[ad_1]

[ad_1]

Introduction

If this is your first time reading a report on Bitcoin (BTC-USD) (COIN) (OTCQX: GBTC) value indicators, you may wish to refer to the original article to update you.

Breakdown Signal

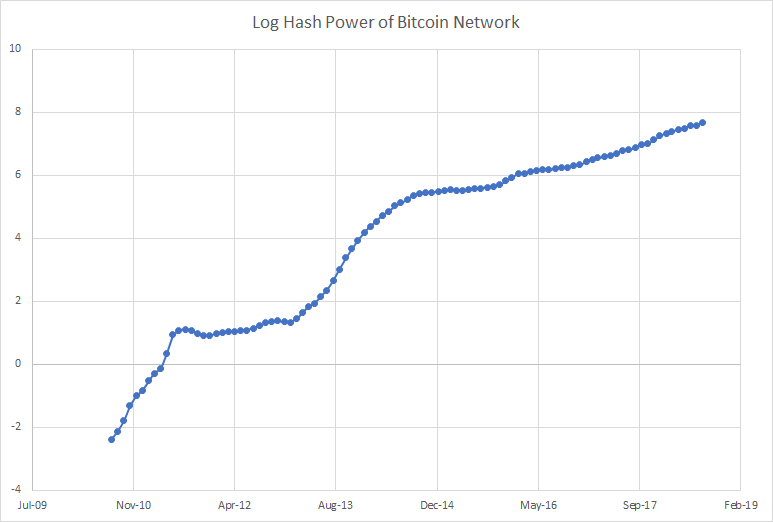

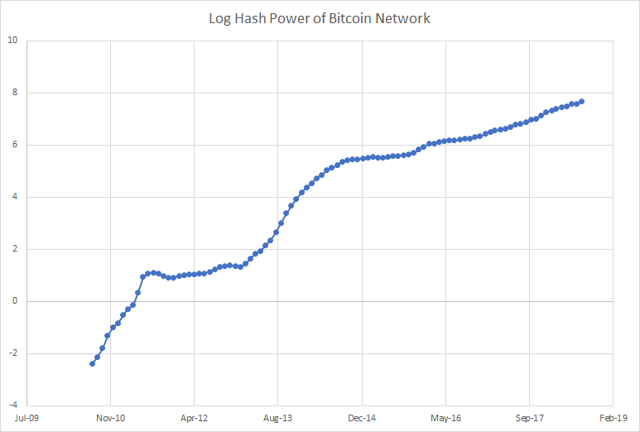

First, we turn our attention to the hash rate of the network. I'm using the long view here, and as you can see, Bitcoin miners still have to beat an eyelid, despite the fact that the price of Bitcoin has declined since December / January. Part of this is a delayed investment starting in 2017, but it should be considered a good sign that companies are still moving dirt and installing new equipment (companies like Hut 8 Mining (OTCQX: HUTMF), of which I wrote about recent example). [19659005] Hash speed

Data source: blockchain.com

Data source: blockchain.com

Total transactions

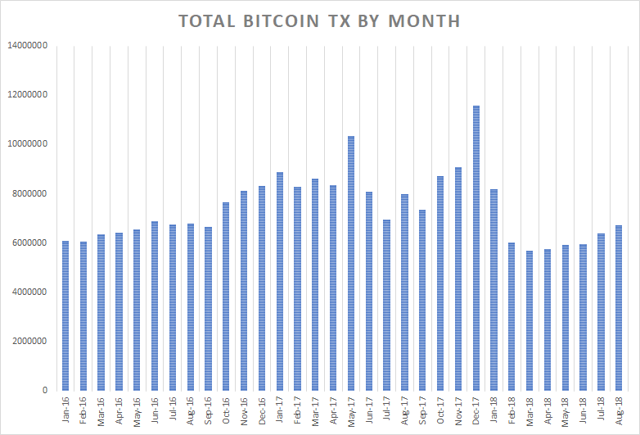

The total number of Bitcoin transactions increased to a constant clip in August. As I pointed out last month, monthly transactions hit the bottom in March and have since been on the rise. August was no exception and represented the fifth month of consecutive increases.

Data source: blockchain.com

An increasing number of transactions means that people still use Bitcoin, despite the price decrease and all the negative press. With less speculators on the market, the remaining activity should be considered a very positive signal. The actual Bitcoin user base is growing again.

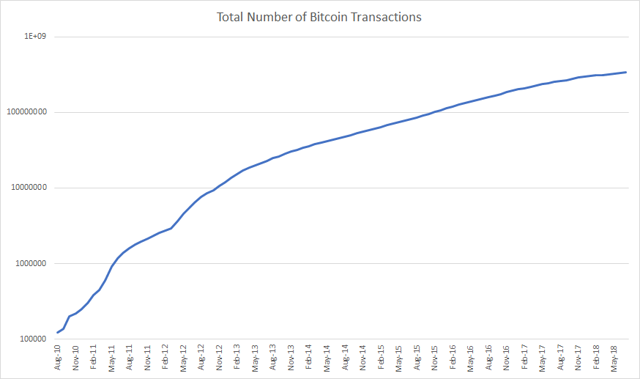

The cumulative view of the transaction, which acts as a time proxy, is shown below. The longer Bitcoin experiment continues, the more precious it will tend to be.

Data Source: blockchain.com

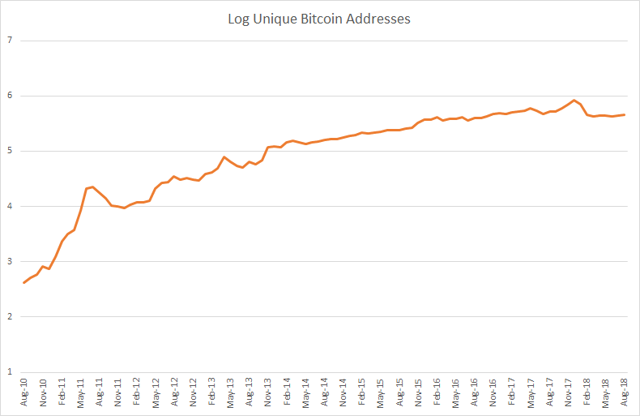

Unique addresses (proxy by number of users, discussed in detail here)

The number of unique addresses in use had a double bottom, touching a minimum in March, and then again in June. However, this also seems to have turned a corner. As I said earlier, if this bear / bull cycle looks like the last two (especially like 2011), I expect the number of daily transactions to be restored before the number of unique addresses. It would seem that this is taking shape now.

Data source: blockchain.com

Side-by-side comparison

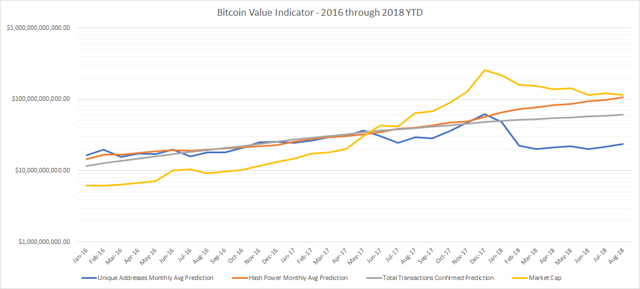

While the prospect of entering the Bitcoin market is now more interesting than last month, the Bitcoin Value Indicator would seem to suggest that Bitcoin is still overbought.

| Indicator Name | Unique Addresses | Hash Power | Total Transactions |

| Expected Market Coverage | $ 23,472,221,626.78 | $ 107,859,980,912.96 | $ 60,926,006,396.05 |

| Actual / Predicted | 4.92x | 1.07x | 1.89x |

| Metric Signal | Overbought | Overbought | Overbought |

Data source: Blockchain.info

September 2018 Signal – Overbought

The metric hash power is crawling dangerously close to reality. Unless something changes in the next month, I expect these two lines to cross by the end of the month. If this happens, then it will be the first time since the beginning of 2017 that the price of Bitcoin is equal to or lower than that expected by this model.

YTD chart 2016-2018

Image source: Author graphs

Aspects of the technical update Bitcoin

Instead of doing the typical monthly comparison, I thought to seize the opportunity to reduce a po & # 39; and see how far we have arrived this year. After all, it has been a bearish market since December / January and sometimes some good news does not hurt.

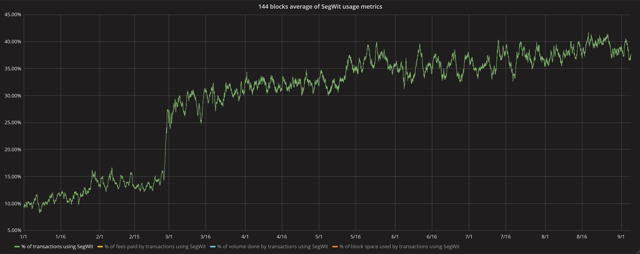

Segwit started the year using only 10% of transactions and is now up 40%. Recall that segwit has the ability to increase transaction throughput of about 4x when fully implemented (under ideal conditions).

Image source: P2sh (grafana)

Image source: P2sh (grafana)

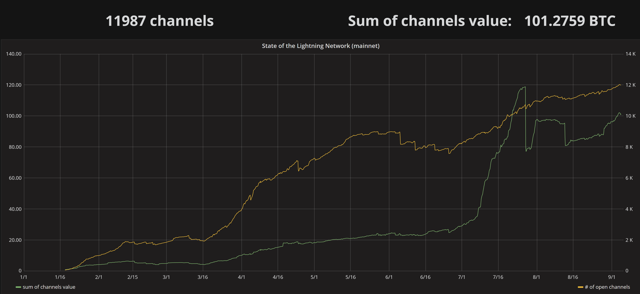

Meanwhile, the Lightning Network (which did not exist before January of this year, at least not outside the test network) has grown to almost 12,000 channels and currently has over 100 BTCs on all these channels. This growth represents an increase of almost 5 times since March of this year

Image source: P2sh (graphana)

Image source: P2sh (graphana)

A note on changes to the Lightning network

In an article I recently wrote, I talked about how the Lightning Network allows Bitcoin to scale up to handle multiple transactions, actually more than orders of magnitude. However, there are changes coming to the Lightning network that will add privacy as a feature enabled by default. This means that the network will appear to shrink as people enter "invisible mode". See this from Jameson Lopp (an important software engineer in the cryptocurrency space).

Source: Twitter

Source: Twitter

I am currently examining ways to quantify the growth of the Lightning network in the future. The members of Crypto Blue Chips will be the first to know when I will decide on the best approach.

Conclusion

Bitcoin has continued to grow through the bear market. As I said in the past, it would not be correct to assume that Bitcoin was dead or failing by looking only at the price. If we look at the data, we see growth everywhere, from new technologies, from the use of resizing protocols, from hash power and even from the number of users that has started growing again since March.

Bitcoin has many obstacles to overcome before it can reach its full potential. However, I find it increasingly difficult to make the case against Bitcoin, since all the pieces are joining together. The promise of a global payments network that can be delivered with privacy and without permission, quickly and effectively to anyone, is a concept too powerful to ignore.

Bonus reading material

has suggested quite a bit of reading material on Bitcoin / blockchain technology in the past. I wanted to summarize that list for people who may not have seen these recommendations. Bitcoin is new and radical, so it takes a bit of time and effort to figure out where this ship could come. This list could be interesting if this looks like something you are in.

I have separated the list into two parts, a specific part for cryptocurrency / blockchain and another on other technology trends that can help you extend your understanding of how Bitcoin could adapt to our possible future. I hope you like them, like I did. If you've already read any of these, leave a comment below and let me know what you think.

Bitcoin / Blockchain / Cryptocurrency Specific

Related to the technology / Larger image

Disclosure: We are / are long-term BTC-USD, ETH-USD.

I wrote this article alone, and expresses my opinions. I'm not getting any compensation for this (other than Seeking Alpha). I have no business relationship with any company whose title is mentioned in this article.

[ad_2]Source link