & # 39; Early May the bitcoin was "probably a square poison" while Munger told the Berkshire meeting that the thought of owning cryptocurrencies was "just dementia."

It is also worth noting that the recent dip in the bitcoin comes in a time when the Turkish lira, the Indian rupee and the weight Argentine are in free fall while the dollar is strengthened.

So investors do not seem willing to bet on bitcoins as a substitute for the fragile currencies of emerging markets.

However, the bitcoin pullback also comes when more and more companies and organizations have adopted blockchain technology, the digital ledger that tracks transactions in virtual currencies.

IBM ( IBM ) is a great supporter of the blockchain. The World Bank has announced the intention to launch a blockchain bond. It's also a company that wants to run a fantasy football league using blockchain. (Call me old school, but I will continue with Yahoo for my league.)

There is a clear difference between bitcoin and blockchain. The future of money may still be fine digital, but that does not mean that bitcoin or the score of other virtual currencies out there will survive and prosper.

Julia Horowitz of CNNMoney contributed to this report.

CNNMoney (New York) First published on September 6, 2018: 12:42 ET